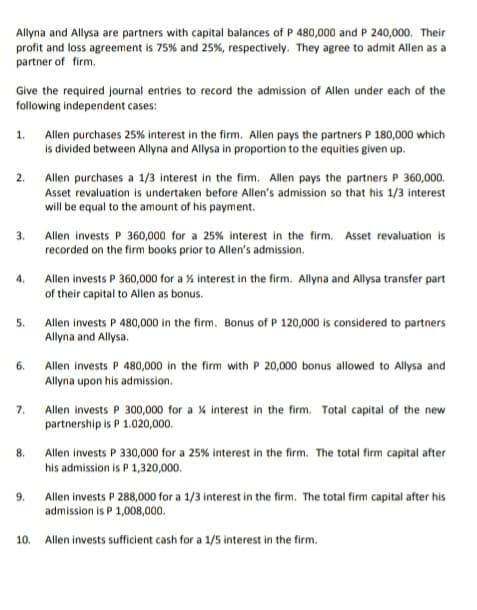

Allyna and Allysa are partners with capital balances of P 480,000 and P 240,000. Their profit and loss agreement is 75% and 25%, respectively. They agree to admit Allen as a partner of firm. Give the required journal entries to record the admission of Allen under each of the following independent cases: Allen purchases 25% interest in the firm. Allen pays the partners P 180,000 which is divided between Allyna and Allysa in proportion to the equities given up. 1. Allen purchases a 1/3 interest in the fim. Allen pays the partners P 360,000. Asset revaluation is undertaken before Allen's admission so that his 1/3 interest will be equal to the amount of his payment. 3. Allen invests P 360,000 for a 25% interest in the firm. Asset revaluation is recorded on the firm books prior to Allen's admission. 4. Allen invests P 360,000 for a % interest in the firm. Allyna and Allysa transfer part of their capital to Allen as bonus.

Allyna and Allysa are partners with capital balances of P 480,000 and P 240,000. Their profit and loss agreement is 75% and 25%, respectively. They agree to admit Allen as a partner of firm. Give the required journal entries to record the admission of Allen under each of the following independent cases: Allen purchases 25% interest in the firm. Allen pays the partners P 180,000 which is divided between Allyna and Allysa in proportion to the equities given up. 1. Allen purchases a 1/3 interest in the fim. Allen pays the partners P 360,000. Asset revaluation is undertaken before Allen's admission so that his 1/3 interest will be equal to the amount of his payment. 3. Allen invests P 360,000 for a 25% interest in the firm. Asset revaluation is recorded on the firm books prior to Allen's admission. 4. Allen invests P 360,000 for a % interest in the firm. Allyna and Allysa transfer part of their capital to Allen as bonus.

SWFT Essntl Tax Individ/Bus Entities 2020

23rd Edition

ISBN:9780357391266

Author:Nellen

Publisher:Nellen

Chapter14: Partnerships And Limited Liability Entities

Section: Chapter Questions

Problem 2BD

Related questions

Question

Transcribed Image Text:Allyna and Allysa are partners with capital balances of P 480,000 and P 240,000. Their

profit and loss agreement is 75% and 25%, respectively. They agree to admit Allen as a

partner of firm.

Give the required journal entries to record the admission of Allen under each of the

following independent cases:

Allen purchases 25% interest in the firm. Allen pays the partners P 180,000 which

Is divided between Allyna and Allysa in proportion to the equities given up.

1.

2.

Allen purchases a 1/3 interest in the fim. Allen pays the partners P 360,000.

Asset revaluation is undertaken before Allen's admission so that his 1/3 interest

will be equal to the amount of his payment.

Allen invests P 360,000 for a 25% interest in the firm. Asset revaluation is

recorded on the firm books prior to Allen's admission.

3.

Allen invests P 360,000 for a % interest in the firm. Allyna and Allysa transfer part

of their capital to Allen as bonus.

4.

5.

Allen invests P 480,000 in the firm. Bonus of P 120,000 is considered to partners

Allyna and Allysa.

6.

Allen invests P 480,000 in the firm with P 20,000 bonus allowed to Allysa and

Allyna upon his admission.

7.

Allen invests P 300,000 for a % interest in the firm. Total capital of the new

partnership is P 1.020,000.

8.

Allen invests P 330,000 for a 25% interest in the firm. The total firm capital after

his admission is P 1,320,000.

9.

Allen invests P 288,000 for a 1/3 interest in the firm. The total firm capital after his

admission is P 1,008,000.

10. Allen invests sufficient cash for a 1/5 interest in the firm.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

4. Allen invests P 360,000 for a ½ interest in the firm. Allyna and Allysa transfer part of their capital to Allen as bonus.

Solution

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,