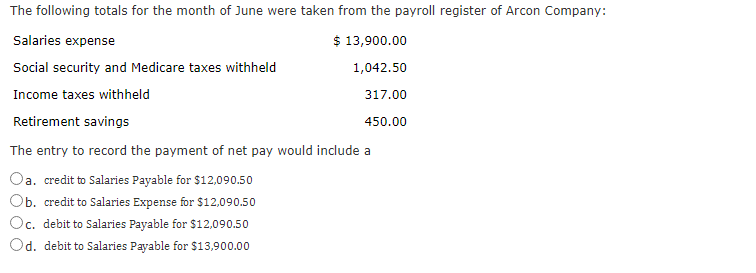

The following totals for the month of June were taken from the payroll register of Arcon Company: Salaries expense $ 13,900.00 Social security and Medicare taxes withheld 1,042.50 Income taxes withheld 317.00 Retirement savings 450.00 The entry to record the payment of net pay would include a Oa. credit to Salaries Payable for $12,090.50 Ob. credit to Salaries Expense for $12,090.50 Oc. debit to Salaries Payable for $12,090.50 Od. debit to Salaries Payable for $13,900.00

The following totals for the month of June were taken from the payroll register of Arcon Company: Salaries expense $ 13,900.00 Social security and Medicare taxes withheld 1,042.50 Income taxes withheld 317.00 Retirement savings 450.00 The entry to record the payment of net pay would include a Oa. credit to Salaries Payable for $12,090.50 Ob. credit to Salaries Expense for $12,090.50 Oc. debit to Salaries Payable for $12,090.50 Od. debit to Salaries Payable for $13,900.00

College Accounting, Chapters 1-27 (New in Accounting from Heintz and Parry)

22nd Edition

ISBN:9781305666160

Author:James A. Heintz, Robert W. Parry

Publisher:James A. Heintz, Robert W. Parry

Chapter9: Payroll Accounting: Employer Taxes And Reports

Section: Chapter Questions

Problem 1SEA: CALCULATION AND JOURNAL ENTRY FOR EMPLOYER PAYROLL TAXES Portions of the payroll register for...

Related questions

Question

Transcribed Image Text:The following totals for the month of June were taken from the payroll register of Arcon Company:

Salaries expense

$ 13,900.00

Social security and Medicare taxes withheld

1,042.50

Income taxes withheld

317.00

Retirement savings

450.00

The entry to record the payment of net pay would include a

Oa. credit to Salaries Payable for $12,090.50

Ob. credit to Salaries Expense for $12,090.50

Oc. debit to Salaries Payable for $12,090.50

Od. debit to Salaries Payable for $13,900.00

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning