Firm 1 must decide whether to enter an industry in which firm 2 is an incumbent. To enter this industry, firm

Firm 1 must decide whether to enter an industry in which firm 2 is an incumbent. To enter this industry, firm

Essentials of Business Analytics (MindTap Course List)

2nd Edition

ISBN:9781305627734

Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Chapter15: Decision Analysis

Section: Chapter Questions

Problem 5P: Hudson Corporation is considering three options for managing its data warehouse: continuing with its...

Related questions

Question

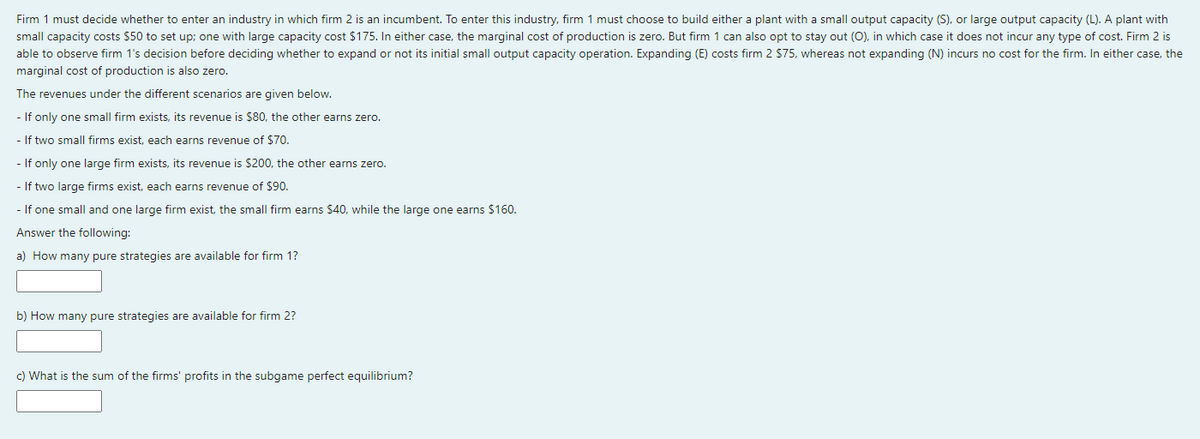

Transcribed Image Text:Firm 1 must decide whether to enter an industry in which firm 2 is an incumbent. To enter this industry, firm 1 must choose to build either a plant with a small output capacity (S), or large output capacity (L). A plant with

small capacity costs $50 to set up; one with large capacity cost $175. In either case, the marginal cost of production is zero. But firm 1 can also opt to stay out (O), in which case it does not incur any type of cost. Firm 2 is

able to observe firm 1's decision before deciding whether to expand or not its initial small output capacity operation. Expanding (E) costs firm 2 $75, whereas not expanding (N) incurs no cost for the firm. In either case, the

marginal cost of production is also zero.

The revenues under the different scenarios are given below.

- If only one small firm exists, its revenue is $80, the other earns zero.

- If two small firms exist, each earns revenue of $70.

- If only one large firm exists, its revenue is $200, the other earns zero.

- If two large firms exist, each earns revenue of $90.

- If one small and one large firm exist, the small firm earns $40, while the large one earns $160.

Answer the following:

a) How many pure strategies are available for firm 1?

b) How many pure strategies are available for firm 2?

c) What is the sum of the firms' profits in the subgame perfect equilibrium?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Recommended textbooks for you

Essentials of Business Analytics (MindTap Course …

Statistics

ISBN:

9781305627734

Author:

Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Essentials of Business Analytics (MindTap Course …

Statistics

ISBN:

9781305627734

Author:

Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning