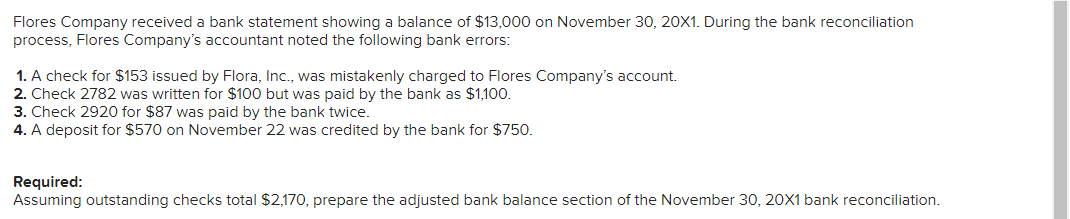

Flores Company received a bank statement showing a balance of $13,000 on November 30, 20X1. During the bank reconciliation process, Flores Company's accountant noted the following bank errors: 1. A check for $153 issued by Flora, Ic., was mistakenly charged to Flores Company's account. 2. Check 2782 was written for $100 but was paid by the bank as $1,100. 3. Check 2920 for $87 was paid by the bank twice. 4. A deposit for $570 on November 22 was credited by the bank for $750. Required: Assuming outstanding checks total $2,170, prepare the adjusted bank balance section of the November 30, 20X1 bank reconciliation.

Flores Company received a bank statement showing a balance of $13,000 on November 30, 20X1. During the bank reconciliation process, Flores Company's accountant noted the following bank errors: 1. A check for $153 issued by Flora, Ic., was mistakenly charged to Flores Company's account. 2. Check 2782 was written for $100 but was paid by the bank as $1,100. 3. Check 2920 for $87 was paid by the bank twice. 4. A deposit for $570 on November 22 was credited by the bank for $750. Required: Assuming outstanding checks total $2,170, prepare the adjusted bank balance section of the November 30, 20X1 bank reconciliation.

College Accounting (Book Only): A Career Approach

13th Edition

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:Scott, Cathy J.

Chapter6: Bank Accounts, Cash Funds, And Internal Controls

Section: Chapter Questions

Problem 3E

Related questions

Question

Transcribed Image Text:Flores Company received a bank statement showing a balance of $13,000 on November 30, 20X1. During the bank reconciliation

process, Flores Company's accountant noted the following bank errors:

1. A check for $153 issued by Flora, Ic., was mistakenly charged to Flores Company's account.

2. Check 2782 was written for $100 but was paid by the bank as $1,100.

3. Check 2920 for $87 was paid by the bank twice.

4. A deposit for $570 on November 22 was credited by the bank for $750.

Required:

Assuming outstanding checks total $2170, prepare the adjusted bank balance section of the November 30, 20X1 bank reconciliation.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College