Chapter11: Capital Budgeting Decisions

Section: Chapter Questions

Problem 3PA: Use the tables in Appendix B to answer the following questions. A. If you would like to accumulate...

Related questions

Question

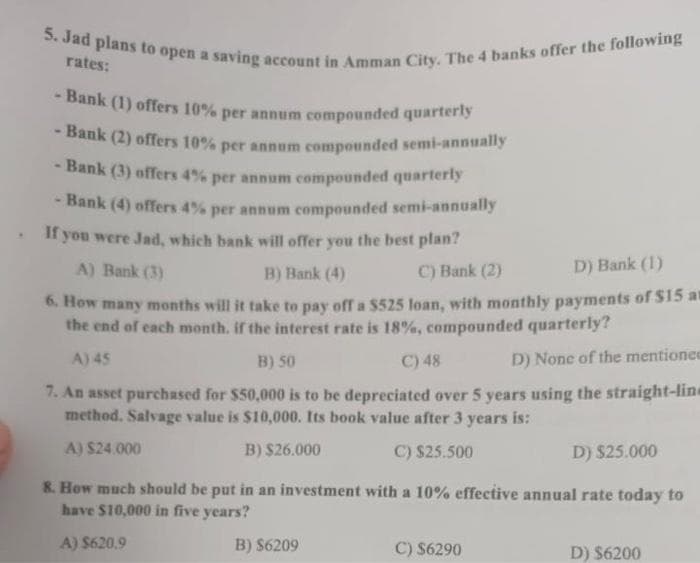

Transcribed Image Text:5. Jad plans to open a saving account in Amman City. The 4 banks offer the following

rates:

- Bank (1) offers 10% per annum compounded quarterly

- Bank (2) offers 10% per annum compounded semi-annually

- Bank (3) offers 4% per annum compounded quarterly

- Bank (4) offers 4% per annum compounded semi-annually

. If you were Jad, which bank will offer you the best plan?

A) Bank (3)

B) Bank (4)

C) Bank (2)

D) Bank (1)

6. How many months will it take to pay off a $525 loan, with monthly payments of $15 an

the end of each month, if the interest rate is 18%, compounded quarterly?

A) 45

B) 50

C) 48

D) None of the mentionee

7. An asset purchased for $50,000 is to be depreciated over 5 years using the straight-line

method. Salvage value is $10,000. Its book value after 3 years is:

A) $24.000

B) $26.000

C) $25.500

D) $25.000

8. How much should be put in an investment with a 10% effective annual rate today to

have $10,000 in five years?

A) $620.9

B) $6209

C) $6290

D) $6200

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT