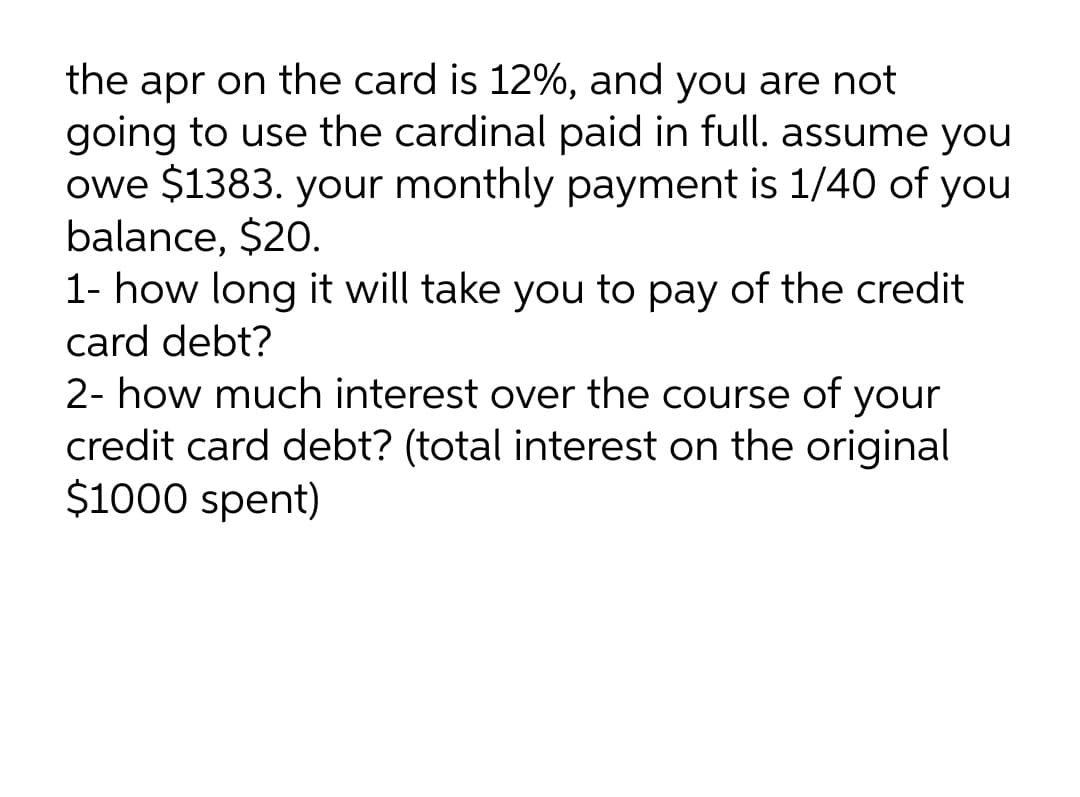

the apr on the card is 12%, and you are not going to use the cardinal paid in full. assume you owe $1383. your monthly payment is 1/40 of you balance, $20. 1- how long it will take you to pay of the credit card debt? 2- how much interest over the course of your

Q: Suppose we are pricing a five-year Libor-based interest rate swap with annual resets (30/360 day cou...

A: The fixed rate of the swap can be calculated by deducting the present value of final year (Z N) and ...

Q: A new car is purchased for \$25,000$25,000 and over time its value depreciates by one half every 5.5...

A: The depreciation is the concept used in time value of money which states that value of fixed asset h...

Q: Valuation of a constsnt growth stock Investors require a 15% rate of return on levine company stock ...

A: The dividend Discount Model would be considered as the model under which the price of the stock is d...

Q: BUSINESS FINANCE Name: Grade & Section: General Directions: ALL FORMS OF ALTERATIONS OR ERASURES WIL...

A: Note : As per the guidelines, only first question will be answered. Kindly post the remaining parts ...

Q: Return on Assets, or ROA, can be expressed as the product of two ratios. Which two?

A: Return on Assets: It refers to the ratio that measures the profitability of the company with respect...

Q: On March 15, year 1 ABC Corporation adopted a plan to accumulate P1,000,000 by September 1, year 5. ...

A: Annual deposit = X Interest rate (i) = 10%

Q: Use the following information to answer this question: Windswept, Incorporated 2021 Income Statem...

A: Analysts typically utilize the fixed asset turnover ratio (FAT) to assess operating performance. Thi...

Q: Bramble Company sells 8% bonds having a maturity value of $2,000,000 for $1,848,366. The bonds are d...

A: Bond Amortization is similar amortization of loan which is prepared to determine the actual interest...

Q: Ashely Corporation has 80 million outstanding equity shares and the following projected financial in...

A: Cost of capital (r) = 13% Tax rate (T) = 25% PE ratio in year 4 = 20 Shares outstanding (n) = 80 mil...

Q: What is the NPV of this project?

A: Calculation of present value of cash inflows: Year 1 2 3 Revnue 4500 4500 4500 Cost 2000 2000...

Q: An asset has an average return of 10.11 percent and a standard deviation of 19.02 percent. What rang...

A: Here we will apply the empirical rule in finance using the statistical principles. As per the empiri...

Q: a) Explain the term 'annuity'. b) What is meant by 'investment appraisal? c) Explain the term 'usefu...

A: As you have asked a question with multiple parts, we will solve the first 3 parts as per the policy ...

Q: A RM2,000 bond with 8% convertible semi-annually coupon matures at par on 15th October 2025. The bon...

A: Hi There, Thanks for posting the questions. As per our Q&A guidelines, must be answered only one...

Q: An investment promises to pay 3500 per year for the next 3 years and then 4000 per year for the foll...

A: Year Income 1 3500 2 3500 3 3500 4 4000 5 4000 Discount rate = 15%

Q: ccounts receivable 58,500 90,000 upplies 28,000 40,000 and quipment 360,000 300,000 120,000 1,066,50...

A: Given information : Assets 2019 2020 Cash 500000 400000 Accounts receivable 58500 90000 Sup...

Q: Q3. A) If the supply price of machine is Rs. 3000 and Marginal productivity of capital is 10% , the ...

A: For Prospective income and supply price of an asset to be equal cost of capital must be at that rate...

Q: You decide to invest in a portfolio consisting of 25 percent Stock A, 35 percent Stock B, and the re...

A: The portfolio return is computed based on weighted returns based on different states of the economy.

Q: n the general stock and bond markets lead to changes in the required rate of return on a firm’s stoc...

A: Step 1 The required reimbursement rate is the minimum refund that an investor will receive from havi...

Q: You are provided with the following exchange rate quotations: American Terms Bank quotations British...

A: Bid on (€/£) = 1/ Ask ($/€) Ask ($/€) = $1.4742 Bid ($/£) = $1.9712

Q: Which of the following does not explain why a peso today is worth more than a peso to be received in...

A: The time value of money states that an amount of money is worth more now than it will be in the futu...

Q: r creates a bear spread by selling a six-month put option with a $25 strike price for $2.15 and buyi...

A: Call gives the the opportunity to buy and put give opportunity to sell the stock. Both give the both...

Q: Stock Percentage of Portfolio Expected Return Standard Deviation Artemis Inc. 20% 6.00% 29.00% Babis...

A:

Q: Innovative Financial Inc. issues a bond with the following information: Par: $1,000 Time...

A: Par value (FV) = $1000 Period = 20 Years Quarterly period (n) = 20*4 = 80 YTM = 8% Quarterly YTM (r)...

Q: Rank the following from highest present value to lowest present value. A payment of $5000 to be rece...

A: Option 1. Payment of 5000 N = 5 Option 2. Payment of 5000 N = 2 Option 3. Payment of 2000 in 1 y...

Q: Saved An initial $3300 investment was worth $3820 after two years and six months. What quarterly com...

A: An interest rate method in which current interest is computed by multiplying the interest rate by th...

Q: Suppose we are thinking about replacing an old computer with a new one. The old one cost us $1,240,0...

A: Net present value: It is the difference between the present value of cash inflows and cash outflows.

Q: 6% effemive RM1000 is invested in a fund for 3 years at 6% simple interest rate for the first intere...

A: We have to calculate the Interest earned in the second year and the rate for the second year is 6% ...

Q: estimated cash flows before tax (CFBT) are? 10,000; 11,000; 14,000; 15,000 and v machinery. The proj...

A: Tax rate is 55% Discount rate is 10% Depriciation Method is straight line To Find: Average rate o...

Q: A Zack Firm is evaluating an Accounts Receivable Change that would increase Bad Debts from 2% to 4% ...

A: Bad debt is an expense that a business incurs once the repayment of credit previously extended to a ...

Q: Question 1- Texas Instruments (TXN) (please include your Excel spreadsheet file!) Actual data for Te...

A: An Investment is an asset with the goal of generating Income. Investors get return from the Investme...

Q: On March 15, year 1, ABC Corporation adopted a plan to accumulate P1,000,000 by September 1, year 5....

A: There are 2 types of annuity:- A) Ordinary Annuity B) Annuity in Advance A) Ordinary Annuity:- Whe...

Q: Howie Long has just learned he has won a $500,000 prize in the lottery. The lottery has given him tw...

A: In the given case the howie long has won a $500000 prize and he has been offered two options either ...

Q: Hiram Finnegan Inc. just paid a dividend of $5 per share because of the strong sales figure in the l...

A: Dividend per share = $5 Retention ratio = 0.80 Growth rate = 4.8%

Q: 1. A shop sells animal dolls at a very steady pace of 10 per day, 310 days per year. The wholesale c...

A: It is specifically asked the solution in Handwritten notes hence we will give the solution according...

Q: Briefiy explain (in one or two sentences) what the meaning is of the SFr/AS bid rate that you calcul...

A: Foreign Exchange rates: The value of one currency vis-vis another currency is known as the foreign e...

Q: Consider three stocks: Q, R and S Beta STD (annual) Forecast for Nov 2009 Dividend Stock Pr...

A:

Q: Pedro Corp. currently has sales of P2,000,000, and its days sales outstanding is 2 week. The financi...

A: SINCE YOU WANT US TO SOLVE THREE PARTS BUT THE LAST PART BELONGS TO ACCOUNTS AS IT REQUIRES PREPARAT...

Q: Assume that your client invests $2,300 at the end of each of the next four years. The investments ea...

A: Time value of money (TVM) refers to the concept which proves that the value of money today is higher...

Q: A. find the monthly payment of an ordinary if the present value is P18,500 with an interest rate of ...

A: A) Present value of annuity = P 18500 Interest rate = 10% quarterly compounded n = 6 years = 72 mont...

Q: You buy a house for $340000, and take out a 30-year mortgage at 5.5% interest. For simplicity, assum...

A: Loan Amount = $340,000 Time Period = 30 Years Interest Rate = 5.5%

Q: Using the tables presented in your reading material find the maturity value of $1 at a compound inte...

A:

Q: . Mr. Formento pays at the end of every month for a loan that charges 5% inter ompounded quarterly. ...

A: There are many types of annuities depending on the payment at the end or beginning or whether it is ...

Q: 2. 1 2 3. 4 6. 7. 8. 10 EOY 20 21 22 23 24 25 26 27 28 29 30 CF $300 $270 $240 $210 $180 Five deposi...

A: using the compounding formula: Amount = Principal1 +rnnt for deposit $300 maturity value in EOY 30...

Q: An Australian firm asks the bank for an AS/SFr quote because it received SFr and wants to change it ...

A: Calculate the ask rate of US$/SFR by dividing 1 by the bid rate of SFR/US$ which is 1.4950. Thus, t...

Q: Find the amount to which semi-annual deposits of $200.00 will grow in four years at 6.6% p.a. compou...

A: Semi annual deposit (PMT) = $200 Interest rate = 6.6% Semi annual interest rate (i) = 6.6%/2 = 3.3% ...

Q: When a country's currency depreciates against the currencies of major trading partners: O a. The cou...

A: The exchange rate is the rate at which one currency is exchanged for another. When one currency beco...

Q: In 1983 the average tuition for one year at an Ivy League school was $11,800. Thirty years later, in...

A: Growth rate is used in time value of money which shows the increase in nominal value of an asset or ...

Q: Your mother has an annuity that will give her monthly payments for 13 years. She tell you it is wort...

A: The term "annuity" refers to an insurance contract issued and distributed by financial institutions ...

Q: Rank the following car loan descriptions from highest payment ot lowest payment. The loan amount is ...

A: For the calculation purpose, the loan amount is assumed as 1,000.

Q: Jesse does not remember the how long he has to repay his loan. He remembers that the principal was $...

A:

Step by step

Solved in 3 steps with 6 images

- Marathon Peanuts converts a $130,000 account payable into a short-term note payable, with an annual interest rate of 6%, and payable in four months. How much interest will Marathon Peanuts owe at the end of four months? A. $2,600 B. $7,800 C. $137,800 D. $132,600A customer takes out a loan of $130,000 on January 1, with a maturity date of 36 months, and an annual interest rate of 11%. If 6 months have passed since note establishment, what would be the recorded interest figure at that time? A. $7,150 B. $65,000 C. $14,300 D. $2,383A person borrows $3,000 on a bank credit card at a nominalrate of 18% per year, which is actually charged at a rate of1.5% per month. a. What is the annual percentage rate (APR) for the card?(See Example 5.6.8 for a definition of APR.) b. Assume that the person does not place any additionalcharges on the card and pays the bank $150 eachmonth to pay off the loan. Let Bn be the balance owedon the card after n months. Find an explicit formulafor Bn . c. How long will be required to pay off the debt? d. What is the total amount of money the person will havepaid for the loan? If you could please answer b and d for me I put the other 2 questions there in cases they where somehow apart of b and d

- If your Visa credit card has an APR of 14.49%, compounded monthly and your current balance is $425.69. a) If you make no payments and no additional purchases for one year, what will bethe amount owed at the end of that year?b) How much total interest will be paid?c) What is the nominal rate?d) What is the effective annual rate (EAR)?e) Suppose this credit card company requires a minimum monthly payment of $15.Assuming that no additional purchases are made and also assuming that this minimum amount is paid every month, prepare an amortization schedule for the first three months of payments.Suppose that on January 1 you have a balance of $3100 on a credit card whose APR is 17%, which you want to pay off in 1 year. Assume that you make no additional charges to the card after January 1 a. Calculate your monthly payments.b. When the card is paid off, how much will you have paid since January 1?c. What percentage of your total payment from part (b) is interest?You get an offer for a credit card that charges 13.99% interest APR, compounded monthly. What effective annual interest rate does this credit card charge? Answer in percent format, to 2 decimal places, for example, __.__%.

- You have $2,650 balance on your charge card, and the finance charge is 16.8% annually.You send in the minimum monthly payment requested, which is $40.How much of this payment decreases your debt_______________________?And how much is the finance charge_________________?Assume you have a balance of $1000 on a credit card with an APR of 24%, or 2% per month. You start making monthly payments of $200, but at the same time you charge an additional $90 per month to the credit card. Assume that interest for a given month is based on the balance for the previous month. The following table shows how you can calculate your monthly balance. Complete and extend t the debt is paid off. How long does it take to pay off the credit card debt?One of your customers is delinquent on his accounts payable balance. You've mutally agreed to a repayment schedule of $520 per month. You will charge .92 percetn per month interest on the overdue balance. If the current balance is $14740, how long will it take for teh account to be paid off?

- You have credit card debt of $25,000 that has an APR (monthly compounding) of 17%. Each month you pay the minimum monthly payment only. You are required to pay only the outstanding interest. You have received an offer in the mail for an otherwise identical credit card with an APR of 12%. After considering all your alternatives, you decide to switch cards, roll over the outstanding balance on the old card into the new card, and borrow additional money as well. How much can you borrow today on the new card without changing the minimum monthly payment you will be required to pay?A credit card has a 21.99% APR, a minimum monthly payment of 3.15%, and a current monthly statement balance of $3,651.21. If there are $791.25 in purchases and a payment of $210.00 in the next month, what will be the next minimum monthly payment?Suppose your Visa credit card charges an APR of 13.5%, compounded monthly and your current statement shows a balance of $758.50.a) If you make no payments and no additional purchases for one year, what will bethe amount owed at the end of that year?b) How much total interest will be paid?c) What is the nominal rate?d) What is the effective annual rate (EAR)?e) Suppose this credit card company requires a minimum monthly payment of $25.Assuming that no additional purchases are made and also assuming that this minimum amount is paid every month, prepare an amortization schedule for the first three months of payments.