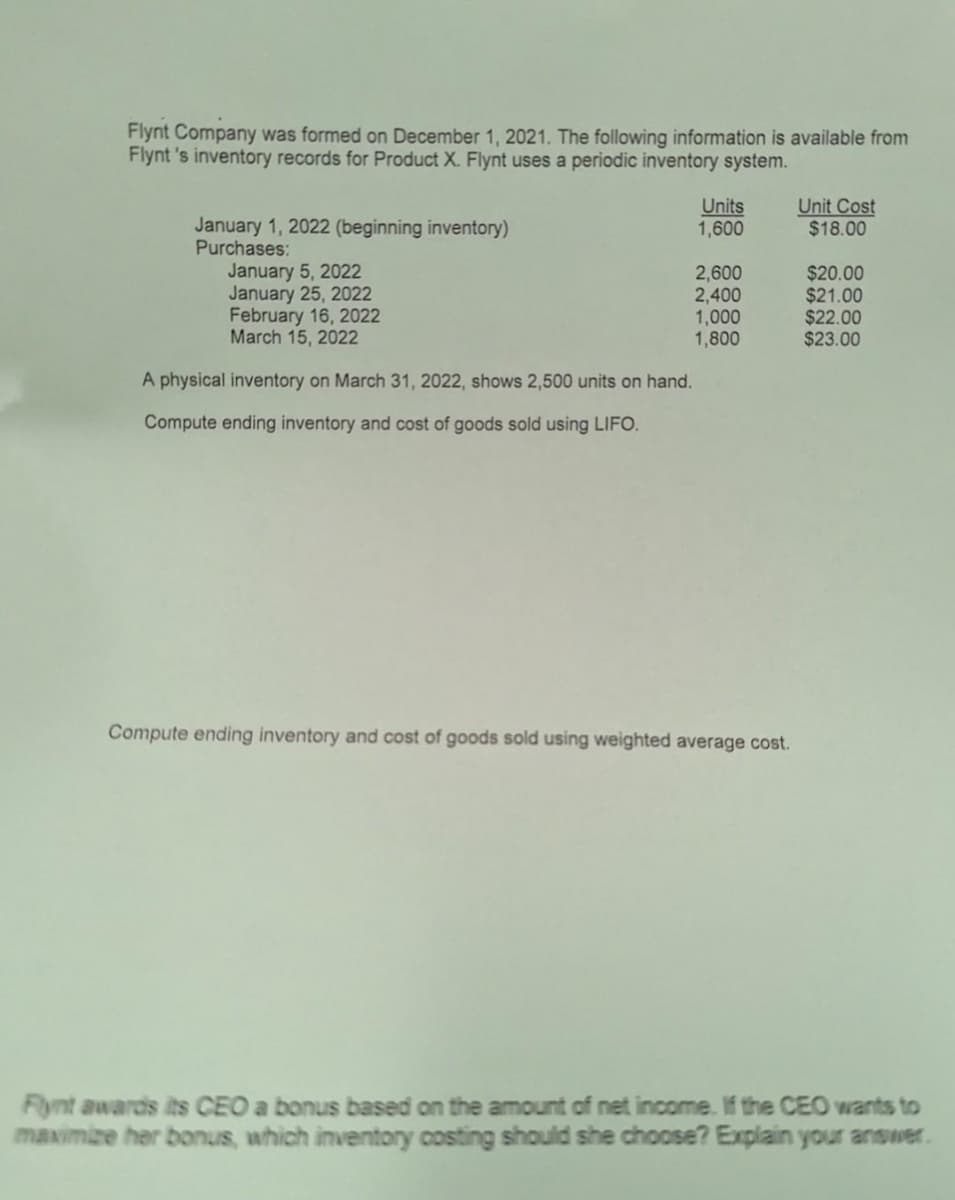

Flynt Company was formed on December 1, 2021. The following information is available from Flynt 's inventory records for Product X. Flynt uses a periodic inventory system. January 1, 2022 (beginning inventory) Purchases: January 5, 2022 January 25, 2022 February 16, 2022 March 15, 2022 Units 1,600 2,600 2,400 1,000 1,800 A physical inventory on March 31, 2022, shows 2,500 units on hand. Compute ending inventory and cost of goods sold using LIFO. Compute ending inventory and cost of goods sold using weighted average cost. Unit Cost $18.00 $20.00 $21.00 $22.00 $23.00 Flynt awards its CEO a bonus based on the amount of net income. If the CEO wants to maximize her bonus, which inventory costing should she choose? Explain your answer.

Flynt Company was formed on December 1, 2021. The following information is available from Flynt 's inventory records for Product X. Flynt uses a periodic inventory system. January 1, 2022 (beginning inventory) Purchases: January 5, 2022 January 25, 2022 February 16, 2022 March 15, 2022 Units 1,600 2,600 2,400 1,000 1,800 A physical inventory on March 31, 2022, shows 2,500 units on hand. Compute ending inventory and cost of goods sold using LIFO. Compute ending inventory and cost of goods sold using weighted average cost. Unit Cost $18.00 $20.00 $21.00 $22.00 $23.00 Flynt awards its CEO a bonus based on the amount of net income. If the CEO wants to maximize her bonus, which inventory costing should she choose? Explain your answer.

Financial Accounting

15th Edition

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter6: Accounting For Merchandising Businesses

Section: Chapter Questions

Problem 9PB: On June 30, 2019, the balances of the accounts appearing in the ledger of Simkins Company are as...

Related questions

Topic Video

Question

Y3

Transcribed Image Text:Flynt Company was formed on December 1, 2021. The following information is available from

Flynt's inventory records for Product X. Flynt uses a periodic inventory system.

January 1, 2022 (beginning inventory)

Purchases:

January 5, 2022

January 25, 2022

February 16, 2022

March 15, 2022

Units

1,600

2,600

2,400

1,000

1,800

A physical inventory on March 31, 2022, shows 2,500 units on hand.

Compute ending inventory and cost of goods sold using LIFO.

Compute ending inventory and cost of goods sold using weighted average cost.

Unit Cost

$18.00

$20.00

$21.00

$22.00

$23.00

Flynt awards its CEO a bonus based on the amount of net income. If the CEO wants to

maximize her bonus, which inventory costing should she choose? Explain your answer.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning