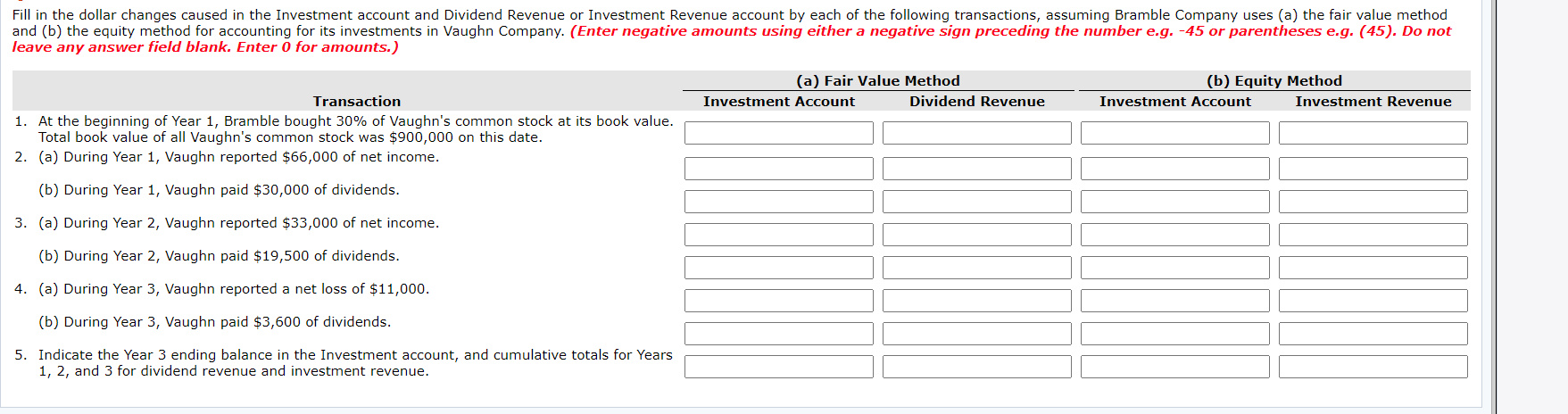

Fill in the dollar changes caused in the Investment account and Dividend Revenue or Investment Revenue account by each of the following transactions, assuming Bramble Company uses (a) the fair value method and (b) the equity method for accounting for its investments in Vaughn Company. (Enter negative amounts using either a negative sign preceding the number e.g. -45 or parentheses e.g. (45). Do not leave any answer field blank. Enter 0 for amounts.) (a) Fair Value Method (b) Equity Method Transaction Investment Account Dividend Revenue Investment Account Investment Revenue 1. At the beginning of Year 1, Bramble bought 30% of Vaughn's common stock at its book value. Total book value of all Vaughn's common stock was $900,000 on this date. 2. (a) During Year 1, Vaughn reported $66,000 of net income. (b) During Year 1, Vaughn paid $30,000 of dividends. 3. (a) During Year 2, Vaughn reported $33,000 of net income. (b) During Year 2, Vaughn paid $19,500 of dividends. 4. (a) During Year 3, Vaughn reported a net loss of $11,000. (b) During Year 3, Vaughn paid $3,600 of dividends. 5. Indicate the Year 3 ending balance in the Investment account, and cumulative totals for Years 1, 2, and 3 for dividend revenue and investment revenue.

Fill in the dollar changes caused in the Investment account and Dividend Revenue or Investment Revenue account by each of the following transactions, assuming Bramble Company uses (a) the fair value method and (b) the equity method for accounting for its investments in Vaughn Company. (Enter negative amounts using either a negative sign preceding the number e.g. -45 or parentheses e.g. (45). Do not leave any answer field blank. Enter 0 for amounts.) (a) Fair Value Method (b) Equity Method Transaction Investment Account Dividend Revenue Investment Account Investment Revenue 1. At the beginning of Year 1, Bramble bought 30% of Vaughn's common stock at its book value. Total book value of all Vaughn's common stock was $900,000 on this date. 2. (a) During Year 1, Vaughn reported $66,000 of net income. (b) During Year 1, Vaughn paid $30,000 of dividends. 3. (a) During Year 2, Vaughn reported $33,000 of net income. (b) During Year 2, Vaughn paid $19,500 of dividends. 4. (a) During Year 3, Vaughn reported a net loss of $11,000. (b) During Year 3, Vaughn paid $3,600 of dividends. 5. Indicate the Year 3 ending balance in the Investment account, and cumulative totals for Years 1, 2, and 3 for dividend revenue and investment revenue.

Financial Accounting Intro Concepts Meth/Uses

14th Edition

ISBN:9781285595047

Author:Weil

Publisher:Weil

Chapter2: The Basics Of Record Keeping And Financial Statement Preparation: Balance Sheet

Section: Chapter Questions

Problem 8E

Related questions

Question

100%

Transcribed Image Text:Fill in the dollar changes caused in the Investment account and Dividend Revenue or Investment Revenue account by each of the following transactions, assuming Bramble Company uses (a) the fair value method

and (b) the equity method for accounting for its investments in Vaughn Company. (Enter negative amounts using either a negative sign preceding the number e.g. -45 or parentheses e.g. (45). Do not

leave any answer field blank. Enter 0 for amounts.)

(a) Fair Value Method

(b) Equity Method

Transaction

Investment Account

Dividend Revenue

Investment Account

Investment Revenue

1. At the beginning of Year 1, Bramble bought 30% of Vaughn's common stock at its book value.

Total book value of all Vaughn's common stock was $900,000 on this date.

2. (a) During Year 1, Vaughn reported $66,000 of net income.

(b) During Year 1, Vaughn paid $30,000 of dividends.

3. (a) During Year 2, Vaughn reported $33,000 of net income.

(b) During Year 2, Vaughn paid $19,500 of dividends.

4. (a) During Year 3, Vaughn reported a net loss of $11,000.

(b) During Year 3, Vaughn paid $3,600 of dividends.

5. Indicate the Year 3 ending balance in the Investment account, and cumulative totals for Years

1, 2, and 3 for dividend revenue and investment revenue.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College