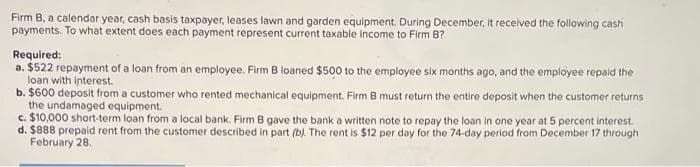

Firm B, a calendar year, cash basis taxpayer, leases lawn and garden equipment. During December, it received the following cash payments. To what extent does each payment represent current taxable income to Firm 8? Required: a. $522 repayment of a loan from an employee. Firm B loaned $500 to the employee six months ago, and the employee repaid the loan with interest. b. $600 deposit from a customer who rented mechanical equipment. Firm B must return the entire deposit when the customer returns the undamaged equipment. c. $10,000 short-term loan from a local bank. Firm B gave the bank a written note to repay the loan in one year at 5 percent interest. d. $888 prepaid rent from the customer described in part (b). The rent is $12 per day for the 74-day period from December 17 through February 28.

Firm B, a calendar year, cash basis taxpayer, leases lawn and garden equipment. During December, it received the following cash payments. To what extent does each payment represent current taxable income to Firm 8? Required: a. $522 repayment of a loan from an employee. Firm B loaned $500 to the employee six months ago, and the employee repaid the loan with interest. b. $600 deposit from a customer who rented mechanical equipment. Firm B must return the entire deposit when the customer returns the undamaged equipment. c. $10,000 short-term loan from a local bank. Firm B gave the bank a written note to repay the loan in one year at 5 percent interest. d. $888 prepaid rent from the customer described in part (b). The rent is $12 per day for the 74-day period from December 17 through February 28.

Chapter19: Corporations: Distributions Not In Complete Liquidation

Section: Chapter Questions

Problem 35P

Related questions

Question

Transcribed Image Text:Firm B, a calendar year, cash basis taxpayer, leases lawn and garden equipment. During December, it received the following cash

payments. To what extent does each payment represent current taxable income to Firm 8?

Required:

a. $522 repayment of a loan from an employee. Firm B loaned $500 to the employee six months ago, and the employee repaid the

loan with interest.

b. $600 deposit from a customer who rented mechanical equipment. Firm B must return the entire deposit when the customer returns

the undamaged equipment.

c. $10,000 short-term loan from a local bank. Firm B gave the bank a written note to repay the loan in one year at 5 percent interest.

d. $888 prepaid rent from the customer described in part (b). The rent is $12 per day for the 74-day period from December 17 through

February 28.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT