Find Investment Balance 12/31/21 B. Consolidation Worksheet Entries -Prepare Entry *G -Prepare Entry S -Prepare Entry A -Prepare Entry I -Prepare Entry D -Prepare Entry E -Prepare Entry TI -Prepare Entry G

Find Investment Balance 12/31/21 B. Consolidation Worksheet Entries -Prepare Entry *G -Prepare Entry S -Prepare Entry A -Prepare Entry I -Prepare Entry D -Prepare Entry E -Prepare Entry TI -Prepare Entry G

Chapter5: Operating Activities: Purchases And Cash Payments

Section: Chapter Questions

Problem 2.1C

Related questions

Question

100%

A. Find Investment Balance 12/31/21

B. Consolidation Worksheet Entries

-Prepare Entry *G

-Prepare Entry S

-Prepare Entry A

-Prepare Entry I

-Prepare Entry D

-Prepare Entry E

-Prepare Entry TI

-Prepare Entry G

Transcribed Image Text:ducation.com/ext/map/index.html?_con=con&external_browser3D0&launchUrl=https%253A%252F%252Fnewconnect.mheducation.com%252F#/activity/question-

Tube

Maps

O News

Translate

mework Assignment

Saved

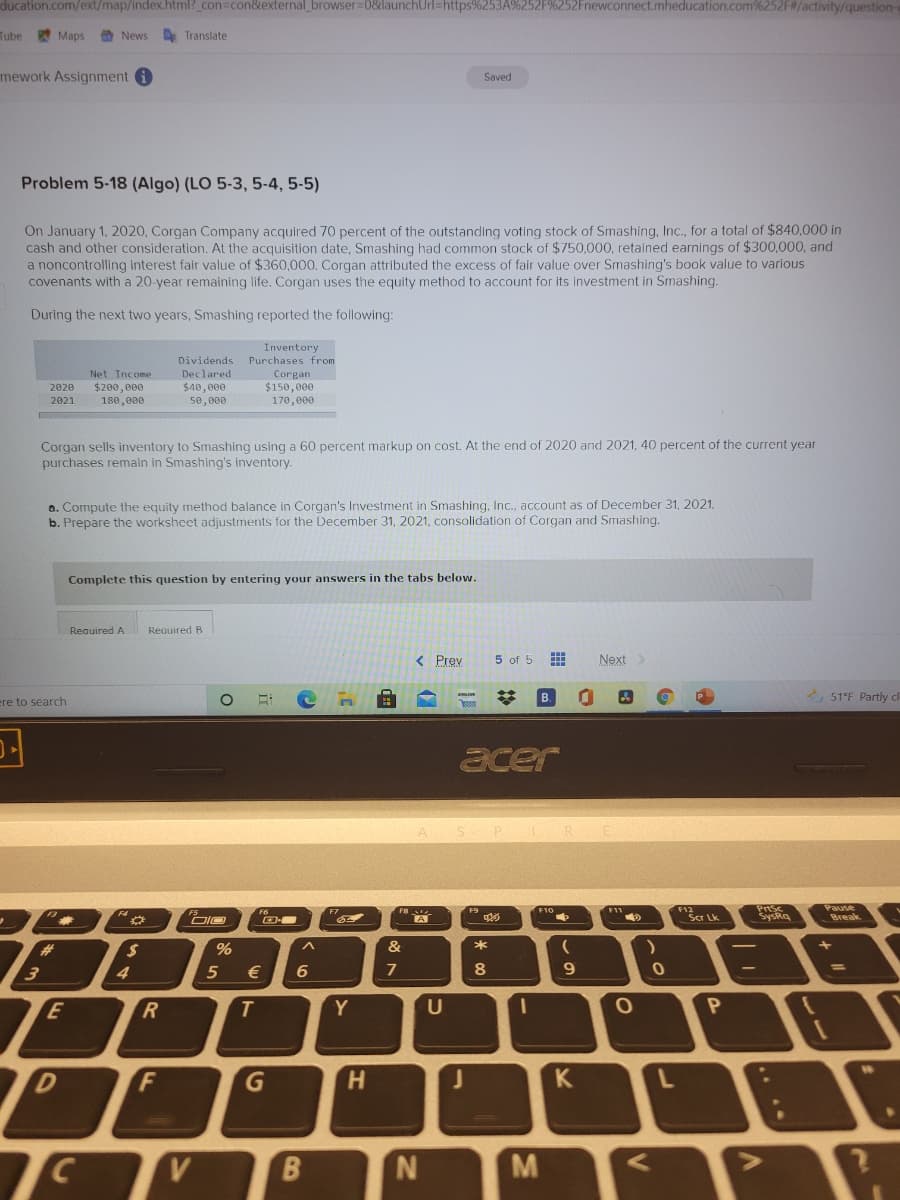

Problem 5-18 (Algo) (LO 5-3, 5-4, 5-5)

On January 1, 2020, Corgan Company acquired 70 percent of the outstanding voting stock of Smashing, Inc., for a total of $840,000 in

cash and other consideration. At the acquisition date, Smashing had common stock of $750,000, retained earnings of $300,000, and

a noncontrolling interest fair value of $360,000. Corgan attributed the excess of fair value over Smashing's book value to various

covenants with a 20-year remaining life. Corgan uses the equity method t

account for its investment in Smashing.

During the next two years, Smashing reported the following:

Inventory

Dividends Purchases from

Declared

$40,000

5e, 000

Net Income

$200, 000

180,000

Corgan

$150,000

170,000

2020

2021

Corgan sells inventory to Smashing using a 60 percent markup on cost. At the end of 2020 and 2021, 40 percent of the current year

purchases

Smashing's

a. Compute the equity method balance in Corgan's Investment in Smashing, Inc., account as of December 31, 2021.

b. Prepare the worksheet adjustments for the December 31, 2021, consolidation of Corgan and Smashing.

Complete this question by entering your answers in the tabs below.

Reauired A

Reauired B

< Prey

5 of 5

Next>

В.

* 51°F Partly ch

ere to search

acer

PrSc

SysRa

Pause

F12

Scr Lk

F10

A

Break

23

24

&

7

9.

E

R

Y

U

H.

K

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Recommended textbooks for you