FILLING IN THE RATIOS .. THE LEFT SIDE IS 2019 THE RIGHT SIDE IS 2020 IN THE IMAGE. Jergan Corporation Balance Sheets December 31 2020 2019 2018 Cash $ 30,800 $ 17,600 $ 18,700 Accounts receivable (net) 50,500 44,200 47,100 Other current assets 89,600 94,900 63,900 Investments 55,300 71,000 45,100 Plant and equipment (net) 500,500 370,000 358,500 $726,700 $597,700 $533,300 Current liabilities $85,500 $79,800 $69,400 Long-term debt 144,300 84,100 50,300 Common stock, $10 par 348,000 316,000 304,000 Retained earnings 148,900 117,800 109,600 $726,700 $597,700 $533,300 Jergan Corporation Income Statement For the Years Ended December 31 2020 2019 Sales revenue $738,000 $605,500 Less: Sales returns and allowances 39,100 29,900 Net sales 698,900 575,600 Cost of goods sold 425,600 367,000 Gross profit 273,300 208,600 Operating expenses (including income taxes) 182,443 151,040 Net income $ 90,857 $ 57,560

FILLING IN THE RATIOS .. THE LEFT SIDE IS 2019 THE RIGHT SIDE IS 2020 IN THE IMAGE. Jergan Corporation Balance Sheets December 31 2020 2019 2018 Cash $ 30,800 $ 17,600 $ 18,700 Accounts receivable (net) 50,500 44,200 47,100 Other current assets 89,600 94,900 63,900 Investments 55,300 71,000 45,100 Plant and equipment (net) 500,500 370,000 358,500 $726,700 $597,700 $533,300 Current liabilities $85,500 $79,800 $69,400 Long-term debt 144,300 84,100 50,300 Common stock, $10 par 348,000 316,000 304,000 Retained earnings 148,900 117,800 109,600 $726,700 $597,700 $533,300 Jergan Corporation Income Statement For the Years Ended December 31 2020 2019 Sales revenue $738,000 $605,500 Less: Sales returns and allowances 39,100 29,900 Net sales 698,900 575,600 Cost of goods sold 425,600 367,000 Gross profit 273,300 208,600 Operating expenses (including income taxes) 182,443 151,040 Net income $ 90,857 $ 57,560

Fundamentals of Financial Management (MindTap Course List)

15th Edition

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Eugene F. Brigham, Joel F. Houston

Chapter4: Analysis Of Financial Statements

Section: Chapter Questions

Problem 11P: RATIO CALCULATIONS Assume the following relationships for the Caulder Corp.: Sales/Total assets 1.3...

Related questions

Question

Practice Pack

FILLING IN THE RATIOS .. THE LEFT SIDE IS 2019 THE RIGHT SIDE IS 2020 IN THE IMAGE.

|

Jergan Corporation

Balance Sheets December 31 |

|||||||||

|---|---|---|---|---|---|---|---|---|---|

|

2020

|

2019

|

2018

|

|||||||

|

Cash

|

$ 30,800 | $ 17,600 | $ 18,700 | ||||||

|

|

50,500 | 44,200 | 47,100 | ||||||

|

Other current assets

|

89,600 | 94,900 | 63,900 | ||||||

|

Investments

|

55,300 | 71,000 | 45,100 | ||||||

|

Plant and equipment (net)

|

500,500 | 370,000 | 358,500 | ||||||

| $726,700 | $597,700 | $533,300 | |||||||

|

Current liabilities

|

$85,500 | $79,800 | $69,400 | ||||||

|

Long-term debt

|

144,300 | 84,100 | 50,300 | ||||||

|

Common stock, $10 par

|

348,000 | 316,000 | 304,000 | ||||||

|

|

148,900 | 117,800 | 109,600 | ||||||

| $726,700 | $597,700 | $533,300 |

|

Jergan Corporation

Income Statement For the Years Ended December 31 |

||||||

|---|---|---|---|---|---|---|

|

2020

|

2019

|

|||||

|

Sales revenue

|

$738,000 | $605,500 | ||||

|

Less: Sales returns and allowances

|

39,100 | 29,900 | ||||

|

Net sales

|

698,900 | 575,600 | ||||

|

Cost of goods sold

|

425,600 | 367,000 | ||||

|

Gross profit

|

273,300 | 208,600 | ||||

|

Operating expenses (including income taxes)

|

182,443 | 151,040 | ||||

|

Net income

|

$ 90,857 | $ 57,560 |

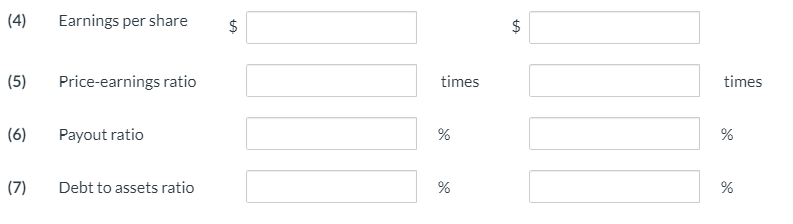

Transcribed Image Text:(4)

Earnings per share

2$

$

(5)

Price-earnings ratio

times

times

(6)

Payout ratio

%

(7)

Debt to assets ratio

%

%

%24

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Includes step-by-step video

Trending now

This is a popular solution!

Learn your way

Includes step-by-step video

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning