Asset Turnover Financial statement data for the years ending December 31, 20Y3 and 20Y2, for Linstrum Company follow: 20Υ3 20Υ2 Sales $2,310,000 $2,278,000 Total assets: Beginning of year 680,000 660,000 End of year 720,000 680,000 a. Determine the asset turnover for 20Y3 and 20Y2. Round your answers to one decimal place. 20Υ3 20Υ2 Asset turnover b. Is the change in the asset turnover from 20Y2 to 20Y3 favorable or unfavorable? Unfavorable v

Asset Turnover Financial statement data for the years ending December 31, 20Y3 and 20Y2, for Linstrum Company follow: 20Υ3 20Υ2 Sales $2,310,000 $2,278,000 Total assets: Beginning of year 680,000 660,000 End of year 720,000 680,000 a. Determine the asset turnover for 20Y3 and 20Y2. Round your answers to one decimal place. 20Υ3 20Υ2 Asset turnover b. Is the change in the asset turnover from 20Y2 to 20Y3 favorable or unfavorable? Unfavorable v

College Accounting, Chapters 1-27

23rd Edition

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:HEINTZ, James A.

Chapter10: Accounting For Sales And Cash Receipts

Section: Chapter Questions

Problem 4SEA: SALES RETURNS AND ALLOWANCES ADJUSTMENT At the end of year 1, JCs estimates that 2,000 of the...

Related questions

Question

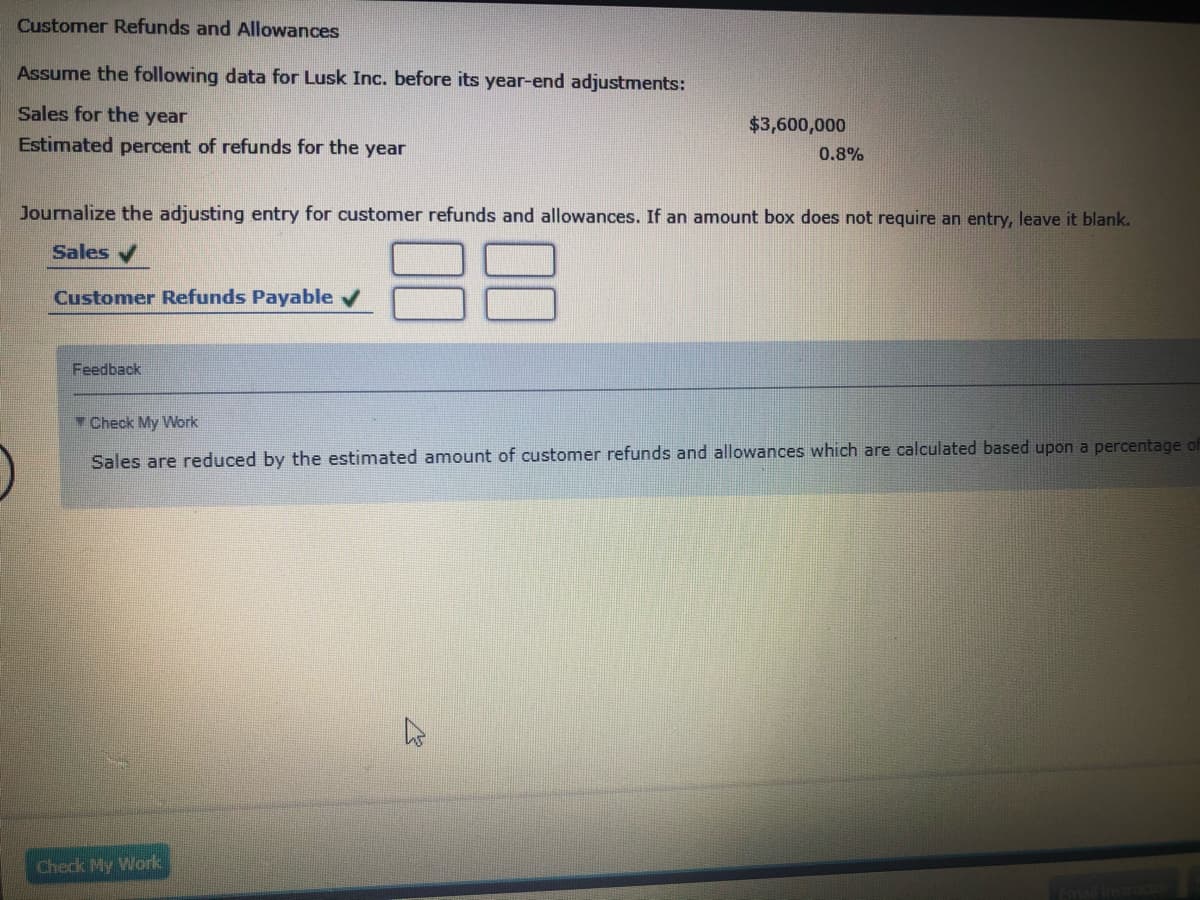

Transcribed Image Text:Customer Refunds and Allowances

Assume the following data for Lusk Inc. before its year-end adjustments:

Sales for the year

$3,600,000

Estimated percent of refunds for the year

0.8%

Journalize the adjusting entry for customer refunds and allowances. If an amnount box does not require an entry, leave it blank.

88

Sales v

Customer Refunds Payable

Feedback

Check My Work

Sales are reduced by the estimated amount of customer refunds and allowances which are calculated based upon a percentage of

Check My Work

Transcribed Image Text:Print Item

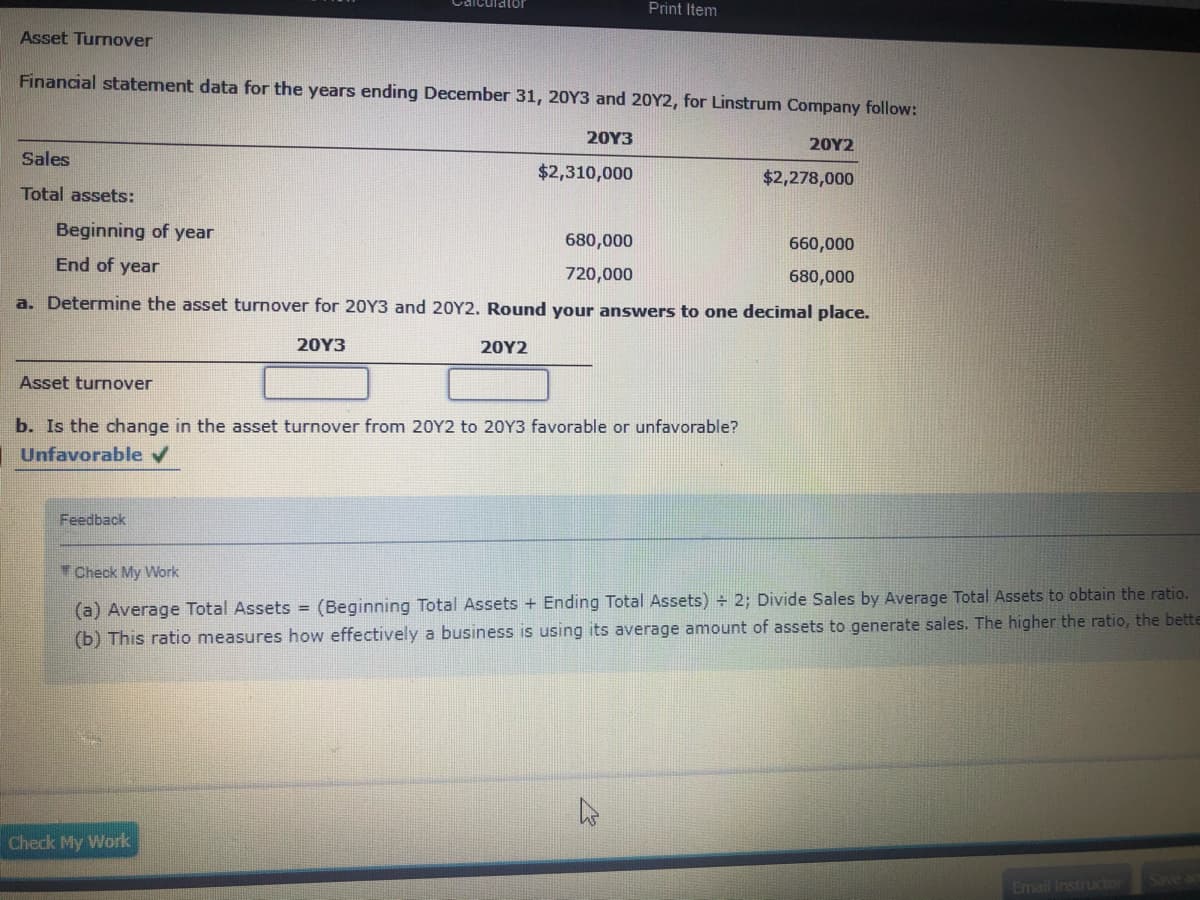

Asset Turnover

Financial statement data for the years ending December 31, 20Y3 and 20Y2, for Linstrum Company follow:

20Υ3

20Υ2

Sales

$2,310,000

$2,278,000

Total assets:

Beginning of year

680,000

660,000

End of year

720,000

680,000

a. Determine the asset turnover for 20Y3 and 20Y2. Round your answers to one decimal place.

20Y3

20Υ2

Asset turnover

b. Is the change in the asset turnover from 20Y2 to 20Y3 favorable or unfavorable?

Unfavorable v

Feedback

Check My Work

(a) Average Total Assets = (Beginning Total Assets + Ending Total Assets) + 2; Divide Sales by Average Total Assets to obtain the ratio.

(b) This ratio measures how effectively a business is using its average amount of assets to generate sales. The higher the ratio, the bette

Check My Work

Email Instructor

Save a

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 5 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT