Hello! look at the attached images and answee the following points: (a) Calculate ratios for the year ended 31 December 2021 (showing your workings) for Primrose Plc, equivalent to those provided above. Return on year-end capital employed Net asset turnover Gross profit margin

Hello! look at the attached images and answee the following points: (a) Calculate ratios for the year ended 31 December 2021 (showing your workings) for Primrose Plc, equivalent to those provided above. Return on year-end capital employed Net asset turnover Gross profit margin

Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Chapter15: Financial Statement Analysis

Section: Chapter Questions

Problem 19BEA

Related questions

Question

Hello! look at the attached images and answee the following points:

(a) Calculate ratios for the year ended 31 December 2021 (showing your workings) for Primrose Plc, equivalent to those provided above.

- Return on year-end capital employed

- Net asset turnover

- Gross profit margin

- Net profit margin

Current ratio - Closing inventory holding period

- Trade receivables’ collection period viii. Trade payables’ payment period

- Dividend yield

- Dividend cover

(b) Analyse the financial performance and position of Primrose Plc for the year ended 31 December 2021 compared to 31 December 2020.

(c) Explain the uses and the general limitations of ratio analysis.

Thank you a lot!

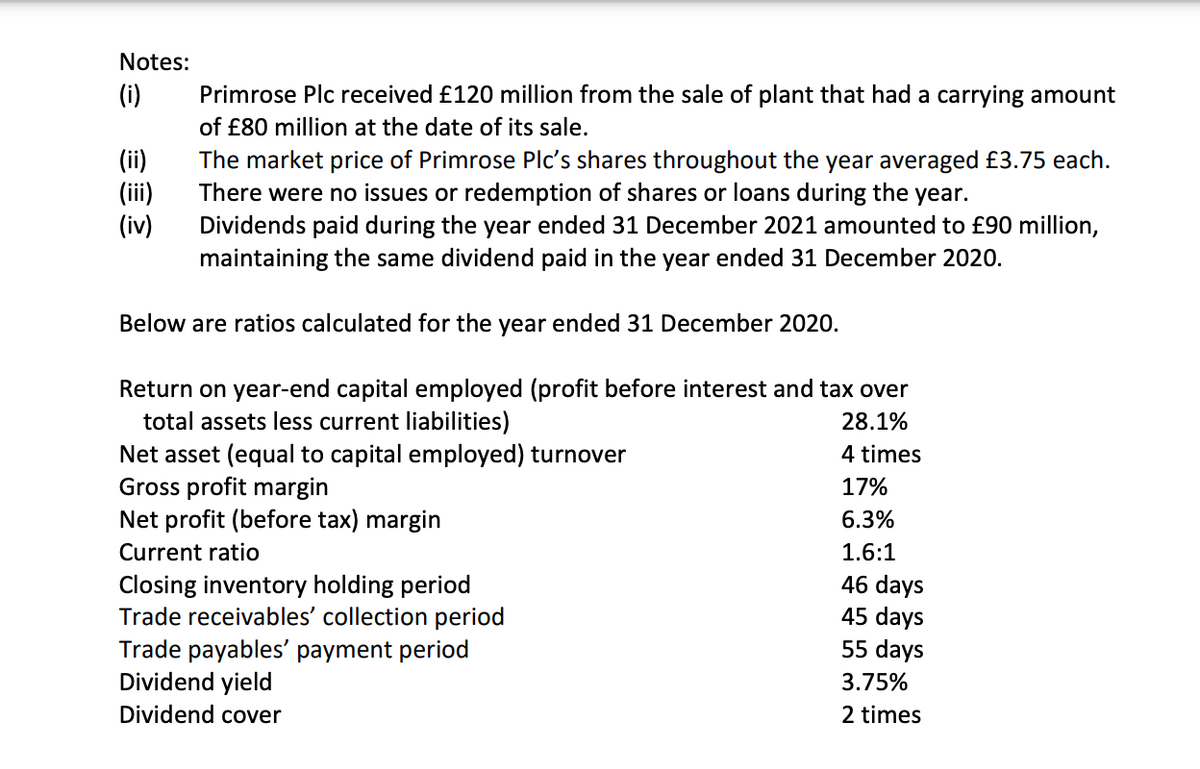

Transcribed Image Text:Notes:

(i)

Primrose Plc received £120 million from the sale of plant that had a carrying amount

of £80 million at the date of its sale.

(ii)

The market price of Primrose Plc's shares throughout the year averaged £3.75 each.

There were no issues or redemption of shares or loans during the year.

(iii)

(iv)

Dividends paid during the year ended 31 December 2021 amounted to £90 million,

maintaining the same dividend paid in the year ended 31 December 2020.

Below are ratios calculated for the year ended 31 December 2020.

Return on year-end capital employed (profit before interest and tax over

total assets less current liabilities)

28.1%

Net asset (equal to capital employed) turnover

4 times

Gross profit margin

17%

6.3%

Net profit (before tax) margin

Current ratio

1.6:1

46 days

45 days

Closing inventory holding period

Trade receivables' collection period

Trade payables' payment period

Dividend yield

55 days

3.75%

Dividend cover

2 times

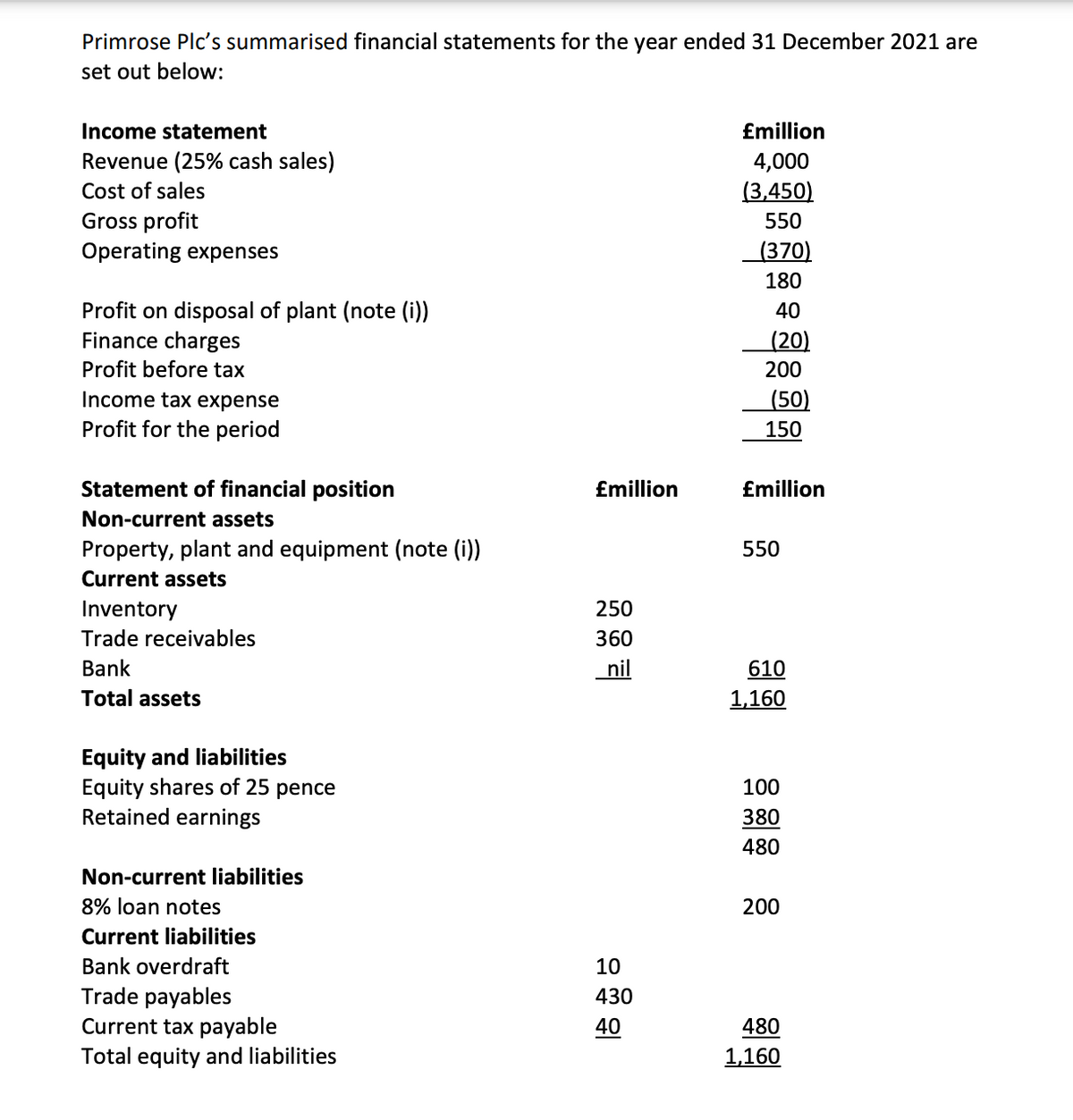

Transcribed Image Text:Primrose Plc's summarised financial statements for the year ended 31 December 2021 are

set out below:

Income statement

£million

Revenue (25% cash sales)

4,000

Cost of sales

(3,450)

Gross profit

550

Operating expenses

(370)

180

Profit on disposal of plant (note (i))

40

Finance charges

(20)

Profit before tax

Income tax expense

Profit for the period

Statement of financial position

Non-current assets

Property, plant and equipment (note (i))

Current assets

Inventory

Trade receivables

Bank

Total assets

Equity and liabilities

Equity shares of 25 pence

Retained earnings

Non-current liabilities

8% loan notes

Current liabilities

Bank overdraft

Trade payables

Current tax payable

Total equity and liabilities

£million

250

360

nil

10

430

40

200

(50)

150

£million

550

610

1,160

100

380

480

200

480

1,160

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning