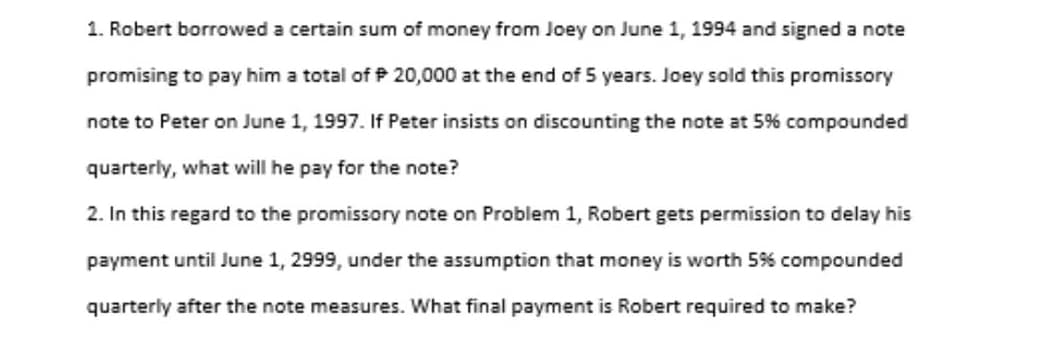

1. Robert borrowed a certain sum of money from Joey on June 1, 1994 and signed a note promising to pay him a total of P 20,000 at the end of 5 years. Joey sold this promissory note to Peter on June 1, 1997. If Peter insists on discounting the note at 5% compounded quarterly, what will he pay for the note? 2. In this regard to the promissory note on Problem 1, Robert gets permission to delay his payment until June 1, 2999, under the assumption that money is worth 5% compounded quarterly after the note measures. What final payment is Robert required to make?

1. Robert borrowed a certain sum of money from Joey on June 1, 1994 and signed a note promising to pay him a total of P 20,000 at the end of 5 years. Joey sold this promissory note to Peter on June 1, 1997. If Peter insists on discounting the note at 5% compounded quarterly, what will he pay for the note? 2. In this regard to the promissory note on Problem 1, Robert gets permission to delay his payment until June 1, 2999, under the assumption that money is worth 5% compounded quarterly after the note measures. What final payment is Robert required to make?

Chapter3: Income Sources

Section: Chapter Questions

Problem 32P

Related questions

Question

Transcribed Image Text:1. Robert borrowed a certain sum of money from Joey on June 1, 1994 and signed a note

promising to pay him a total of P 20,000 at the end of 5 years. Joey sold this promissory

note to Peter on June 1, 1997. If Peter insists on discounting the note at 5% compounded

quarterly, what will he pay for the note?

2. In this regard to the promissory note on Problem 1, Robert gets permission to delay his

payment until June 1, 2999, under the assumption that money is worth 5% compounded

quarterly after the note measures. What final payment is Robert required to make?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT