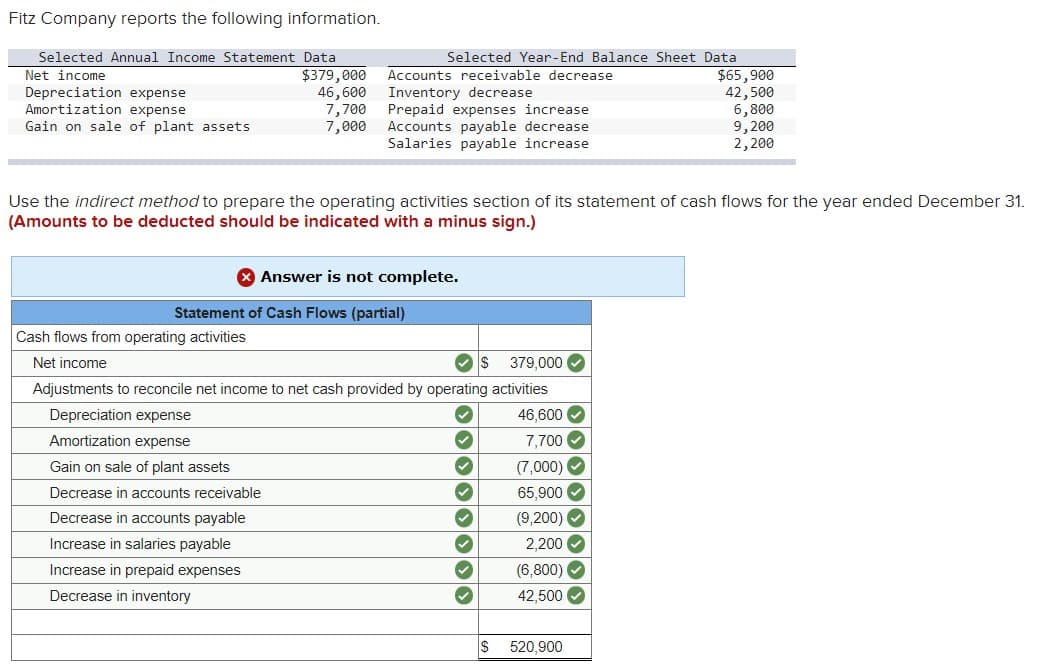

Fitz Company reports the following information. Selected Annual Income Statement Data Selected Year-End Balance Sheet Data $379,000 46,600 7,700 7,000 $65,900 42,500 6,800 9,200 2,200 Net income Accounts receivable decrease Depreciation expense Amortization expense Gain on sale of plant assets Inventory decrease Prepaid expenses increase Accounts payable decrease Salaries payable increase Use the indirect method to prepare the operating activities section of its statement of cash flows for the year ended December 31. (Amounts to be deducted should be indicated with a minus sign.) X Answer is not complete. Statement of Cash Flows (partial) Cash flows from operating activities Net income 379,000 O Adjustments to reconcile net income to net cash provided by operating activities Depreciation expense 46,600 O Amortization expense 7,700 (7,000) O 65,900 O Gain on sale of plant assets Decrease in accounts receivable Decrease in accounts payable (9,200) O Increase in salaries payable 2,200 V Increase in prepaid expenses (6,800) O Decrease in inventory 42,500 $ 520,900 Oooo

Fitz Company reports the following information. Selected Annual Income Statement Data Selected Year-End Balance Sheet Data $379,000 46,600 7,700 7,000 $65,900 42,500 6,800 9,200 2,200 Net income Accounts receivable decrease Depreciation expense Amortization expense Gain on sale of plant assets Inventory decrease Prepaid expenses increase Accounts payable decrease Salaries payable increase Use the indirect method to prepare the operating activities section of its statement of cash flows for the year ended December 31. (Amounts to be deducted should be indicated with a minus sign.) X Answer is not complete. Statement of Cash Flows (partial) Cash flows from operating activities Net income 379,000 O Adjustments to reconcile net income to net cash provided by operating activities Depreciation expense 46,600 O Amortization expense 7,700 (7,000) O 65,900 O Gain on sale of plant assets Decrease in accounts receivable Decrease in accounts payable (9,200) O Increase in salaries payable 2,200 V Increase in prepaid expenses (6,800) O Decrease in inventory 42,500 $ 520,900 Oooo

Fundamentals Of Financial Management, Concise Edition (mindtap Course List)

10th Edition

ISBN:9781337902571

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Eugene F. Brigham, Joel F. Houston

Chapter3: Financial Statements, Cash Flow, And Taxes

Section: Chapter Questions

Problem 12P

Related questions

Concept explainers

Question

12 ex 5

Transcribed Image Text:Fitz Company reports the following information.

Selected Annual Income Statement Data

Selected Year-End Balance Sheet Data

Net income

Depreciation expense

Amortization expense

Gain on sale of plant assets

$379,000

46,600

7,700

7,000

$65,900

42,500

6,800

9,200

2,200

Accounts receivable decrease

Inventory decrease

Prepaid expenses increase

Accounts payable decrease

Salaries payable increase

Use the indirect method to prepare the operating activities section of its statement of cash flows for the year ended December 31.

(Amounts to be deducted should be indicated with a minus sign.)

X Answer is not complete.

Statement of Cash Flows (partial)

Cash flows from operating activities

Net income

379,000 O

Adjustments to reconcile net income to net cash provided by operating activities

Depreciation expense

46,600 O

Amortization expense

7,700

(7,000) O

65,900 O

Gain on sale of plant assets

Decrease in accounts receivable

Decrease in accounts payable

(9,200) O

Increase in salaries payable

2,200 O

Increase in prepaid expenses

(6,800) O

Decrease in inventory

42,500

$ 520,900

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning