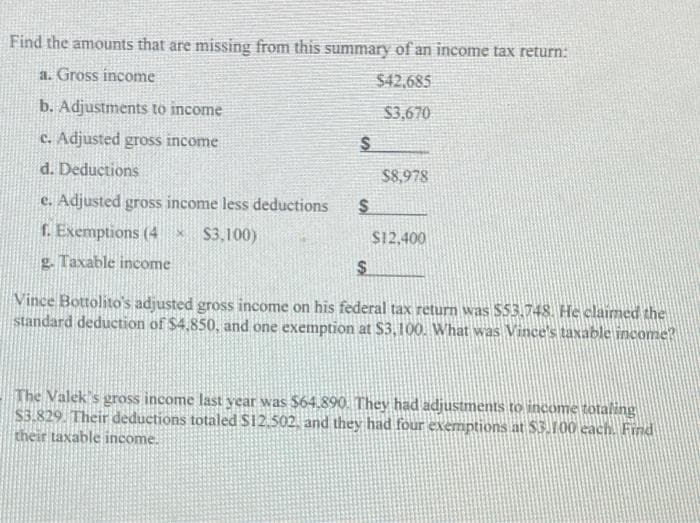

Find the amounts that are missing from this summary of an income tax return: a. Gross income $42,685 b. Adjustments to income $3,670 c. Adjusted gross income d. Deductions $8,978 e. Adjusted gross income less deductions f. Exemptions (4 $3.100) $12,400 g. Taxable income Vince Bottolito's adjusted gross income on his federal tax return was $53.748. He claimed the standard deduction of $4,850, and one exemption at $3,100. What was Vince's taxable income? The Valek's gross income last vear was $64.890. They had adjustments to income totaling S3.829. Their deductions totaled $12.502. and they had four exemptions at S3.100 each. Find their taxable income.

Find the amounts that are missing from this summary of an income tax return: a. Gross income $42,685 b. Adjustments to income $3,670 c. Adjusted gross income d. Deductions $8,978 e. Adjusted gross income less deductions f. Exemptions (4 $3.100) $12,400 g. Taxable income Vince Bottolito's adjusted gross income on his federal tax return was $53.748. He claimed the standard deduction of $4,850, and one exemption at $3,100. What was Vince's taxable income? The Valek's gross income last vear was $64.890. They had adjustments to income totaling S3.829. Their deductions totaled $12.502. and they had four exemptions at S3.100 each. Find their taxable income.

Chapter14: Taxes On The Financial Statements

Section: Chapter Questions

Problem 37P

Related questions

Question

Transcribed Image Text:Find the amounts that are missing from this summary of an income tax return:

a. Gross income

$42,685

b. Adjustments to income

$3,670

c. Adjusted gross income

d. Deductions

$8,978

e. Adjusted gross income less deductions

f. Exemptions (4

$3,100)

$12,400

g. Taxable income

Vince Bottolito's adjusted gross income on his federal tax return was $53.748. He claimed the

standard deduction of $4,850, and one exemption at $3,100. What was Vince's taxable income?

The Valek's gross income last vear was $64.890. They had adjustments to income totaling

S3.829. Their deductions totaled $12.502. and they had four exemptions at S3.100 each. Find

their taxable income.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning