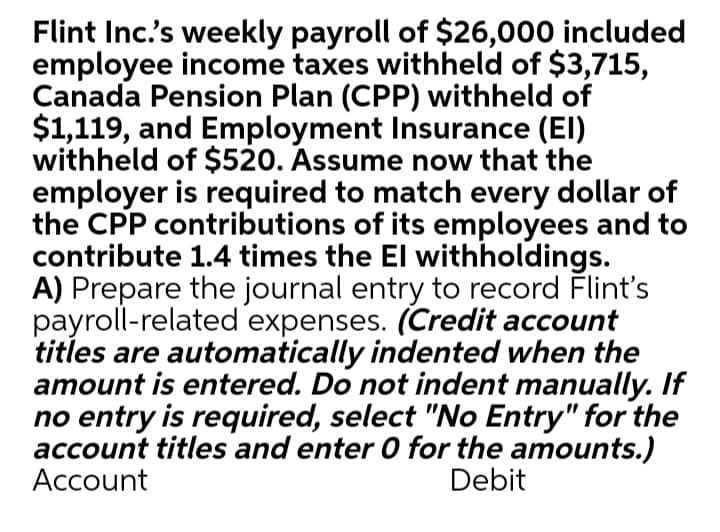

Flint Inc's weekly payroll of $26,000 included employee income taxes withheld of $3,715, Canada Pension Plan (CPP) withheld of $1,119, and Employment Insurance (EI) withheld of $520. Assume now that the employer is required to match every dollar of the CPP contributions of its employees and to contribute 1.4 times the El withholdings. A) Prepare the journal entry to record Flint's payroll-related expenses. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.) Account Debit

Flint Inc's weekly payroll of $26,000 included employee income taxes withheld of $3,715, Canada Pension Plan (CPP) withheld of $1,119, and Employment Insurance (EI) withheld of $520. Assume now that the employer is required to match every dollar of the CPP contributions of its employees and to contribute 1.4 times the El withholdings. A) Prepare the journal entry to record Flint's payroll-related expenses. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.) Account Debit

College Accounting (Book Only): A Career Approach

12th Edition

ISBN:9781305084087

Author:Cathy J. Scott

Publisher:Cathy J. Scott

Chapter8: Employer Taxes, Payments, And Reports

Section: Chapter Questions

Problem 2PA

Related questions

Question

1

Transcribed Image Text:Flint Inc's weekly payroll of $26,000 included

employee income taxes withheld of $3,715,

Canada Pension Plan (CPP) withheld of

$1,119, and Employment Insurance (EI)

withheld of $520. Assume now that the

employer is required to match every dollar of

the CPP contributions of its employees and to

contribute 1.4 times the El withholdings.

A) Prepare the journal entry to record Flint's

payroll-related expenses. (Credit account

titles are automatically indented when the

amount is entered. Do not indent manually. If

no entry is required, select "No Entry" for the

account titles and enter 0 for the amounts.)

Account

Debit

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,