Fiscal pollcy, the money market, and aggregate demand Suppose there is some hypothetical economy in which households spend $0.50 of each additional dollar they earn and save the $0.50 they have left over. The following graph plots the economy's initial aggregate demand curve (AD1). Suppose now that the government increases its purchases by $2.5 billion. / Tools Use the green line (triangle symbol) on the following graph to show the aggregate demand curve (AD,) after the multiplier effect takes place. Hint: Be sure the new aggregate demand curve (ADs) is parallel to ADj. You can see the slope of ADi by selecting it on the following graph. Suppose that for every increase in the interest rate of one percentage point, the level of investment spending declines by $0.5 billion. Based on the changes made to the money market in the previous scenario, the new interest rate causes the level of investment spending to _____ by____ A-z T Tips Tips Taking the multiplier effect into account, the change in investment spending will cause the quantity of output demanded to_____ by_____ at every price level. The impact of an increase in govermment purchases on the interest rate and the level of investment spending is ________effect. ols Elates br known as the Use the purple line (diamond symbol) on the graph at the beginning of this problem to show the aggregate demand curve (AD3) after accounting for the impact of the increase in government purchases on the interest rate and the level of investment spending. Hint: Be sure your final aggregate demand curve (AD3) is parallel to AD1 and AD2. You can see the slopes of AD and 4D2 by selecting them on the graph

Fiscal pollcy, the money market, and aggregate demand Suppose there is some hypothetical economy in which households spend $0.50 of each additional dollar they earn and save the $0.50 they have left over. The following graph plots the economy's initial aggregate demand curve (AD1). Suppose now that the government increases its purchases by $2.5 billion. / Tools Use the green line (triangle symbol) on the following graph to show the aggregate demand curve (AD,) after the multiplier effect takes place. Hint: Be sure the new aggregate demand curve (ADs) is parallel to ADj. You can see the slope of ADi by selecting it on the following graph. Suppose that for every increase in the interest rate of one percentage point, the level of investment spending declines by $0.5 billion. Based on the changes made to the money market in the previous scenario, the new interest rate causes the level of investment spending to _____ by____ A-z T Tips Tips Taking the multiplier effect into account, the change in investment spending will cause the quantity of output demanded to_____ by_____ at every price level. The impact of an increase in govermment purchases on the interest rate and the level of investment spending is ________effect. ols Elates br known as the Use the purple line (diamond symbol) on the graph at the beginning of this problem to show the aggregate demand curve (AD3) after accounting for the impact of the increase in government purchases on the interest rate and the level of investment spending. Hint: Be sure your final aggregate demand curve (AD3) is parallel to AD1 and AD2. You can see the slopes of AD and 4D2 by selecting them on the graph

Principles of Economics 2e

2nd Edition

ISBN:9781947172364

Author:Steven A. Greenlaw; David Shapiro

Publisher:Steven A. Greenlaw; David Shapiro

Chapter7: Production, Costs, And Industry Structure

Section: Chapter Questions

Problem 2SCQ: Continuing from Exercise 7.1, the films factory sits on land owned by the firm that it could rent...

Related questions

Question

5. Fiscal pollcy, the money market , and aggregate demand

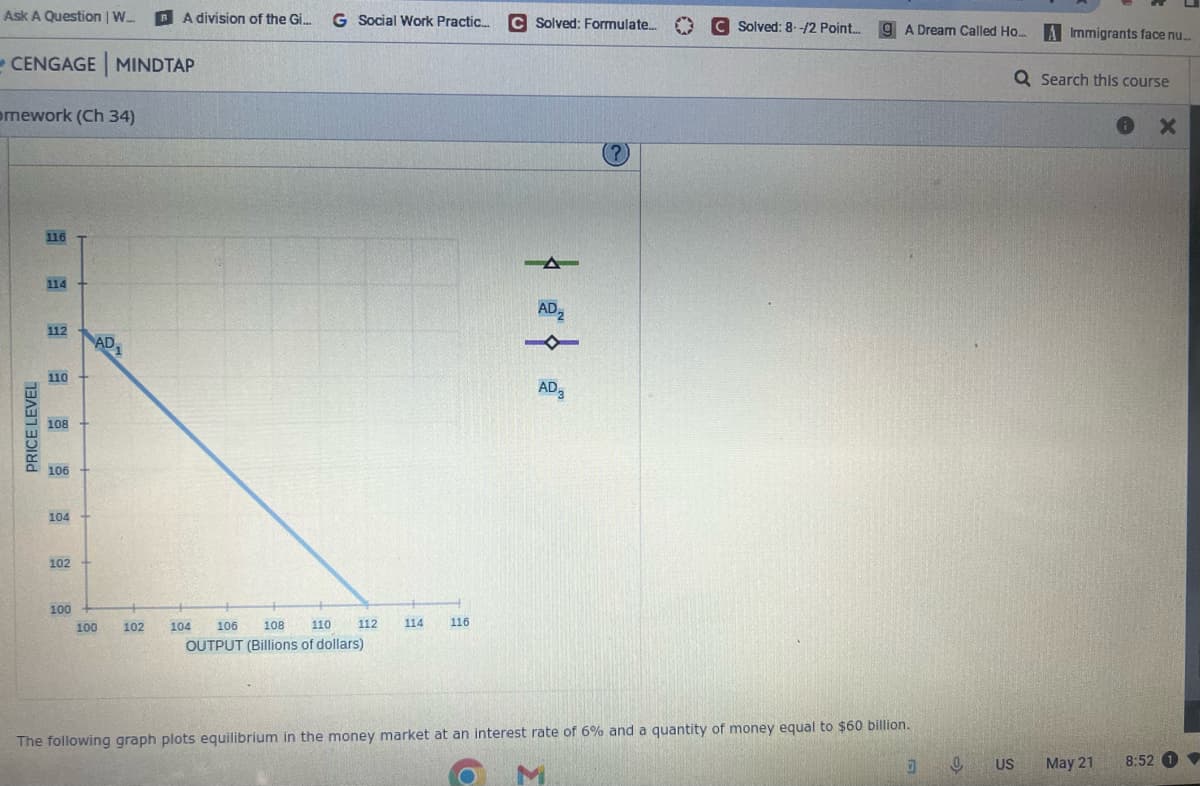

Suppose there is some hypothetical economy in which households spend $0.50 of each additional dollar they earn and save the $0.50 they have left over. The following graph plots the economy's initial aggregate demand curve (AD1).

Suppose now that the government increases its purchases by $2.5 billion.

/ Tools

Use the green line (triangle symbol) on the following graph to show the aggregate demand curve (AD,) after the multiplier effect takes place.

Hint: Be sure the new aggregate demand curve (ADs) is parallel to ADj. You can see the slope of ADi by selecting it on the following graph.

Suppose that for every increase in the interest rate of one percentage point, the level of investment spending declines by $0.5 billion. Based on the changes made to the money market in the previous scenario, the new interest rate causes the level of investment spending to _____ by____

A-z

T

Tips

Tips

Taking the multiplier effect into account, the change in investment spending will cause the quantity of output demanded to_____

by_____

at every price level. The impact of an increase in govermment purchases on the interest rate and the level of investment spending is

________effect.

ols

Elates br

known as the

Use the purple line (diamond symbol) on the graph at the beginning of this problem to show the aggregate demand curve (AD3) after accounting for the impact of the increase in government purchases on the interest rate and the level of investment spending.

Hint: Be sure your final aggregate demand curve (AD3) is parallel to AD1 and AD2. You can see the slopes of AD and 4D2 by selecting them on the graph

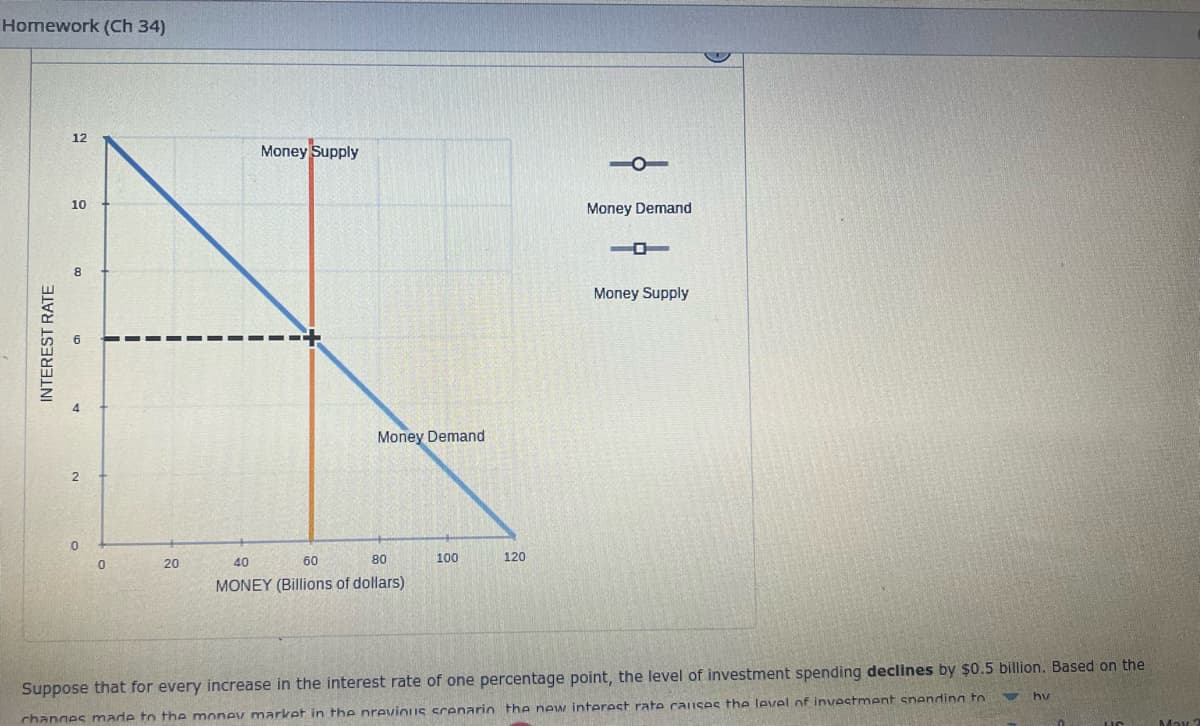

Transcribed Image Text:Homework (Ch 34)

INTEREST RATE

12

10

0

0

20

Money Supply

Money Demand

40

60

80

MONEY (Billions of dollars)

100

120

Money Demand

Money Supply

Suppose that for every increase in the interest rate of one percentage point, the level of investment spending declines by $0.5 billion. Based on the

channes made to the money market in the previous scenario the new interest rate causes the level of investment spending to

hv

May 2

Transcribed Image Text:Ask A Question | W... BA division of the Gi... G Social Work Practic... C Solved: Formulate...

CENGAGE MINDTAP

mework (Ch 34)

PRICE LEVEL

116

114

112

110

108

106

104

102

100

AD₁

100

102

104

106 108 110

OUTPUT (Billions of dollars)

112

114

116

-▲

AD₂

AD3

(?)

C Solved: 8--/2 Point....

g A Dream Called Ho.... A Immigrants face nu...

The following graph plots equilibrium in the money market at an interest rate of 6% and a quantity of money equal to $60 billion.

M

D

0

Q Search this course

US

X

May 21 8:52 1

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Economics 2e

Economics

ISBN:

9781947172364

Author:

Steven A. Greenlaw; David Shapiro

Publisher:

OpenStax

Principles of Economics 2e

Economics

ISBN:

9781947172364

Author:

Steven A. Greenlaw; David Shapiro

Publisher:

OpenStax