Firee Ltd has a year end of 28 February and a functional currency of Rands. On 1 March 2016 Firee Ltd took out a loan from UK company for £350 00. Interest is payable annually in arreal on 28 February each year at a rate of 5% per annum. The loan is repayable in full on 28 February 2018. There have been no repayments on the loan before the 28 February 2018. Date 1 March 2016 28 February 2017 28 February 2018 Average rate 2017 Average rate 2018 R/£ exchange rate R21.77 R16.25 R16.77 R16.15 R16.20

Firee Ltd has a year end of 28 February and a functional currency of Rands. On 1 March 2016 Firee Ltd took out a loan from UK company for £350 00. Interest is payable annually in arreal on 28 February each year at a rate of 5% per annum. The loan is repayable in full on 28 February 2018. There have been no repayments on the loan before the 28 February 2018. Date 1 March 2016 28 February 2017 28 February 2018 Average rate 2017 Average rate 2018 R/£ exchange rate R21.77 R16.25 R16.77 R16.15 R16.20

Financial Accounting: The Impact on Decision Makers

10th Edition

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Gary A. Porter, Curtis L. Norton

Chapter9: Current Liabilities, Contingencies, And The Time Value Of Money

Section: Chapter Questions

Problem 9.9AMCP

Related questions

Question

Transcribed Image Text:Question 1

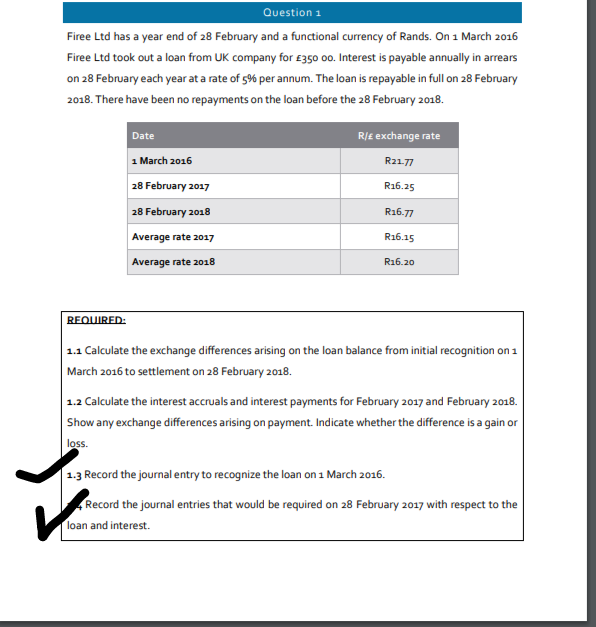

Firee Ltd has a year end of 28 February and a functional currency of Rands. On 1 March 2016

Firee Ltd took out a loan from UK company for £350 00. Interest is payable annually in arrears

on 28 February each year at a rate of 5% per annum. The loan is repayable in full on 28 February

2018. There have been no repayments on the loan before the 28 February 2018.

REQUIRED:

Date

1 March 2016

28 February 2017

28 February 2018

Average rate 2017

Average rate 2018

R/£ exchange rate

R21-77

R16.25

R16.77

R16.15

R16.20

1.1 Calculate the exchange differences arising on the loan balance from initial recognition on 1

March 2016 to settlement on 28 February 2018.

1.2 Calculate the interest accruals and interest payments for February 2017 and February 2018.

Show any exchange differences arising on payment. Indicate whether the difference is a gain or

loss.

1.3 Record the journal entry to recognize the loan on 1 March 2016.

Record the journal entries that would be required on 28 February 2017 with respect to the

loan and interest.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning