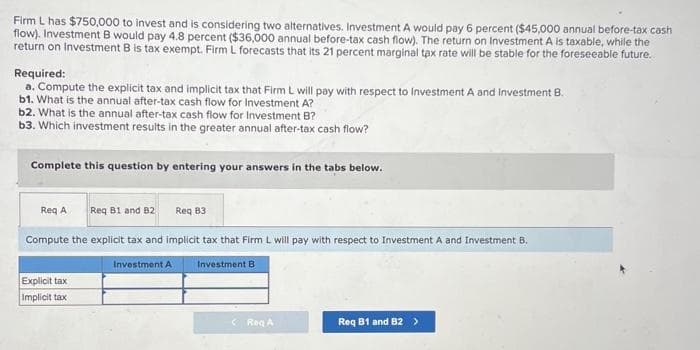

Firm L has $750,000 to invest and is considering two alternatives. Investment A would pay 6 percent ($45,000 annual before-tax cash flow). Investment B would pay 4.8 percent ($36,000 annual before-tax cash flow). The return on Investment A is taxable, while the return on Investment B is tax exempt. Firm L forecasts that its 21 percent marginal tax rate will be stable for the foreseeable future. Required: a. Compute the explicit tax and implicit tax that Firm L will pay with respect to Investment A and Investment B. b1. What is the annual after-tax cash flow for Investment A? b2. What is the annual after-tax cash flow for Investment B? b3. Which investment results in the greater annual after-tax cash flow? Complete this question by entering your answers in the tabs below.

Firm L has $750,000 to invest and is considering two alternatives. Investment A would pay 6 percent ($45,000 annual before-tax cash flow). Investment B would pay 4.8 percent ($36,000 annual before-tax cash flow). The return on Investment A is taxable, while the return on Investment B is tax exempt. Firm L forecasts that its 21 percent marginal tax rate will be stable for the foreseeable future. Required: a. Compute the explicit tax and implicit tax that Firm L will pay with respect to Investment A and Investment B. b1. What is the annual after-tax cash flow for Investment A? b2. What is the annual after-tax cash flow for Investment B? b3. Which investment results in the greater annual after-tax cash flow? Complete this question by entering your answers in the tabs below.

Chapter4: Gross Income: Concepts And Inclusions

Section: Chapter Questions

Problem 29P

Related questions

Question

vaibhav

subject-Accounting

Transcribed Image Text:Firm L has $750,000 to invest and is considering two alternatives. Investment A would pay 6 percent ($45,000 annual before-tax cash

flow). Investment B would pay 4.8 percent ($36,000 annual before-tax cash flow). The return on Investment A is taxable, while the

return on Investment B is tax exempt. Firm L forecasts that its 21 percent marginal tax rate will be stable for the foreseeable future.

Required:

a. Compute the explicit tax and implicit tax that Firm L will pay with respect to Investment A and Investment B.

b1. What is the annual after-tax cash flow for Investment A?

b2. What is the annual after-tax cash flow for Investment B?

b3. Which investment results in the greater annual after-tax cash flow?

Complete this question by entering your answers in the tabs below.

Req A Req B1 and B2

Compute the explicit tax and implicit tax that Firm L will pay with respect to Investment A and Investment B.

Explicit tax

Implicit tax

Req 83

Investment A

Investment B

Reg A

Req B1 and B2 >

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT