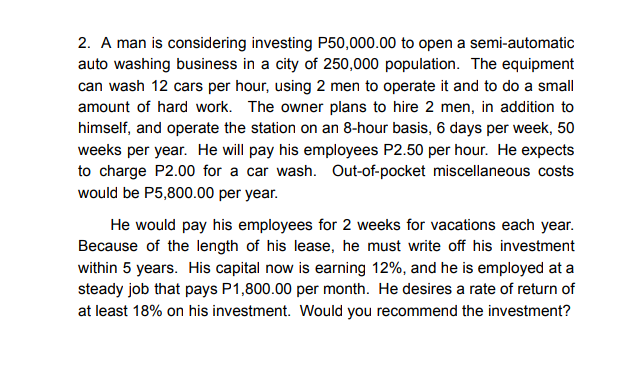

2. A man is considering investing P50,000.00 to open a semi-automatic auto washing business in a city of 250,000 population. The equipment can wash 12 cars per hour, using 2 men to operate it and to do a small amount of hard work. The owner plans to hire 2 men, in addition to himself, and operate the station on an 8-hour basis, 6 days per week, 50 weeks per year. He will pay his employees P2.50 per hour. He expects to charge P2.00 for a car wash. Out-of-pocket miscellaneous costs would be P5,800.00 per year. He would pay his employees for 2 weeks for vacations each year. Because of the length of his lease, he must write off his investment within 5 years. His capital now is earning 12%, and he is employed at a steady job that pays P1,800.00 per month. He desires a rate of return of at least 18% on his investment. Would you recommend the investment?

2. A man is considering investing P50,000.00 to open a semi-automatic auto washing business in a city of 250,000 population. The equipment can wash 12 cars per hour, using 2 men to operate it and to do a small amount of hard work. The owner plans to hire 2 men, in addition to himself, and operate the station on an 8-hour basis, 6 days per week, 50 weeks per year. He will pay his employees P2.50 per hour. He expects to charge P2.00 for a car wash. Out-of-pocket miscellaneous costs would be P5,800.00 per year. He would pay his employees for 2 weeks for vacations each year. Because of the length of his lease, he must write off his investment within 5 years. His capital now is earning 12%, and he is employed at a steady job that pays P1,800.00 per month. He desires a rate of return of at least 18% on his investment. Would you recommend the investment?

Chapter9: Capital Budgeting And Cash Flow Analysis

Section: Chapter Questions

Problem 12P

Related questions

Question

Please show all the solution

Transcribed Image Text:2. A man is considering investing P50,000.00 to open a semi-automatic

auto washing business in a city of 250,000 population. The equipment

can wash 12 cars per hour, using 2 men to operate it and to do a small

amount of hard work. The owner plans to hire 2 men, in addition to

himself, and operate the station on an 8-hour basis, 6 days per week, 50

weeks per year. He will pay his employees P2.50 per hour. He expects

to charge P2.00 for a car wash. Out-of-pocket miscellaneous costs

would be P5,800.00 per year.

He would pay his employees for 2 weeks for vacations each year.

Because of the length of his lease, he must write off his investment

within 5 years. His capital now is earning 12%, and he is employed at a

steady job that pays P1,800.00 per month. He desires a rate of return of

at least 18% on his investment. Would you recommend the investment?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College