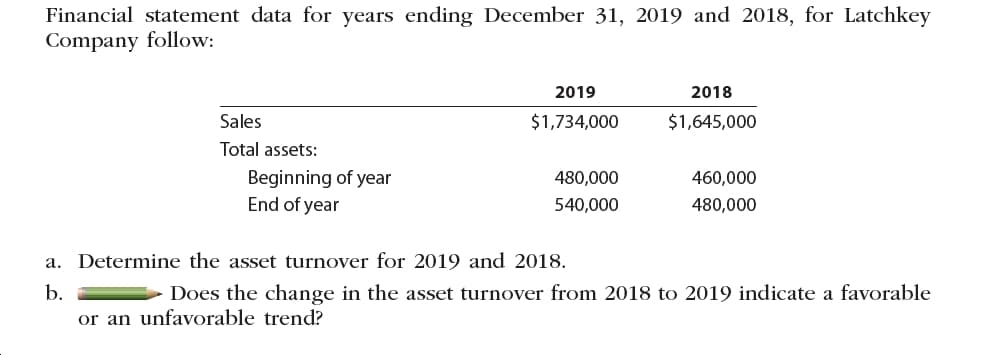

Financial statement data for years ending December 31, 2019 and 2018, for Latchkey Company follow: 2019 2018 Sales $1,734,000 $1,645,000 Total assets: Beginning of year End of year 480,000 460,000 540,000 480,000 a. Determine the asset turnover for 2019 and 2018. b. Does the change in the asset turnover from 2018 to 2019 indicate a favorable or an unfavorable trend?

Q: Condensed financial data of Cullumber Company for 2020 and 2019 are presented below. CULLUMBER…

A: Cash flow statement is a statement which is prepared to find out the cash comes in and goes out , by…

Q: During 2020, Metlock, Inc. reported net sales of $2,850,900 and net income of $1,550,000. Its…

A: Asset turnover ratio calculates how much the company was able to generate revenue using it's assets.…

Q: Barker, Inc. had reported the folowing details for the year ended December 31, 2019: Net sales…

A: The asset turnover ratio is calculated as ratio of sales and average total assets

Q: As Reported Annual Income Statement Report Date Scale 2019 2018 2017 Thousands 121,162,000…

A: Ratio Analysis: This is the process of computing, determining, and presenting the relationship of…

Q: Income Statement For the Year Ended June 30, 2020 Net of goods sold (including depreciation of…

A: In the direct method of a cash flow statement, cash flow from operating activities is calculated by…

Q: Financial statement data for years ending December 31, 2019 and 2018, for Edison Company follow:…

A: Ratio analysis is a tool used for the evaluation of various aspects of the entity such as liquidity,…

Q: Figures are in millions. Total assets Total liabilities Net sales Net income December 31, 2019…

A: Total asset in year 2019=$930.90 millions Total asset in year 2018=$920.10 millions Asset…

Q: Return on Assets Ratio and Asset Turnover Ratio Northern Systems reported the following financial…

A: Return on Assets (ROA): This financial ratio evaluates a company's efficiency in operating the…

Q: Northern Systems reported the following financial data (in millions) in its annual report: 2018 2019…

A: Return on assets =Net income / Average total assets Where, Average total assets = (total assets,…

Q: Summary financial information for Gandaulf Company is as follows. Compute the amount and percentage…

A: Horizontal analysis is a method of analyzing financial statements that involves comparing particular…

Q: The balance sheet of Huan Corporation reported net fixed assets of $332,000 at the end of 2018. The…

A: Fixed Assets: It refers to the long-term assets having a useful life of more than a year which is,…

Q: Return on Assets Ratio and Asset Turnover Ratio Northern Systems reported the following financial…

A: First, there is a need to calculate average total assets:

Q: Balance Sheet 2019 2018 Income Statement 2019 2018 Assets Sales $ 51,000,000 $ 47,000,000 Cash…

A: common stock gives the holder the ownership of the firm. formula to find the number of common stock:…

Q: Following are selected balance sheet accounts of Monty Bros. Corp. at December 31, 2020 and 2019,…

A: Operating activities: Operating activity is the main business activity of any organization. The…

Q: Following are selected balance sheet accounts of Oriole Bros. Corp. at December 31, 2020 and 2019,…

A: Calculation for above requirement are as follows.

Q: The following information for Ford Company for the year 2019 has been assembled: Market value at…

A: Given information : Market value at December 31, 2019 : $600,000 Total liabilities : $100,000 Debt…

Q: Current Attempt in Progress Coronado Industries’ balance sheet at December 31, 2021, is…

A:

Q: Selected items from Lemus Enterprises 12-31-2019 and 12-31-2018, financial statements are presented…

A: Assets Turnover Ratio determines the ability of a firm or company to generate revenue from its…

Q: Direction: Presented above is the comparative statements of the financial position of ABC Company.…

A: Horizontal analysis is prepared to calculate the variance from previous year by showing…

Q: Income Statement (Extract) for the year ended 31 March 2018 2019 £ £ Sales 3,000,000…

A: Financial ratio is an arithmetic expression used to describe the significant relationship between…

Q: Here is financial information for Sage Hill Inc. Prepare a schedule showing a horizontal analysis…

A: Horizontal analysis means where the analysis is made with regard with two different period where as…

Q: Suppose selected comparative statement data for the giant bookseller Barnes & Noble are presented…

A: The question is based on the concept of Financial Accounting. As per the Bartleby guidelines we are…

Q: This is single question of two parts a. A company's summary information is as follows: 2019 2018…

A: Answer a) Calculation of Amount and percentage change in total assets in 2019 Amount of Change in…

Q: Compute for the company's profitability and operating efficiency's ratios for 2019 B.Operating…

A: "Since you have posted a question with multiple sub-parts, we will solve first three sub-parts for…

Q: Condensed financial data of Flounder Company for 2020 and 2019 are presented below. FLOUNDER…

A: Cash flows statements is categories into three activities Operating activity Investing activity…

Q: The balance sheets of Davidson Corporation reported net fixed assets of $348,000 at the end of 2021.…

A: Fixed asset turnover ratio: It is an efficiency ratio that indicates how efficient a business is at…

Q: Computing the asset turnover ratio Biagas, Inc. had net sales of $55,500,000 for the year ended May…

A: Asset turnover ratio = Net sales / Average total assets Where, Average total assets = ( Beginning…

Q: Financial statement data for years ending December 31, 2019 and 2018, for Edison Company follow:…

A: Asset turnover ratio is used to determine the efficiency of the company towards the use of asset…

Q: Forecast an Income Statement Seagate Technology reports the following income statement for fiscal…

A: Income statement: Under this Statement showing the company’s performance over a period of time by…

Q: Referring to the following data of the Omani Company, that extracted from the balance sheet at…

A: Total Asset Turnover = Net Sales/ Total Assets Total Assets = Fixed Assets + Current Assets Current…

Q: Financial statement data for years ending December 31, 2019 and 2018, for Edison Company follow:…

A: a.Calculate the asset turnover for 2019.

Q: Condensed financial data of Pat Metheny Company for 2020 and 2019 are presented below. Pat…

A: A statement prepared to analyze the liquidity of the company is called as the cash flow statement.…

Q: elected items from Lemus Enterprises 12-31-2019 and 12-31-2018, financial statements are presented…

A: Asset turnover ratio= Net sales/ average total assets calculation of average total asset = (opening…

Q: The following information for Ford Company for the year 2019 has been assembled: Market value at…

A: Asset turnover= Total Sales/ Average Assets Return on sales= Operating Profit/ Net Sales Debt…

Q: he management of Zigby Manufacturing prepared the following estimated balance sheet for March 2019.…

A: "Since you have posted a question with multiple sub-parts, we will solve first three sub-parts for…

Q: Suppose selected comparative statement data for the giant bookseller Barnes & Noble are presented…

A: Accounting ratios are determined by the corporation in identifying the efficiency in generating…

Q: Following are selected balance sheet accounts of Allman Bros. Corp. at December 31, 2020 and 2019,…

A: Determine the category (operating, investing, or financing) and the amount that should be reported…

Q: Prepare a statement of cash flows using the direct method.

A: Cash flow statements helps a company to identify it cash inflows and outflows from various…

Q: Balance Sheet 2019 2018 Income Statement 2019 2018 Assets Sales $ 51,000,000 $ 47,000,000 5,100,000…

A: Book value per share can be calculated by dividing stockholders equity excluding preferred stock…

Q: Suppose selected comparative statement data for the giant bookseller Barnes & Noble are presented…

A: Formulas: Return on Common stockholders equity = Net income / Average Common stockholders equity…

Q: KORBIN COMPANY Comparative Balance Sheets December 31, 2019, 2018, and 2017 2019 2018 2017 Assets…

A: We have the following information:

Q: During 2020, Riverbed Corporation reported net sales of $5,542,800 and net income of $1,560,0O0. Its…

A: Turnover: Turnover is a ratio used to measure the efficiency of a company's ability to use its…

Q: The balance sheets of Pinewood Resorts reported net fixed assets of $740,000 and $940,000 at the end…

A:

Q: Return on Assets Ratio and Asset Turnover Ratio United Systems reported the following financial data…

A: Generally, the assets turnover is calculated by dividing the net sales by average total assets. In…

Q: PERFORM A LIQUIDITY AND PROFITABILITY ANALYSIS ON THE FOLLOWING COMPANY UTILIZING THE FOLLOWING…

A: Liquidity and Profitability Analysis The purpose behind to know the liquidity and profitability…

Q: Balance Sheet Calculations Fermer Company's balance sheet information at the end of 2019 and 2020 is…

A: 1. Balance Sheet - This Statement shows the balance of assets liabilities and Equity as at the…

Q: Presented below is information related to Blossom Company at December 31, 2020, the end of its first…

A: Income from operations or operating income or earnings before income and taxes refers to the total…

Q: PERFORM A LIQUIDITY AND PROFITABILITY ANALYSIS ON THE FOLLOWING COMPANY UTILIZING THE RATIOS LISTED:…

A: NOTE : As per BARTLEBY guidelines, when multiple questions are given then first question is to be…

Q: During 2019, Paola Corporation reported net sales of $3,500,000 and net income of $1,500,000. Its…

A: Asset turnover: This ratio analyzes number of times sales or revenue generated from the available…

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

- Analyzing Fixed Assets Pitt reported the following information for 2018 and 2019: Required: Compute Pitts fixed asset turnover ratio and the average age of its fixed assets. ( Note: Round all answers to two decimal places.)On December 31, 2019, Vail Company owned the following assets: Vail computes depreciation and amortization expense to the nearest whole year. During 2020, Vail engaged in the following transactions: Required: 1. Check the accuracy of the accumulated depreciation balances at December 31, 2019. Round to the nearest whole dollar in all requirements. 2. Prepare journal entries to record the preceding events in 2020, as well as the year-end recording of depreciation expense. 3. Prepare an Accumulated Depreciation account for each category of assets, enter the beginning balance, post the journal entries from Requirement 2, and compute the ending balance.Asset Efficiency Ratios Refer to financial statements in Exercise 12-76 and the information below. Required: 1. Compute the three asset efficiency ratios (rounded to two decimal places) for 2018 and 2019. 2. Indicate the length of Steeles operating cycle in days (rounded to two decimal places) for the years ended December 31, 2019. and December 31, 2018.

- Investing Activities and Depreciable Assets Verlando Company had the following account balances and information available for 2019: During 2019, Verlando recorded the following transactions affecting these accounts: a. Land with a carrying value of 35,000 was sold at a loss of 6,000. b. Land and equipment were purchased with cash during the period. c. Equipment with an original cost of 20,000 that had a book value of 4,000 was written off as obsolete. d. A building with an original cost of 60,000 and accumulated depreciation of 25,000 was sold at a 23,000 gain. e. Depreciation expense and amortization expense were recorded. f. Net income for the year was 60,000. g. A patent was acquired during the year in exchange for 1,200 shares of common stock with a par value of 1 per share and a market value of 26 per share. h. Additional marketable securities wefe purchased during the year. i. Verlando Company has no notes payable in the liabilities section of its balance sheet. Required: 1. Next Level Assuming that Verlando uses the indirect method to determine operating cash flows, what is the amount of depreciation expense and amortization expense that would be added back to net income: 2. Prepare the investing activities section of the statement of cash flows for the year ended December 31, 2019. 3. Prepare the disclosure for significant noncash transactions for the statement of cash flows for the year ended December 31, 2019.Depreciation Methods Nickle Company purchased three identical assets for 17,000 on January 2, 2019. Each asset has an expected residual value of 1,000. The depreciation expense for 2019 and 2020 is shown below for three assets: Required: 1. Next Level Which depreciation method is the company using for each asset? 2. Compute the depreciation expense for 2021 and 2022 for each asset.Asset Efficiency Ratios Rumsford Inc.s financial statements for 2019 indicate the following account balances: Required: 1. Using this information, calculate Rumsfords receivable turnover ratio. (Note: Round to two decimal places.) 2. Using this information, calculate Rumsfords asset turnover ratio and also convert the ratio into days.

- Refer to the information for Cox Inc. above. What amount would Cox record as depreciation expense for 2019 if the units-of-production method were used ( Note: Round your answer to the nearest dollar)? a. $179,400 b. $184,000 c. $218,400 d. $224,000Depreciation Methods Sorter Company purchased equipment for 200,000 on January 2, 2019. The equipment has an estimated service life of 8 years and an estimated residual value of 20,000. Required: Compute the depreciation expense for 2019 under each of the following methods: 1. straight-line 2. sum-of-the-years-digits 3. double-declining-balance 4. Next Level What effect does the depreciation of the equipment have on the analysis of rate of return?Balance Sheet and Notes Listed here in random order are Wicks Construction Limiteds balance sheet accounts and related ending balances as of December 31, 2019: Additional information: 1. The company reports on the balance sheet the total amount for inventories and the net book value of property, plant, and equipment, with the related details for each account disclosed in notes. 2. The straight line method is used to depreciate buildings, machinery, and equipment, based upon their cost and estimated residual values and lives. A breakdown of property, plant, and equipment shows the following: land at a cost of 32,000, buildings at a cost of 182,400 and a net book value of 120,200, machinery at a cost of 63,900, and related accumulated depreciation of 18,600, and equipment (40% depreciated) at a cost of 53,000. 3. Patents are amortized on a straight line basis directly to the Patent account. 4. Inventories are listed at the lower of cost or market value using an average cost. The inventories include raw-materials, 22,200; work in process, 34,700; and finished goods, 41,600. 5. Common stock has a 10 par value per share, 12,000 shares are authorized, and 6,280 shares have been issued. 6. Preferred stock has a 100 par value per share, 1,000 shares are authorized, and 400 shares have been issued. 7. The investment in bonds is carried at the original cost, which is the face value, and is being held to maturity. 8. Short-term investments in marketable securities were purchased at year-end. 9. The bonds payable mature on December 31, 2024. 10. The company attaches a 1-year warranty on all the products it sells. Required: 1. Prepare Wicks Constructions December 31, 2019, balance sheet (including appropriate parenthetical notations). 2. Prepare notes to accompany the balance sheet that itemize company accounting policies; inventories; and property, plant, and equipment. 3. Next Level Compute the current ratio and the quick ratio. How do these two ratios provide different information about the companys liquidity? Why are these ratios useful?

- Comprehensive: Balance Sheet, Schedules, and Notes The following is an alphabetical listing of Stone Boat Companys balances sheet accounts and account balances on December 31, 2019: Additional information: 1. The company reports on the balance sheet the net book value of property and equipment and long-term liabilities (known as control accounts). The related details are disclosed in the notes. 2. The straight-line method is used to depreciate property and equipment based upon cost, estimated residual value, and estimated life. The costs of the assets in this account are: land, 29,500; buildings, 164,600; store fixtures, 72,600; and office equipment, 30,000. 3. The accumulated depreciation breakdown is as follows: buildings, 54,600; store fixtures, 37,400; and office equipment, 17,300. 4. The long term debt includes 12%, 36,000 face value bonds that mature on December 31, 2024, and have an unamortized bond discount of 1,000; 11%, 48,000 face value bonds that mature on December 31, 2025, have a premium on bonds payable of 1,800, and whose retirement is being funded by a bond sinking fund; and a 13% note payable that has a face value of 6,200 and matures on January 1, 2022. 5. The non-interest-bearing note receivable matures on June 1, 2023. 6. Inventory is listed at lower of cost or market; cost is determined on the basis of average cost. 7. The investment in affiliate is carried at cost. The company has guaranteed the interest on 12%, 50,000, 15-year bonds issued by this affiliate, Jay Company. 8. Common stock has a 10 par value per share, 10,000 shares are authorized, and 1,000 shares were issued during 2019 at a price of 13 per share, resulting in 8,000 shares issued at year-end. 9. Preferred stock has a 50 par value per share, 2,000 shares are authorized, and 140 shares were issued during 2019 at a price of 55 per share, resulting in 640 shares issued at year-end. 10. On January 15, 2020, before the December 31, 2019, balance sheet was issued, a building with a cost of 20,000 and a book value of 7,000 was totally destroyed. Insurance proceeds will amount to only 5,000. 11. Net income and dividends declared and paid during the year were 50,500 and 21,000, respectively. Required: 1. Prepare Stone Boats December 31, 2019, balance sheet (including appropriate parenthetical notations). 2. Prepare a statement of shareholders equity for 2019. (Hint: Work back from the ending account balances.) 3. Prepare notes that itemize the balance sheet control accounts and those necessary to disclose any company accounting policies, contingent liabilities, and subsequent events. 4. Next Level Compute the debt-to-assets ratio at the cud of 2019. What is your evaluation of this ratio if it was 39% at the end of 2018? Use the following information for P415 and P416: McCormick Company, Inc. is one of the worlds leading producers of spices, herbs, seasonings, condiments, and other flavorings for foods. Its products are sold to consumers, with sonic of the leading brands of spices and seasonings, as well as to industrial producers of foods. McCormicks consolidated balance sheets for 20X2 and 20X3 follow.Koolman Construction Company began work on a contract in 2019. The contract price is 3,000,000, and the company determined that its performance obligation was satisfied over time. Other information relating to the contract is as follows: Required: 1. Compute the gross profit or loss recognized in 2019 and 2020. 2. Prepare the appropriate sections of the income statement and ending balance sheet for each year.Dinnell Company owns the following assets: In the year of acquisition and retirement of an asset, Dinnell records depreciation expense for one-half year. During 2020, Asset A was sold for 7,000. Required: Prepare the journal entries to record depreciation on each asset for 2017 through 2020 and the sale of Asset A. Round all answers to the nearest dollar.