The stock price 2 months from the expiration of a European option is $99, the exercise price of the option is $61, the dividend yield is 4% per annum, the risk-free interest rate is 18% per annum, and the volatility is 38% per annum. Use the Black-Scholes-Merton formula to find the price of this call option. 4) 38.15 (В) 36.15 (С) 39.15 (D) 35.15 (E) 37.15 Select v Save The stock price 7 months from the expiration of a European option is $90, the exercise price of the option is $131, the dividend yield is 6% per annum, the risk-free interest rate is 14% per annum, and the volatility is 19% per annum. Use the Black-Scholes-Merton formula to find the price of this put option. A) 29.88 (B) 33.88 (C) 30.88 (D) 32.88 (E) 31.88

The stock price 2 months from the expiration of a European option is $99, the exercise price of the option is $61, the dividend yield is 4% per annum, the risk-free interest rate is 18% per annum, and the volatility is 38% per annum. Use the Black-Scholes-Merton formula to find the price of this call option. 4) 38.15 (В) 36.15 (С) 39.15 (D) 35.15 (E) 37.15 Select v Save The stock price 7 months from the expiration of a European option is $90, the exercise price of the option is $131, the dividend yield is 6% per annum, the risk-free interest rate is 14% per annum, and the volatility is 19% per annum. Use the Black-Scholes-Merton formula to find the price of this put option. A) 29.88 (B) 33.88 (C) 30.88 (D) 32.88 (E) 31.88

Chapter5: Currency Derivatives

Section: Chapter Questions

Problem 5ST

Related questions

Question

2

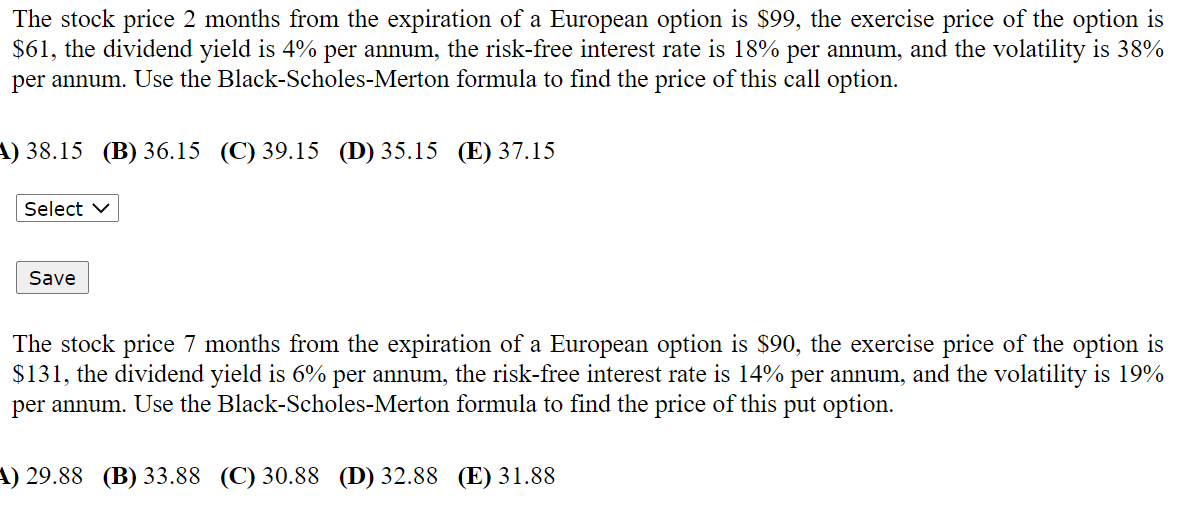

Transcribed Image Text:The stock price 2 months from the expiration of a European option is $99, the exercise price of the option is

$61, the dividend yield is 4% per annum, the risk-free interest rate is 18% per annum, and the volatility is 38%

per annum. Use the Black-Scholes-Merton formula to find the price of this call option.

4) 38.15 (В) 36.15 (С) 39.15 (D) 35.15 (E) 37.15

Select v

Save

The stock price 7 months from the expiration of a European option is $90, the exercise price of the option is

$131, the dividend yield is 6% per annum, the risk-free interest rate is 14% per annum, and the volatility is 19%

per annum. Use the Black-Scholes-Merton formula to find the price of this put option.

A) 29.88 (B) 33.88 (C) 30.88 (D) 32.88 (E) 31.88

Expert Solution

Step 1

Black - scholes option pricing model is used to estimate the fair value cost of option under a given set of conditions. this model is very useful for the investor to perfectly hedge all the options risk by buying and selling option over time. In this model there is no opportunity for the arbitrage and derived only the fair value of option price. , Pricing an options contract using the Black-Scholes model requires many assumptions and the relevant data of the stock such spot price, strike price, dividend yield, interest rate and volatility.

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning