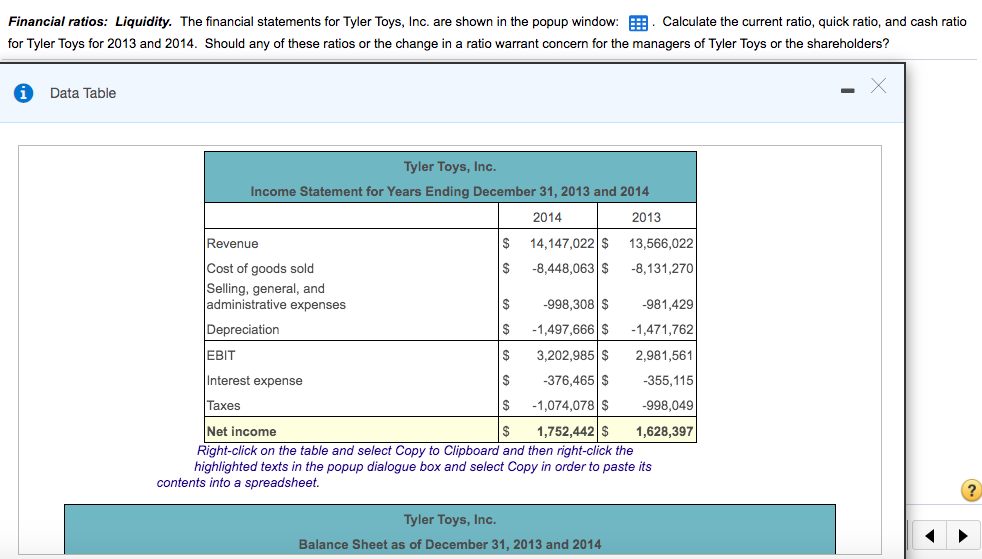

Financial ratios: Liquidity. The financial statements for Tyler Toys, Inc. are shown in the popup window: . Calculate the current ratio, quick ratio, and cash ratio for Tyler Toys for 2013 and 2014. Should any of these ratios or the change in a ratio warrant concern for the managers of Tyler Toys or the shareholders? Data Table Tyler Toys, Inc. Income Statement for Years Ending December 31, 2013 and 2014

Financial ratios: Liquidity. The financial statements for Tyler Toys, Inc. are shown in the popup window: . Calculate the current ratio, quick ratio, and cash ratio for Tyler Toys for 2013 and 2014. Should any of these ratios or the change in a ratio warrant concern for the managers of Tyler Toys or the shareholders? Data Table Tyler Toys, Inc. Income Statement for Years Ending December 31, 2013 and 2014

Financial Accounting: The Impact on Decision Makers

10th Edition

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Gary A. Porter, Curtis L. Norton

Chapter13: Financial Statement Analysis

Section: Chapter Questions

Problem 13.5MCP

Related questions

Question

Practice Pack

Chapter 14, Question 2

Transcribed Image Text:Financial ratios: Liquidity. The financial statements for Tyler Toys, Inc. are shown in the popup window: E. Calculate the current ratio, quick ratio, and cash ratio

for Tyler Toys for 2013 and 2014. Should any of these ratios or the change in a ratio warrant concern for the managers of Tyler Toys or the shareholders?

Data Table

Tyler Toys, Inc.

Income Statement for Years Ending December 31, 2013 and 2014

2014

2013

Revenue

$

14,147,022 $

13,566,022

Cost of goods sold

Selling, general, and

ladministrative expenses

$

-8,448,063 $

-8.131.270

-998,308 $

-981,429

Depreciation

-1.497.666 s

-1,471,762

EBIT

$

3,202,985 $

2,981,561

Interest expense

$

-376,465 $

-355,115

|Таxes

-1,074,078 $

-998.049

Net income

Right-click on the table and select Copy to Clipboard and then right-click the

highlighted texts in the popup dialogue box and select Copy in order to paste its

1,752,442 $

1,628,397

contents into a spreadsheet.

Tyler Toys, Inc.

Balance Sheet as of December 31, 2013 and 2014

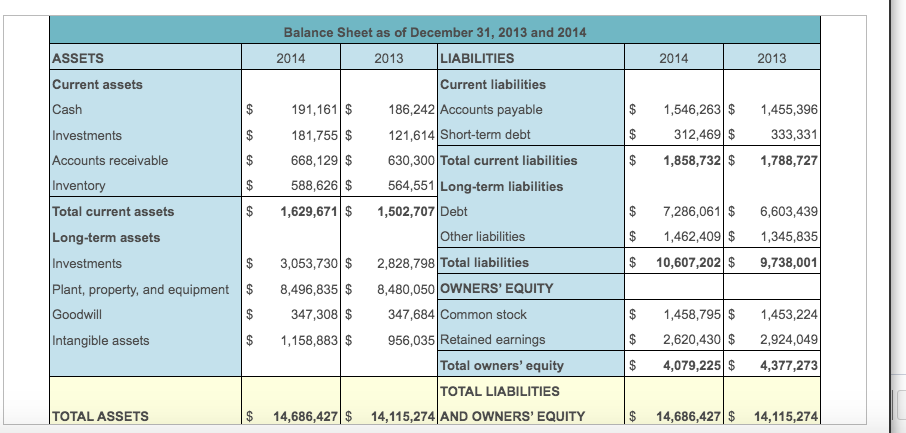

Transcribed Image Text:Balance Sheet as of December 31, 2013 and 2014

ASSETS

2014

2013

LIABILITIES

2014

2013

Current assets

Current liabilities

186,242 Accounts payable

Cash

191,161 $

1,546,263 $

1,455,396

121,614 Short-term debt

$

312,469 $

Investments

Accounts receivable

Inventory

181,755 $

333,331

668,129 $

630,300 Total current liabilities

$

1,858,732 $

1,788,727

$

588,626 $

564,551 Long-term liabilities

Total current assets

$

7,286,061 $

$

1,462,409 $

1,629,671 $

1,502,707 Debt

6,603,439

1,345,835

Long-term assets

Other liabilities

Investments

3,053,730 $

2,828,798 Total liabilities

$

10,607,202 $

9,738,001

Plant, property, and equipment $

8,496,835 $

8,480,050 OWNERS' EQUITY

Goodwill

347,308 $

347,684 Common stock

1,458,795 $

1,453,224

956,035 Retained earnings

Total owners' equity

Intangible assets

1,158,883 $

$

2,620,430 $

2,924,049

$

4,079,225 $

4,377,273

TOTAL LIABILITIES

TOTAL ASSETS

14,686,427| $

14,115,274 AND OWNERS' EQUITY

$ 14,686,427| $

14,115,274

%24

%24

%24

%24

%24

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Includes step-by-step video

Trending now

This is a popular solution!

Learn your way

Includes step-by-step video

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub