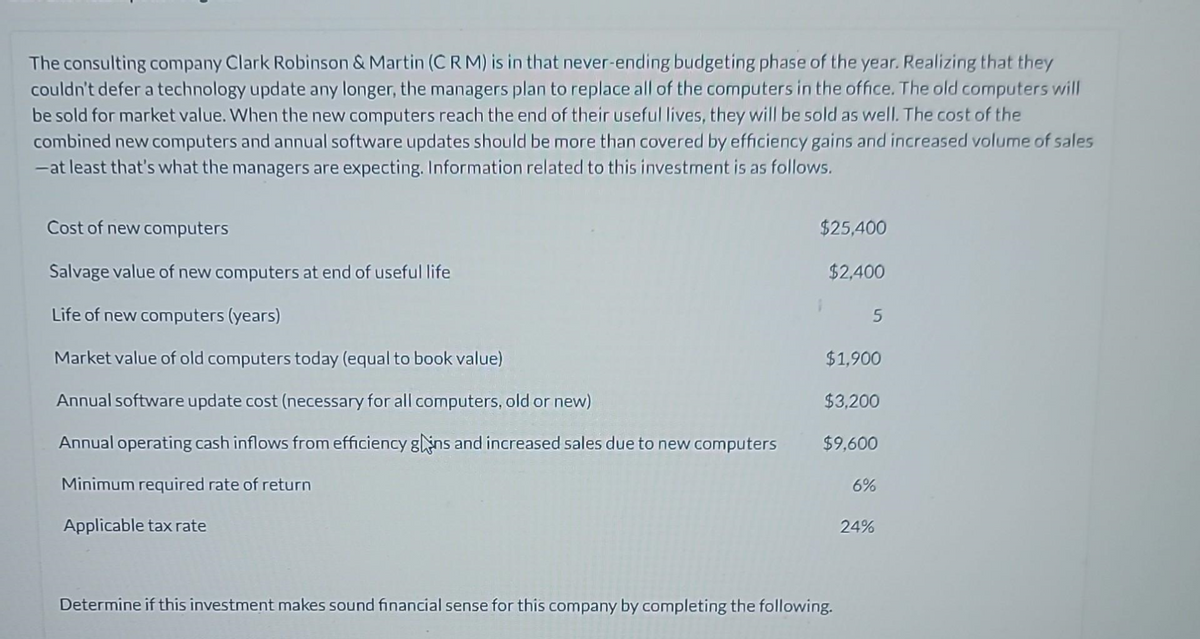

The consulting company Clark Robinson & Martin (CRM) is in that never-ending budgeting phase of the year. Realizing that they couldn't defer a technology update any longer, the managers plan to replace all of the computers in the office. The old computers will be sold for market value. When the new computers reach the end of their useful lives, they will be sold as well. The cost of the combined new computers and annual software updates should be more than covered by efficiency gains and increased volume of sales -at least that's what the managers are expecting. Information related to this investment is as follows. Cost of new computers Salvage value of new computers at end of useful life Life of new computers (years) Market value of old computers today (equal to book value) Annual software update cost (necessary for all computers, old or new) Annual operating cash inflows from efficiency gins and increased sales due to new computers Minimum required rate of return Applicable tax rate $25,400 $2,400 5 $1,900 $3,200 $9,600 Determine if this investment makes sound financial sense for this company by completing the following. 6% 24%

The consulting company Clark Robinson & Martin (CRM) is in that never-ending budgeting phase of the year. Realizing that they couldn't defer a technology update any longer, the managers plan to replace all of the computers in the office. The old computers will be sold for market value. When the new computers reach the end of their useful lives, they will be sold as well. The cost of the combined new computers and annual software updates should be more than covered by efficiency gains and increased volume of sales -at least that's what the managers are expecting. Information related to this investment is as follows. Cost of new computers Salvage value of new computers at end of useful life Life of new computers (years) Market value of old computers today (equal to book value) Annual software update cost (necessary for all computers, old or new) Annual operating cash inflows from efficiency gins and increased sales due to new computers Minimum required rate of return Applicable tax rate $25,400 $2,400 5 $1,900 $3,200 $9,600 Determine if this investment makes sound financial sense for this company by completing the following. 6% 24%

Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Don R. Hansen, Maryanne M. Mowen

Chapter16: Cost-volume-profit Analysis

Section: Chapter Questions

Problem 40P

Related questions

Question

Calculate the Following for the question:

i)

i-a) Based on above NPV, is

ii) IRR for the investment

iii) Determine simple payback period using

iii-a) before-tax cash flows

iii-b) After-tax cash flows

iv) Determine discounted payback period using after tax cash flows

v) Find ARR

vi) Calcualte profitability index for the investment

Transcribed Image Text:The consulting company Clark Robinson & Martin (CRM) is in that never-ending budgeting phase of the year. Realizing that they

couldn't defer a technology update any longer, the managers plan to replace all of the computers in the office. The old computers will

be sold for market value. When the new computers reach the end of their useful lives, they will be sold as well. The cost of the

combined new computers and annual software updates should be more than covered by efficiency gains and increased volume of sales

-at least that's what the managers are expecting. Information related to this investment is as follows.

Cost of new computers

Salvage value of new computers at end of useful life

Life of new computers (years)

Market value of old computers today (equal to book value)

Annual software update cost (necessary for all computers, old or new)

Annual operating cash inflows from efficiency gins and increased sales due to new computers

Minimum required rate of return

Applicable tax rate

$25,400

$2,400

5

$1,900

$3,200

$9,600

Determine if this investment makes sound financial sense for this company by completing the following.

6%

24%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 3 images

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Essentials of Business Analytics (MindTap Course …

Statistics

ISBN:

9781305627734

Author:

Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Essentials of Business Analytics (MindTap Course …

Statistics

ISBN:

9781305627734

Author:

Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning