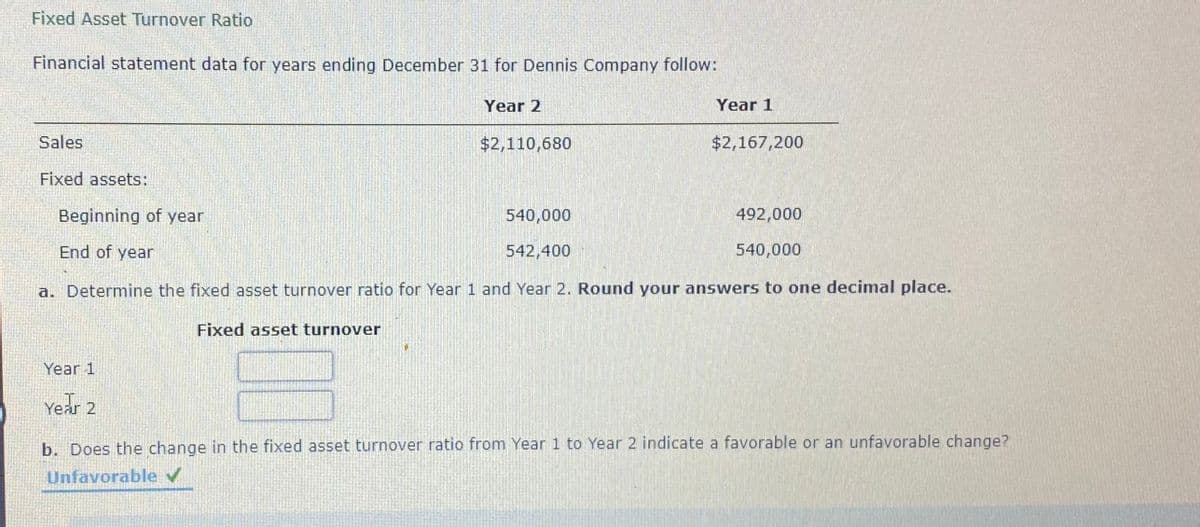

Fixed Asset Turnover Ratio Financial statement data for years ending December 31 for Dennis Company follow: Year 2 Year 1 Sales $2,110,680 $2,167,200 Fixed assets: Beginning of year 540,000 492,000 End of year 542,400 540,000 a. Determine the fixed asset turnover ratio for Year 1 and Year 2. Round your answers to one decimal place. Fixed asset turnover Year 1 Year 2 b. Does the change in the fixed asset turnover ratio from Year 1 to Year 2 indicate a favorable or an unfavorable change? Unfavorable v

Fixed Asset Turnover Ratio Financial statement data for years ending December 31 for Dennis Company follow: Year 2 Year 1 Sales $2,110,680 $2,167,200 Fixed assets: Beginning of year 540,000 492,000 End of year 542,400 540,000 a. Determine the fixed asset turnover ratio for Year 1 and Year 2. Round your answers to one decimal place. Fixed asset turnover Year 1 Year 2 b. Does the change in the fixed asset turnover ratio from Year 1 to Year 2 indicate a favorable or an unfavorable change? Unfavorable v

Corporate Financial Accounting

14th Edition

ISBN:9781305653535

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter5: Accounting For Merchandising Businesses

Section: Chapter Questions

Problem 5.2ADM: Home Depot: Asset turnover ratio The Home Depot reported the following data (in millions) in its...

Related questions

Question

100%

Transcribed Image Text:Fixed Asset Turnover Ratio

Financial statement data for years ending December 31 for Dennis Company follow:

Year 2

Year 1

Sales

$2,110,680

$2,167,200

Fixed assets:

Beginning of year

540,000

492,000

End of year

542,400

540,000

a. Determine the fixed asset turnover ratio for Year 1 and Year 2. Round your answers to one decimal place.

Fixed asset turnover

Year 1

Year 2

b. Does the change in the fixed asset turnover ratio from Year 1 to Year 2 indicate a favorable or an unfavorable change?

Unfavorable v

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College