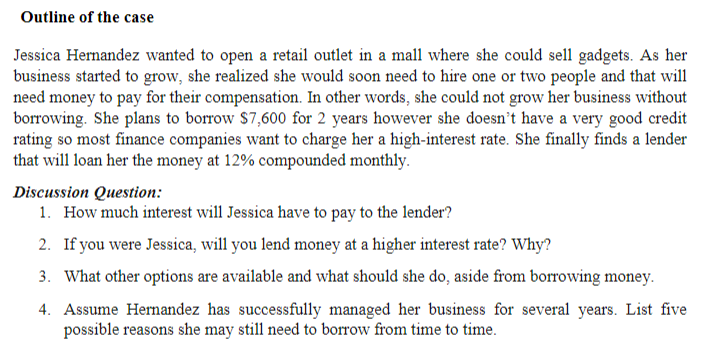

Outline of the case Jessica Hernandez wanted to open a retail outlet in a mall where she could sell gadgets. As her business started to grow, she realized she would soon need to hire one or two people and that will need money to pay for their compensation. In other words, she could not grow her business without borrowing. She plans to borrow $7,600 for 2 years however she doesn't have a very good credit rating so most finance companies want to charge her a high-interest rate. She finally finds a lender that will loan her the money at 12% compounded monthly. Discussion Question: 1. How much interest will Jessica have to pay to the lender? 2. If you were Jessica, will you lend money at a higher interest rate? Why? 3. What other options are available and what should she do, aside from borrowing money. 4. Assume Hernandez has successfully managed her business for several years. List five possible reasons she may still need to borrow from time to time.

Outline of the case Jessica Hernandez wanted to open a retail outlet in a mall where she could sell gadgets. As her business started to grow, she realized she would soon need to hire one or two people and that will need money to pay for their compensation. In other words, she could not grow her business without borrowing. She plans to borrow $7,600 for 2 years however she doesn't have a very good credit rating so most finance companies want to charge her a high-interest rate. She finally finds a lender that will loan her the money at 12% compounded monthly. Discussion Question: 1. How much interest will Jessica have to pay to the lender? 2. If you were Jessica, will you lend money at a higher interest rate? Why? 3. What other options are available and what should she do, aside from borrowing money. 4. Assume Hernandez has successfully managed her business for several years. List five possible reasons she may still need to borrow from time to time.

Chapter6: Business Expenses

Section: Chapter Questions

Problem 89TPC

Related questions

Question

Transcribed Image Text:Outline of the case

Jessica Hernandez wanted to open a retail outlet in a mall where she could sell gadgets. As her

business started to grow, she realized she would soon need to hire one or two people and that will

need money to pay for their compensation. In other words, she could not grow her business without

borrowing. She plans to borrow $7,600 for 2 years however she doesn't have a very good credit

rating so most finance companies want to charge her a high-interest rate. She finally finds a lender

that will loan her the money at 12% compounded monthly.

Discussion Question:

1. How much interest will Jessica have to pay to the lender?

2. If you were Jessica, will you lend money at a higher interest rate? Why?

3. What other options are available and what should she do, aside from borrowing money.

4. Assume Hernandez has successfully managed her business for several years. List five

possible reasons she may still need to borrow from time to time.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning