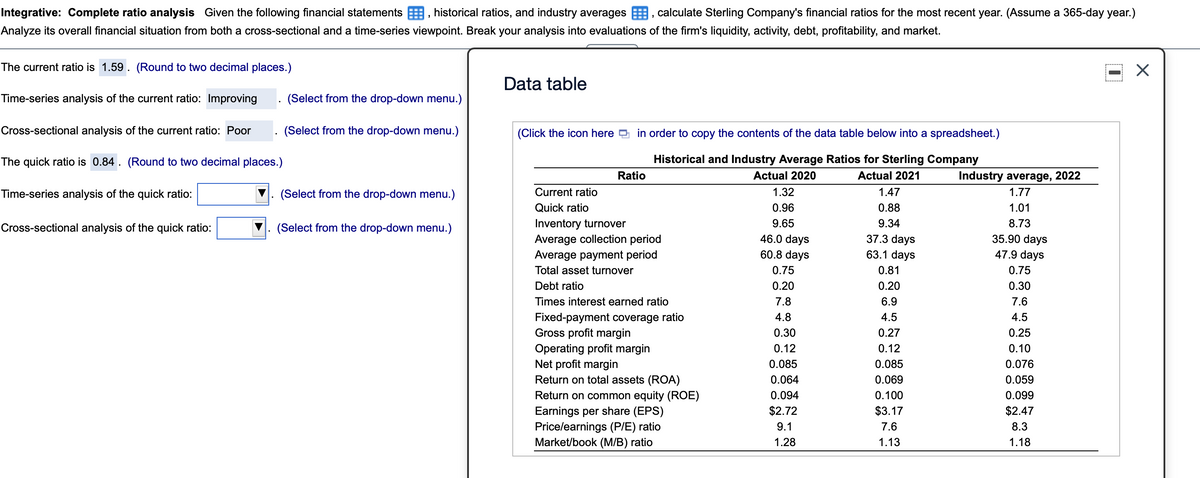

Integrative: Complete ratio analysis Given the following financial statements E, historical ratios, and industry averages , calculate Sterling Company's financial ratios for the most recent year. (Assume a 365-day year.) Analyze its overall financial situation from both a cross-sectional and a time-series viewpoint. Break your analysis into evaluations of the firm's liquidity, activity, debt, profitability, and market. The current ratio is 1.59. (Round to two decimal places.) Data table Time-series analysis of the current ratio: Improving (Select from the drop-down menu.) Cross-sectional analysis of the current ratio: Poor (Select from the drop-down menu.) (Click the icon here O in order to copy the contents of the data table below into a spreadsheet.) The quick ratio is 0.84. (Round to two decimal places.) Historical and Industry Average Ratios for Sterling Company Ratio Actual 2020 Actual 2021 Industry average, 2022 Time-series analysis of the quick ratio: (Select from the drop-down menu.) Current ratio 1.32 1.47 1.77 Quick ratio 0.96 0.88 1.01 Inventory turnover Average collection period Average payment period 9.65 9.34 8.73 Cross-sectional analysis of the quick ratio: (Select from the drop-down menu.) 46.0 days 37.3 days 35.90 days 60.8 days 63.1 days 47.9 days Total asset turnover 0.75 0.81 0.75 Debt ratio 0.20 0.20 0.30 Times interest earned ratio 7.8 6.9 7.6 Fixed-payment coverage ratio Gross profit margin 4.8 4.5 4.5 0.30 0.27 0.25 Operating profit margin Net profit margin 0.12 0.12 0.10 0.085 0.085 0.076 Return on total assets (ROA) Return on common equity (ROE) 0.064 0.069 .059 0.094 0.100 0.099 $2.72 $3.17 $2.47 Earnings per share (EPS) Price/earnings (P/E) ratio Market/book (M/B) ratio 9.1 7.6 8.3 1.28 1.13 1.18

Integrative: Complete ratio analysis Given the following financial statements E, historical ratios, and industry averages , calculate Sterling Company's financial ratios for the most recent year. (Assume a 365-day year.) Analyze its overall financial situation from both a cross-sectional and a time-series viewpoint. Break your analysis into evaluations of the firm's liquidity, activity, debt, profitability, and market. The current ratio is 1.59. (Round to two decimal places.) Data table Time-series analysis of the current ratio: Improving (Select from the drop-down menu.) Cross-sectional analysis of the current ratio: Poor (Select from the drop-down menu.) (Click the icon here O in order to copy the contents of the data table below into a spreadsheet.) The quick ratio is 0.84. (Round to two decimal places.) Historical and Industry Average Ratios for Sterling Company Ratio Actual 2020 Actual 2021 Industry average, 2022 Time-series analysis of the quick ratio: (Select from the drop-down menu.) Current ratio 1.32 1.47 1.77 Quick ratio 0.96 0.88 1.01 Inventory turnover Average collection period Average payment period 9.65 9.34 8.73 Cross-sectional analysis of the quick ratio: (Select from the drop-down menu.) 46.0 days 37.3 days 35.90 days 60.8 days 63.1 days 47.9 days Total asset turnover 0.75 0.81 0.75 Debt ratio 0.20 0.20 0.30 Times interest earned ratio 7.8 6.9 7.6 Fixed-payment coverage ratio Gross profit margin 4.8 4.5 4.5 0.30 0.27 0.25 Operating profit margin Net profit margin 0.12 0.12 0.10 0.085 0.085 0.076 Return on total assets (ROA) Return on common equity (ROE) 0.064 0.069 .059 0.094 0.100 0.099 $2.72 $3.17 $2.47 Earnings per share (EPS) Price/earnings (P/E) ratio Market/book (M/B) ratio 9.1 7.6 8.3 1.28 1.13 1.18

Financial Management: Theory & Practice

16th Edition

ISBN:9781337909730

Author:Brigham

Publisher:Brigham

Chapter3: Analysis Of Financial Statements

Section: Chapter Questions

Problem 14P: The Jimenez Corporation’s forecasted 2020 financial statements follow, along with some industry...

Related questions

Question

Transcribed Image Text:Integrative: Complete ratio analysis Given the following financial statements E, historical ratios, and industry averages , calculate Sterling Company's financial ratios for the most recent year. (Assume a 365-day year.)

Analyze its overall financial situation from both a cross-sectional and a time-series viewpoint. Break your analysis into evaluations of the firm's liquidity, activity, debt, profitability, and market.

The current ratio is 1.59. (Round to two decimal places.)

Data table

Time-series analysis of the current ratio: Improving

(Select from the drop-down menu.)

Cross-sectional analysis of the current ratio: Poor

(Select from the drop-down menu.)

(Click the icon here O in order to copy the contents of the data table below into a spreadsheet.)

The quick ratio is 0.84. (Round to two decimal places.)

Historical and Industry Average Ratios for Sterling Company

Ratio

Actual 2020

Actual 2021

Industry average, 2022

Time-series analysis of the quick ratio:

(Select from the drop-down menu.)

Current ratio

1.32

1.47

1.77

Quick ratio

0.96

0.88

1.01

Inventory turnover

Average collection period

Average payment period

9.65

9.34

8.73

Cross-sectional analysis of the quick ratio:

(Select from the drop-down menu.)

46.0 days

37.3 days

35.90 days

60.8 days

63.1 days

47.9 days

Total asset turnover

0.75

0.81

0.75

Debt ratio

0.20

0.20

0.30

Times interest earned ratio

7.8

6.9

7.6

Fixed-payment coverage ratio

Gross profit margin

4.8

4.5

4.5

0.30

0.27

0.25

Operating profit margin

Net profit margin

0.12

0.12

0.10

0.085

0.085

0.076

Return on total assets (ROA)

Return on common equity (ROE)

0.064

0.069

.059

0.094

0.100

0.099

$2.72

$3.17

$2.47

Earnings per share (EPS)

Price/earnings (P/E) ratio

Market/book (M/B) ratio

9.1

7.6

8.3

1.28

1.13

1.18

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning