Berry's Boxes manufactures boxes. It expects to sell 20,000 bo of direct materials to produce 24,000 units. Beginning inventor inventory of 2,500 units. The boxes sell for $3.00 and the comp costs for each box total $1.00 while direct labour is $0.50. Fact What will be Berry's Boxes production costs incurred for direct

Berry's Boxes manufactures boxes. It expects to sell 20,000 bo of direct materials to produce 24,000 units. Beginning inventor inventory of 2,500 units. The boxes sell for $3.00 and the comp costs for each box total $1.00 while direct labour is $0.50. Fact What will be Berry's Boxes production costs incurred for direct

Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Don R. Hansen, Maryanne M. Mowen

Chapter2: Basic Cost Management Concepts

Section: Chapter Questions

Problem 14E: For each of the following independent situations, calculate the missing values: 1. The Belen plant...

Related questions

Question

H1.

Account

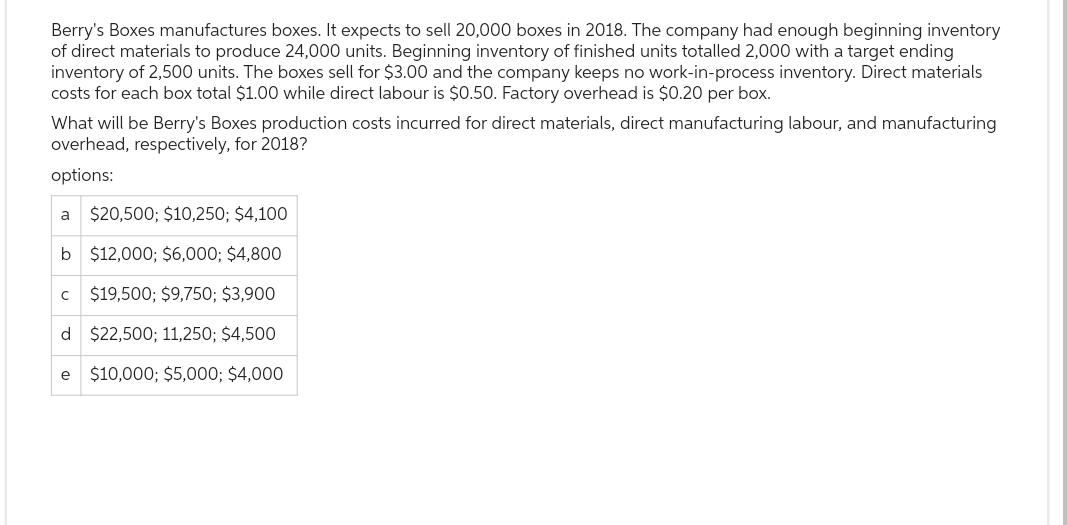

Transcribed Image Text:Berry's Boxes manufactures boxes. It expects to sell 20,000 boxes in 2018. The company had enough beginning inventory

of direct materials to produce 24,000 units. Beginning inventory of finished units totalled 2,000 with a target ending

inventory of 2,500 units. The boxes sell for $3.00 and the company keeps no work-in-process inventory. Direct materials

costs for each box total $1.00 while direct labour is $0.50. Factory overhead is $0.20 per box.

What will be Berry's Boxes production costs incurred for direct materials, direct manufacturing labour, and manufacturing

overhead, respectively, for 2018?

options:

a $20,500; $10,250; $4,100

b

$12,000; $6,000; $4,800

$19,500; $9,750; $3,900

d

$22,500; 11,250; $4,500

e $10,000; $5,000; $4,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Essentials of Business Analytics (MindTap Course …

Statistics

ISBN:

9781305627734

Author:

Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:

Cengage Learning