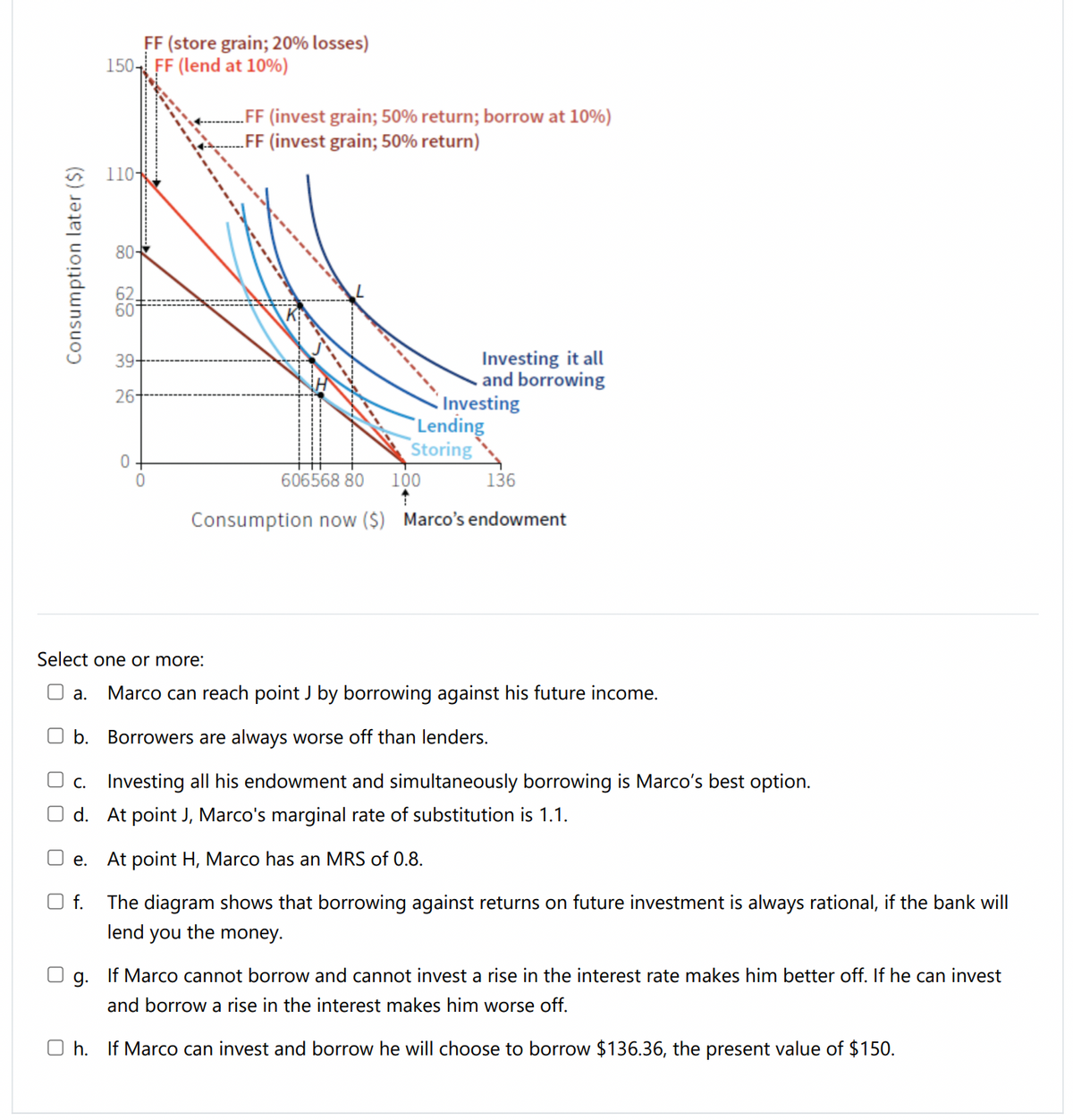

FF (store grain; 20% losses) 150- FF (lend at 10%) .FF (invest grain; 50% return; borrow at 10%) „FF (invest grain; 50% return) 110 80 62. 60 Investing it all and borrowing Investing Lending Storing 39- 26- 606568 80 100 136 Consumption now ($) Marco's endowment Select one or more: O a. Marco can reach point J by borrowing against his future income. Consumption later ($)

FF (store grain; 20% losses) 150- FF (lend at 10%) .FF (invest grain; 50% return; borrow at 10%) „FF (invest grain; 50% return) 110 80 62. 60 Investing it all and borrowing Investing Lending Storing 39- 26- 606568 80 100 136 Consumption now ($) Marco's endowment Select one or more: O a. Marco can reach point J by borrowing against his future income. Consumption later ($)

Principles of Economics 2e

2nd Edition

ISBN:9781947172364

Author:Steven A. Greenlaw; David Shapiro

Publisher:Steven A. Greenlaw; David Shapiro

Chapter17: Financial Markets

Section: Chapter Questions

Problem 4SCQ: Which has a higher average return over time: stocks, bands, or a savings account? Explain your...

Related questions

Question

Transcribed Image Text:FF (store grain; 20% losses)

150- FF (lend at 10%)

„FF (invest grain; 50% return; borrow at 10%)

„FF (invest grain; 50% return)

110-

80-

62

60

Investing it all

- and borrowing

Investing

"Lending

Storing

136

39+

26-

606568 80

100

Consumption now ($) Marco's endowment

Select one or more:

U a.

Marco can reach point J by borrowing against his future income.

O b. Borrowers are always worse off than lenders.

O c. Investing all his endowment and simultaneously borrowing is Marco's best option.

O d. At point J, Marco's marginal rate of substitution is 1.1.

O e.

At point H, Marco has an MRS of 0.8.

O f.

The diagram shows that borrowing against returns on future investment is always rational, if the bank will

lend

you

the

money.

g.

If Marco cannot borrow and cannot invest a rise in the interest rate makes him better off. If he can invest

and borrow a rise in the interest makes him worse off.

O h. If Marco can invest and borrow he will choose to borrow $136.36, the present value of $150.

Consumption later ($)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Economics 2e

Economics

ISBN:

9781947172364

Author:

Steven A. Greenlaw; David Shapiro

Publisher:

OpenStax

Principles of Economics 2e

Economics

ISBN:

9781947172364

Author:

Steven A. Greenlaw; David Shapiro

Publisher:

OpenStax