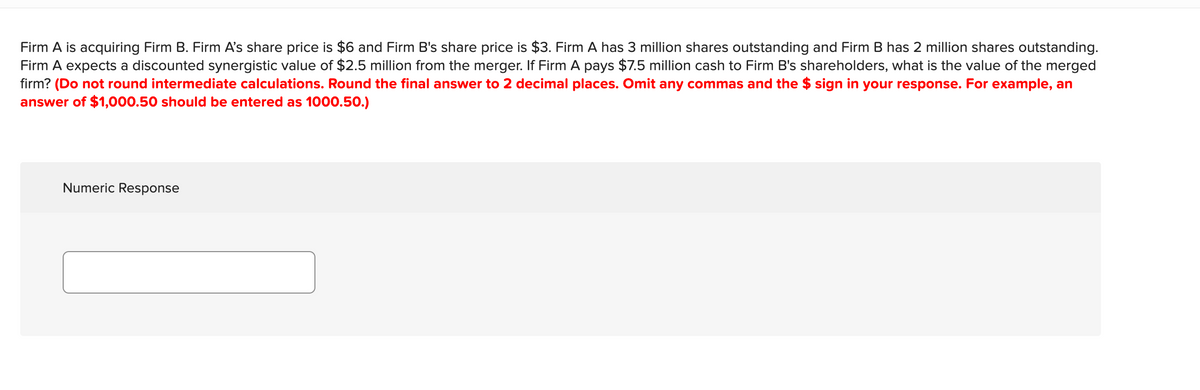

Firm A is acquiring Firm B. Firm A's share price is $6 and Firm B's share price is $3. Firm A has 3 million shares outstanding and Firm B has 2 million shares outstanding. Firm A expects a discounted synergistic value of $2.5 million from the merger. If Firm A pays $7.5 million cash to Firm B's shareholders, what is the value of the merged firm? (Do not round intermediate calculations. Round the final answer to 2 decimal places. Omit any commas and the $ sign in your response. For example, an answer of $1,000.50 should be entered as 1000.50.) Numeric Response

Firm A is acquiring Firm B. Firm A's share price is $6 and Firm B's share price is $3. Firm A has 3 million shares outstanding and Firm B has 2 million shares outstanding. Firm A expects a discounted synergistic value of $2.5 million from the merger. If Firm A pays $7.5 million cash to Firm B's shareholders, what is the value of the merged firm? (Do not round intermediate calculations. Round the final answer to 2 decimal places. Omit any commas and the $ sign in your response. For example, an answer of $1,000.50 should be entered as 1000.50.) Numeric Response

Chapter23: Corporate Restructuring

Section: Chapter Questions

Problem 3P

Related questions

Question

32) can i get help please?

Transcribed Image Text:Firm A is acquiring Firm B. Firm A's share price is $6 and Firm B's share price is $3. Firm A has 3 million shares outstanding and Firm B has 2 million shares outstanding.

Firm A expects a discounted synergistic value of $2.5 million from the merger. If Firm A pays $7.5 million cash to Firm B's shareholders, what is the value of the merged

firm? (Do not round intermediate calculations. Round the final answer to 2 decimal places. Omit any commas and the $ sign in your response. For example, an

answer of $1,000.50 should be entered as 1000.50.)

Numeric Response

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT