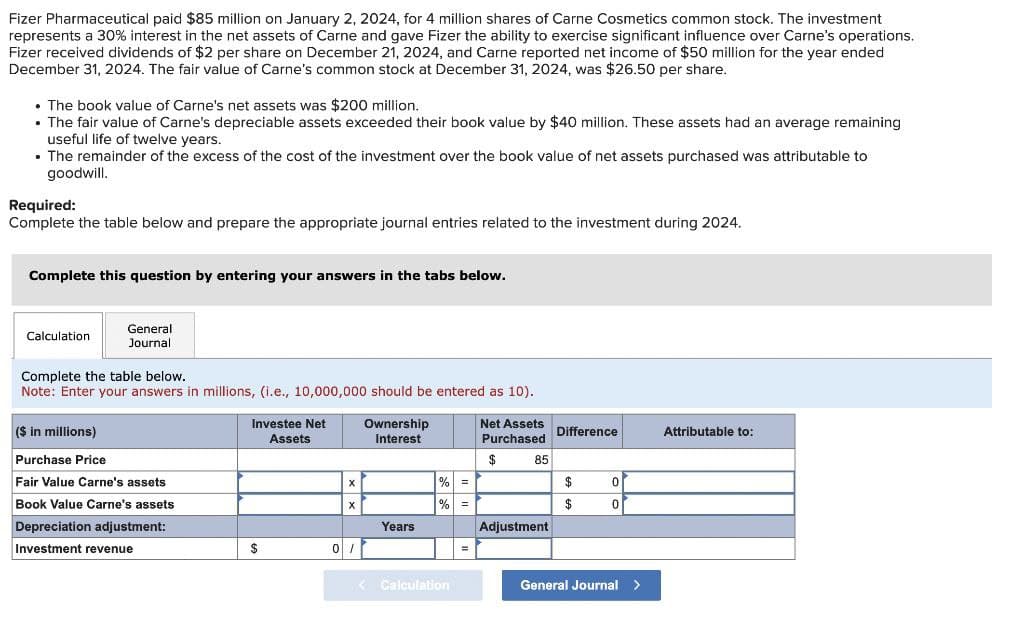

Fizer Pharmaceutical paid $85 million on January 2, 2024, for 4 million shares of Carne Cosmetics common stock. The investment represents a 30% interest in the net assets of Carne and gave Fizer the ability to exercise significant influence over Carne's operations. Fizer received dividends of $2 per share on December 21, 2024, and Carne reported net income of $50 million for the year ended December 31, 2024. The fair value of Carne's common stock at December 31, 2024, was $26.50 per share. The book value of Carne's net assets was $200 million. The fair value of Carne's depreciable assets exceeded their book value by $40 million. These assets had an average remaining useful life of twelve years. The remainder of the excess of the cost of the investment over the book value of net assets purchased was attributable to goodwill. Required: Complete the table below and prepare the appropriate journal entries related to the investment during 2024. Complete this question by entering your answers in the tabs below.

Fizer Pharmaceutical paid $85 million on January 2, 2024, for 4 million shares of Carne Cosmetics common stock. The investment represents a 30% interest in the net assets of Carne and gave Fizer the ability to exercise significant influence over Carne's operations. Fizer received dividends of $2 per share on December 21, 2024, and Carne reported net income of $50 million for the year ended December 31, 2024. The fair value of Carne's common stock at December 31, 2024, was $26.50 per share. The book value of Carne's net assets was $200 million. The fair value of Carne's depreciable assets exceeded their book value by $40 million. These assets had an average remaining useful life of twelve years. The remainder of the excess of the cost of the investment over the book value of net assets purchased was attributable to goodwill. Required: Complete the table below and prepare the appropriate journal entries related to the investment during 2024. Complete this question by entering your answers in the tabs below.

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

ChapterA2: Investments

Section: Chapter Questions

Problem 25E

Related questions

Question

Please answer the question below and do the general journal

Transcribed Image Text:Fizer Pharmaceutical paid $85 million on January 2, 2024, for 4 million shares of Carne Cosmetics common stock. The investment

represents a 30% interest in the net assets of Carne and gave Fizer the ability to exercise significant influence over Carne's operations.

Fizer received dividends of $2 per share on December 21, 2024, and Carne reported net income of $50 million for the year ended

December 31, 2024. The fair value of Carne's common stock at December 31, 2024, was $26.50 per share.

⚫ The book value of Carne's net assets was $200 million.

• The fair value of Carne's depreciable assets exceeded their book value by $40 million. These assets had an average remaining

useful life of twelve years.

• The remainder of the excess of the cost of the investment over the book value of net assets purchased was attributable to

goodwill.

Required:

Complete the table below and prepare the appropriate journal entries related to the investment during 2024.

Complete this question by entering your answers in the tabs below.

Calculation

General

Journal

Complete the table below.

Note: Enter your answers in millions, (i.e., 10,000,000 should be entered as 10).

($ in millions)

Purchase Price

Fair Value Carne's assets

Book Value Carne's assets

Depreciation adjustment:

Investment revenue

Investee Net

Assets

Ownership

Interest

Net Assets

Purchased

Difference

Attributable to:

$

85

% =

$

0

X

% =

$

0

Years

Adjustment

0/

< Calculation

General Journal >

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 1 images

Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning