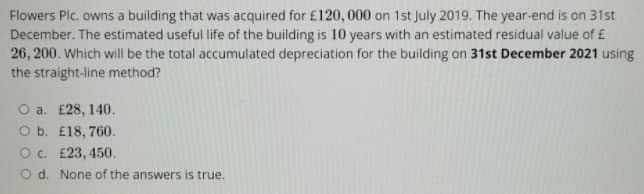

Flowers Plc. owns a building that was acquired for £120, 000 on 1st July 2019. The year-end is on 31st December. The estimated useful life of the building is 10 years with an estimated residual value of £ 26, 200. Which will be the total accumulated depreciation for the building on 31st December 2021 using the straight-line method? O a. £28, 140. O b. £18, 760. O. E23, 450. Nong cfth

Q: ABC Company has sales of $500,000, COGS of $250,000, operating expenses of $200,000, net income of $...

A: Formula: Times interest ratio = Operating income / Interest expense

Q: ABC Corp issued a bond with a maturity of 12 years. It has a 9 percent annual coupon, a yield to mat...

A: Answer) Calculation of Coupon Payment Coupon Payment = Face Value of Bonds X Coupon rate Coupon Paym...

Q: Based on the above information, what are the number of units available for sale? and how much is the...

A: Please see Step 2 for the required information.

Q: Austin Company reports the following components of stockholders' equity on January 1. Common stock-$...

A: The stockholders' equity section represents the total equity that belongs to the shareholders includ...

Q: Started a petty cash fund in the amount of $1,000. b. Replenished petty cash fund using the followin...

A: The petty cash fund is established to maintain the cash balance for smaller cash transactions of the...

Q: The directors of Transport Ltd produced the following Statement of profit or loss account for 2017 a...

A: GIVEN Statement of Profit or Loss Account for the year ended 31st December 2017 Revenue 320,...

Q: All parts of this multi-part (simple, five-line) flexible budget are based upon the same set of data...

A: A flexible budget is prepared on the basis of the budgeted rate and on the basis of different activi...

Q: During October, Company XYZ produced and sold 10,000 units of product A. At this level, the total pr...

A: In the given Question Direct material and Direct labor are full variable cost Direct Material and Di...

Q: Kingbird publishes a monthly sports magazine, Hockey Hits. Subscriptions to the magazine cost $22 pe...

A: To generate a journal entry, you input transaction data into your company's books. Your journal ent...

Q: A and B are in partnership sharing profits and losses in the ratio 3:2 respectively. Profit for the ...

A: there are two methods of capital account creation used they are:- fluctuating capital method under t...

Q: On April 30, Year 1, Augusta Corporation issued $5,000,000 of 4% 10-year bonds paying interest semi-...

A: Journal entry refers to the process of recording business transactions for first time in the books o...

Q: 1. Current ratio 2. Quick ratio 3. Accounts receivable turnover 345-30

A: Solution:- a)Calculation of current ratio as follows under:- Current ratio =Current assets /Current ...

Q: If the firm's dividend policy was based on a constant payout ratio of 50 percent for all of the year...

A: If the firm's earnings are more than P1.5 per share, the dividend payout would be 50%. Otherwise, th...

Q: The Assembly Department started the month with 26,000 units in its beginning work in process invento...

A: The equivalent units are calculated on the basis of percentage of the work completed during the peri...

Q: The client and our firm have agreed on an initial estimated audit fee of $32,000. However, the estim...

A: Company have to do audit of their accounts and they have to audit fee to the CPA firms.

Q: The aging of accounts receivable shows the following: P300,000 already 1-30 days past due; P200,000 ...

A: Allowance Method - Under allowance method company make provision of uncollectible accounts at the en...

Q: Claire Corporation’s trial balance includes the following expenses: Raw materials used in production...

A: Introduction:- Period cost is defined as those expenses incurred which are indirectly incurred for t...

Q: For the year 2021, Aquamarine Corporation has earned a net income of P400,000. Compute for the basic...

A: Earning per share refers to earning per share attributable to the ordinary shareholders. It is a net...

Q: Using the Microsoft 10K for the Fiscal Year ended June 30, 2018 to answer questions: 7. In the fina...

A: The required information on deferred revenue is obtained from the Balance Sheet and Note on Unearned...

Q: The project costs 1,40,000 and has no scrap value after five years. It is depreciated on straight li...

A: It has to be calculated on Return On Average Investment Method Under this method, average investmen...

Q: Balance sheet can be prepared in vertical, net asset and horizontal format. What is the difference b...

A: Balance sheet refers to the financial statement of the business entity. It is divided into two parts...

Q: What is y=mx+b

A: This is a case of equation. when a question is formed , and calculated there is relationship between...

Q: The following data refer to Solaris Power Ltd for the financial year ending 31 December 2021: Sales ...

A: Overhead is applied to the manufacturing process using a predetermined overhead rate. Since actual o...

Q: Required: 1. Compute the total investment property that should be reported in the consolidated state...

A: Invested property means the property that is held as an investment and the income from such property...

Q: You were engaged by CITY CORPORATION, a publicly held company whose shares are traded on the Philip...

A: Shareholder's Equity Shareholder's equity which consist of ordinary shares and preference shares, Tr...

Q: Service Revenue $10,000 Cash $12,000 Accounts Receivable $3,000 Office Supplies Rent Expense Salarie...

A: Introduction: Balance sheet: All Assets and liabilities are shown in Balance sheet. It tells the net...

Q: On June 1, 2019, YODA CORP. acquired a 5-year, 10%, P1,000,000 face value bonds at 92. The company p...

A: Large organization uses the bonds as a fund raising tool which offers a fixed interest rate to the b...

Q: What is the difference in the actual out of pocket cash flows between the two payments? That is, by...

A: In this case the annual end of year payments for the loan will have to be calculated to determine th...

Q: Based on their budget, Bryce and Sylvia have determined they can afford up to $2,500 per month for t...

A: Private mortgage insurance (PMI) is the insurance payable on the balance of the loan per year. At fi...

Q: Jay-ar Corp. issued 20,000 shares of P5 par common stock at P10 per share. On December 31, 2017, Jay...

A: when we prepare the balance sheet of the company then generally there are two category equity and li...

Q: Effect of Stock Split Yeoman Grill Restaurant Corporation wholesales ovens and ranges to restaurant...

A: a. Total no. of shares outstanding = 33,000*2/1 = 66000 shares

Q: Dear Bartleby, could you please assist me with solving this question and please provide the calculat...

A: Annual Report: Annual reports, or yearly reports, are extensive archives intended to furnish the use...

Q: Given the following data for Calandrucci Company, calculate the cost of gocds manufactured: In $'s D...

A: The cost of goods manufactured includes the total cost incurred on the goods that are finished durin...

Q: Ridge Marketing Tnc. two products, Presentiy, the company uses single plantwide factory overnead to ...

A: Painting Department Dlh rate = $236,00011,900= $19.83 Overhead in painting department for each unit ...

Q: SMIC issued 10-year P6,000,000-face value bonds two years ago. The bonds have a current market value...

A: The current effective rate would be the rate at which discounted cash flows is equal to the current ...

Q: On April 2, 2021, Cullumber Company entered into a contract to supply medication to Laxall Drug Stor...

A:

Q: ny produces floor mats used in gyms and dojos. The sales budget for four months of the year is as sh...

A: Ending inventory and beginning inventory must be according the budgeted sales and budgeted growth in...

Q: Rahim and Karim undertook jointly to build a house for a company at an agreed price of Tk. 60,000, p...

A: Joint venture Account : On the debit side of this account all expenses (paid personally by the co - ...

Q: Suppose the net sales is 1,60,000 for a firm and cost of goods sold is 40,000. Calculate gross profi...

A: Gross Profit Ratio is a financial ratio that measures the performance and efficiency of a business b...

Q: Question 8 Which of the following is NOT true about a cash budget? A. A cash budget sets out all cas...

A: Cash Budget - Cash Budget is the statement that shows the cash collection in a month and expected ca...

Q: SUKON Company acquired equity securities at the beginning of 2020. SUKON Company provided you the fo...

A: Carrying value of the investment on December 31, 2021 = Number of shares on December 31, 2021 x Fair...

Q: Altira Corporation provides the following Information related to Its merchandise Inventory during th...

A: The inventory can be valued using various methods as LIFO, FIFO and weighted average method. Cost of...

Q: What would be the bond's price if comparable debt yields 10 percent? Use Appendix B and Appendix D t...

A: Solution Note : Dear student as per the Q&A guideline we are required to answer the first three ...

Q: At the end of its economic life of P45,000 operational hours, an item costing P500,000 has a salvage...

A: Let's understand some basic Depreciation is an accounting method of allocating the cost of a tangibl...

Q: A manufacturing firm just received a shipment of 20 assembly parts, of slightly varied sizes, from a...

A: Given information, Total parts = 20 Suitable parts = 15 Non-suitable parts = total - suitable parts ...

Q: ing transactions in M ased merchandise from Sabine Company under the following y (The cost of the me...

A: Thorsten Should be insuring the merchandise during shipping since Thorsten has purchased the merchan...

Q: $10,000 $12,000 Accounts Receivable $3,000 $4,000 Service Revenue Cash Office Supplies $2,000 Rent E...

A: Revenues and expenses are shown in the income statement. Total assets, liabilties and stockholders'...

Q: Required information [The following information applies to the questions displayed below.] Snack Sha...

A:

Q: The initial amount of the note receivable

A: The notes receivable would be calculated as present value of annual lease payment on the loan. The p...

Q: A commercial vehicle is purchased for an acquisition cost of $300,000. The operating and maintenance...

A: EAC = NPV*r/1-(1+r)-n

Step by step

Solved in 2 steps

- On May 10, 2019, Horan Company purchased equipment for 25,000. The equipment has an estimated service life of 5 years and zero residual value. Assume that the straight-line depreciation method is used. Required: Compute the depreciation expense for 2019 for each of the following four alternatives: 1. Horan computes depreciation expense to the nearest day. (Use 12 months of 30 days each and round the daily depreciation rate to 2 decimal places.) 2. Horan computes depreciation expense to the nearest month. Assets purchased in the first half of the month are considered owned for the whole month. 3. Horan computes depreciation expense to the nearest whole year. Assets purchased in the first half of the year are considered owned for the whole year. 4. Horan records one-half years depreciation expense on all assets purchased during the year.Referring to PA7 where Kenzie Company purchased a 3-D printer for $450,000, consider how the purchase of the printer impacts not only depreciation expense each year but also the assets book value. What amount will be recorded as depreciation expense each year, and what will the book value be at the end of each year after depreciation is recorded?Chapman Inc. purchased a piece of equipment in 2018. Chapman depreciated the equipment on a straight-line basis over a useful life of 10 years and used a residual value of $12,000. Chapmans depreciation expense for 2019 was $11,000. What was the original cost of the building? a. $98,000 b. $110,000 c. $122,000 d. $134,000

- Bliss Company owns an asset with an estimated life of 15 years and an estimated residual value of zero. Bliss uses the straight -line method of depreciation. At the beginning of the sixth year, the assets book value is 200,000 and Bliss changes the estimate of the assets life to 25 years, so that 20 years now remain in the assets life. Explain how this change will be accounted for in Blisss financial statements, and compute the current and future annual depreciation expense.Kam Company purchased a machine on January 2, 2019, for 20,000. The machine had an expected life of 8 years and a residual value of 300. The double-declining-balance method of depreciation is used. Required: 1. Compute the depreciation expense for each year of the assets life and book value at the end of each year. 2. Assuming that the company has a policy of always changing to the straight-line method at the midpoint of the assets life, compute the depreciation expense for each year of the assets life. 3. Assuming that the company always changes to the straight-line method at the beginning of the year when the annual straight-line amount exceeds the double-declining-balance amount, compute the depreciation expense for each year of the assets life.Hunter Company purchased a light truck on January 2, 2019 for 18,000. The truck, which will be used for deliveries, has the following characteristics: Estimated life: 5 years Estimated residual value: 3,000 Depreciation method for financial statements: straight-line method Depreciation for income tax purposes: MACRS (3-year life) From 2019 through 2023, each year, Hunter had sales of 100,000, cost of goods sold of 60,000, and operating expenses (excluding depreciation) of 15,000. The truck was disposed of on December 31, 2023, for 2,000. Required: 1. Prepare an income statement for financial reporting through pretax accounting income for each of the 5 years, 2019 through 2023. 2. Prepare, instead, an income statement for income tax purposes through taxable income for each of the 5 years, 2019 through 2023. 3. Compare the total income for all 5 years under Requirements 1 and 2.

- On January 1, 2014, Klinefelter Company purchased a building for 520,000. The building had an estimated life of 20 years and an estimated residual value of 20,000. The company has been depreciating the building using straight-line depreciation. At the beginning of 2020, the following independent situations occur: a. The company estimates that the building has a remaining life of 10 years (for a total of 16 years). b. The company changes to the sum-of-the-years-digits method. c. The company discovers that it had ignored the estimated residual value in the computation of the annual depreciation each year. Required: For each of the independent situations, prepare all journal entries related to the building for 2020. Ignore income taxes.Hathaway Company purchased a copying machine for 8,700 on October 1, 2019. The machines residual value was 500 and its expected service life was 5 years. Hathaway computes depreciation expense to the nearest whole month. Required: 1. Compute depredation expense (rounded to the nearest dollar) for 2019 and 2020 using the: a. straight-line method b. sum-of-the-years-digits method c. double-declining-balance method 2. Next Level Which method produces the highest book value at the end of 2020? 3. Next Level Which method produces the highest charge to income in 2020? 4. Next Level Over the life of the asset, which method produces the greatest amount of depreciation expense?Dinnell Company owns the following assets: In the year of acquisition and retirement of an asset, Dinnell records depreciation expense for one-half year. During 2020, Asset A was sold for 7,000. Required: Prepare the journal entries to record depreciation on each asset for 2017 through 2020 and the sale of Asset A. Round all answers to the nearest dollar.

- Gray Companys financial statements showed income before income taxes of 4,030,000 for the year ended December 31, 2020, and 3,330,000 for the year ended December 31, 2019. Additional information is as follows: Capital expenditures were 2,800,000 in 2020 and 4,000,000 in 2019. Included in the 2020 capital expenditures is equipment purchased for 1,000,000 on January 1, 2020, with no salvage value. Gray used straight-line depreciation based on a 10-year estimated life in its financial statements. As a result of additional information now available, it is estimated that this equipment should have only an 8-year life. Gray made an error in its financial statements that should be regarded as material. A payment of 180,000 was made in January 2020 and charged to expense in 2020 for insurance premiums applicable to policies commencing and expiring in 2019. No liability had been recorded for this item at December 31, 2019. The allowance for doubtful accounts reflected in Grays financial statements was 7,000 at December 31, 2020, and 97,000 at December 31, 2019. During 2020, 90,000 of uncollectible receivables were written off against the allowance for doubtful accounts. In 2019, the provision for doubtful accounts was based on a percentage of net sales. The 2020 provision has not yet been recorded. Net sales were 58,500,000 for the year ended December 31, 2020, and 49,230,000 for the year ended December 31, 2019. Based on the latest available facts, the 2020 provision for doubtful accounts is estimated to be 0.2% of net sales. A review of the estimated warranty liability at December 31, 2020, which is included in other liabilities in Grays financial statements, has disclosed that this estimated liability should be increased 170,000. Gray has two large blast furnaces that it uses in its manufacturing process. These furnaces must be periodically relined. Furnace A was relined in January 2014 at a cost of 230,000 and in January 2019 at a cost of 280,000. Furnace B was relined for the first time in January 2020 at a cost of 300,000. In Grays financial statements, these costs were expensed as incurred. Since a relining will last for 5 years, Grays management feels it would be preferable to capitalize and depreciate the cost of the relining over the productive life of the relining. Gray has decided to nuke a change in accounting principle from expensing relining costs as incurred to capitalizing them and depreciating them over their productive life on a straight-line basis with a full years depreciation in the year of relining. This change meets the requirements for a change in accounting principle under GAAP. Required: 1. For the years ended December 31, 2020 and 2019, prepare a worksheet reconciling income before income taxes as given previously with income before income taxes as adjusted for the preceding additional information. Show supporting computations in good form. Ignore income taxes and deferred tax considerations in your answer. The worksheet should have the following format: 2. As of January 1, 2020, compute the retrospective adjustment of retained earnings for the change in accounting principle from expensing to capitalizing relining costs. Ignore income taxes and deferred tax considerations in your answer.During 2019, Ryel Companys controller asked you to prepare correcting journal entries for the following three situations: 1. Machine A was purchased for 50,000 on January 1, 2014. Straight-line depreciation has been recorded for 5 years, and the Accumulated Depreciation account has a balance of 25,000. The estimated residual value remains at 5,000, but the service life is now estimated to be 1 year longer than estimated originally. 2. Machine B was purchased for 40,000 on January 1, 2017. It had an estimated residual value of 5,000 and an estimated service life of 10 years. it has been depreciated under the double-declining-balance method for 2 years. Now, at the beginning of the third year, Ryel has decided to change to the straight-line method. 3. Machine C was purchased for 20,000 on January 1, 2018, Double-declining-balance depreciation has been recorded for 1 year. The estimated residual value of the machine is 2,000 and the estimated service life is 5 years. The computation of the depreciation erroneously included the estimated residual value. Required: Prepare any necessary correcting journal entries for each situation. Also prepare the journal entry necessary for each situation to record depreciation expense for 2019.Akron Incorporated purchased an asset at the beginning of Year 1 for 375,000. The estimated residual value is 15,000. Akron estimates that the asset has a service life of 5 years. Calculate the depreciation expense using the sum-of-the-years-digits method for Years 1 and 2 of the assets life.