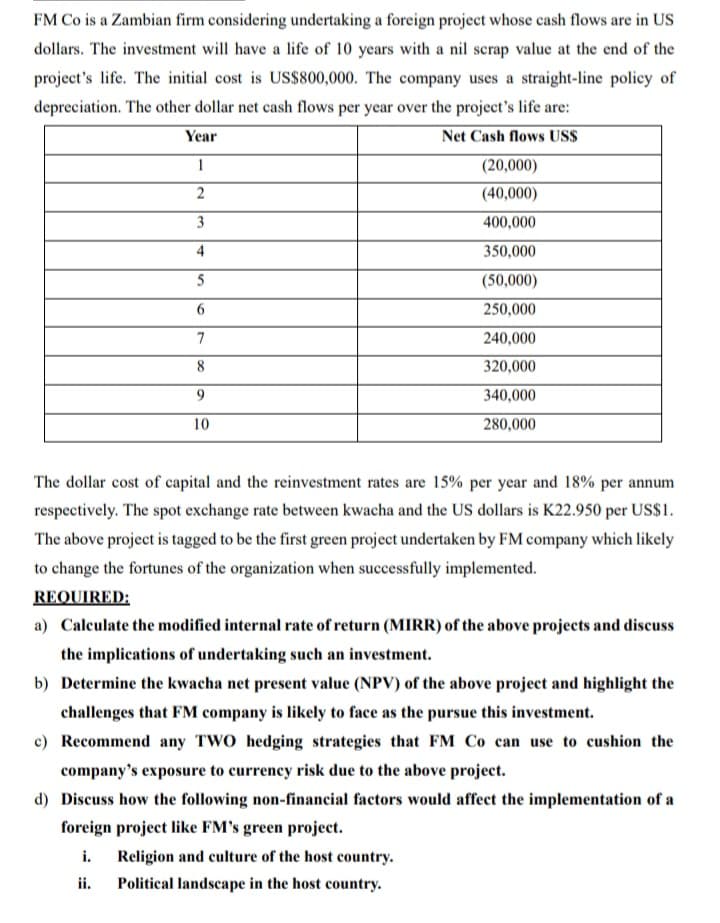

FM Co is a Zambian firm considering undertaking a foreign project whose cash flows are in US dollars. The investment will have a life of 10 years with a nil scrap value at the end of the project's life. The initial cost is US$800,000. The company uses a straight-line policy of depreciation. The other dollar net cash flows per year over the project's life are: Year Net Cash flows US$ 1 (20,000) 2 (40,000) 3 400,000 4 350,000 5 (50,000) 6 250,000 7 240,000 8 320,000 9 340,000 10 280,000 The dollar cost of capital and the reinvestment rates are 15% per year and 18% per annum respectively. The spot exchange rate between kwacha and the US dollars is K22.950 per US$1. The above project is tagged to be the first green project undertaken by FM company which likely to change the fortunes of the organization when successfully implemented. REQUIRED: a) Calculate the modified internal rate of return (MIRR) of the above projects and discuss the implications of undertaking such an investment. b) Determine the kwacha net present value (NPV) of the above project and highlight the challenges that FM company is likely to face as the pursue this investment. c) Recommend any TWO hedging strategies that FM Co can use to cushion the company's exposure to currency risk due to the above project. d) Discuss how the following non-financial factors would affect the implementation of a foreign project like FM's green project. i. Religion and culture of the host country. ii. Political landscape in the host country.

FM Co is a Zambian firm considering undertaking a foreign project whose cash flows are in US dollars. The investment will have a life of 10 years with a nil scrap value at the end of the project's life. The initial cost is US$800,000. The company uses a straight-line policy of depreciation. The other dollar net cash flows per year over the project's life are: Year Net Cash flows US$ 1 (20,000) 2 (40,000) 3 400,000 4 350,000 5 (50,000) 6 250,000 7 240,000 8 320,000 9 340,000 10 280,000 The dollar cost of capital and the reinvestment rates are 15% per year and 18% per annum respectively. The spot exchange rate between kwacha and the US dollars is K22.950 per US$1. The above project is tagged to be the first green project undertaken by FM company which likely to change the fortunes of the organization when successfully implemented. REQUIRED: a) Calculate the modified internal rate of return (MIRR) of the above projects and discuss the implications of undertaking such an investment. b) Determine the kwacha net present value (NPV) of the above project and highlight the challenges that FM company is likely to face as the pursue this investment. c) Recommend any TWO hedging strategies that FM Co can use to cushion the company's exposure to currency risk due to the above project. d) Discuss how the following non-financial factors would affect the implementation of a foreign project like FM's green project. i. Religion and culture of the host country. ii. Political landscape in the host country.

Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Eugene F. Brigham, Phillip R. Daves

Chapter12: Capital Budgeting: Decision Criteria

Section: Chapter Questions

Problem 16P: Shao Airlines is considering the purchase of two alternative planes. Plane A has an expected life of...

Related questions

Question

Kindly show the formulars been used manually and how the calculation is coming about.

Transcribed Image Text:FM Co is a Zambian firm considering undertaking a foreign project whose cash flows are in US

dollars. The investment will have a life of 10 years with a nil scrap value at the end of the

project's life. The initial cost is US$800,000. The company uses a straight-line policy of

depreciation. The other dollar net cash flows per year over the project's life are:

Year

Net Cash flows US$

1

(20,000)

2

(40,000)

3

400,000

4

350,000

5

(50,000)

6

250,000

7

240,000

8

320,000

9

340,000

10

280,000

The dollar cost of capital and the reinvestment rates are 15% per year and 18% per annum

respectively. The spot exchange rate between kwacha and the US dollars is K22.950 per US$1.

The above project is tagged to be the first green project undertaken by FM company which likely

to change the fortunes of the organization when successfully implemented.

REQUIRED:

a) Calculate the modified internal rate of return (MIRR) of the above projects and discuss

the implications of undertaking such an investment.

b) Determine the kwacha net present value (NPV) of the above project and highlight the

challenges that FM company is likely to face as the pursue this investment.

c) Recommend any TWO hedging strategies that FM Co can use to cushion the

company's exposure to currency risk due to the above project.

d) Discuss how the following non-financial factors would affect the implementation of a

foreign project like FM's green project.

i. Religion and culture of the host country.

ii.

Political landscape in the host country.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 1 steps

Recommended textbooks for you

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT