Financial Accounting

15th Edition

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter4: Completing The Accounting Cycle

Section: Chapter Questions

Problem 4PB: The unadjusted trial balance of Recessive Interiors at January 31, 2019, the end of the year,...

Related questions

Question

Transcribed Image Text:The beginning balance represented the unexpired portion of a one-year policy

On Nov. 30, 2019, the end of fiscal year, the following information is available to enable

year were P45,260. The ending inventory revealed supplies on hand of P 13,970.

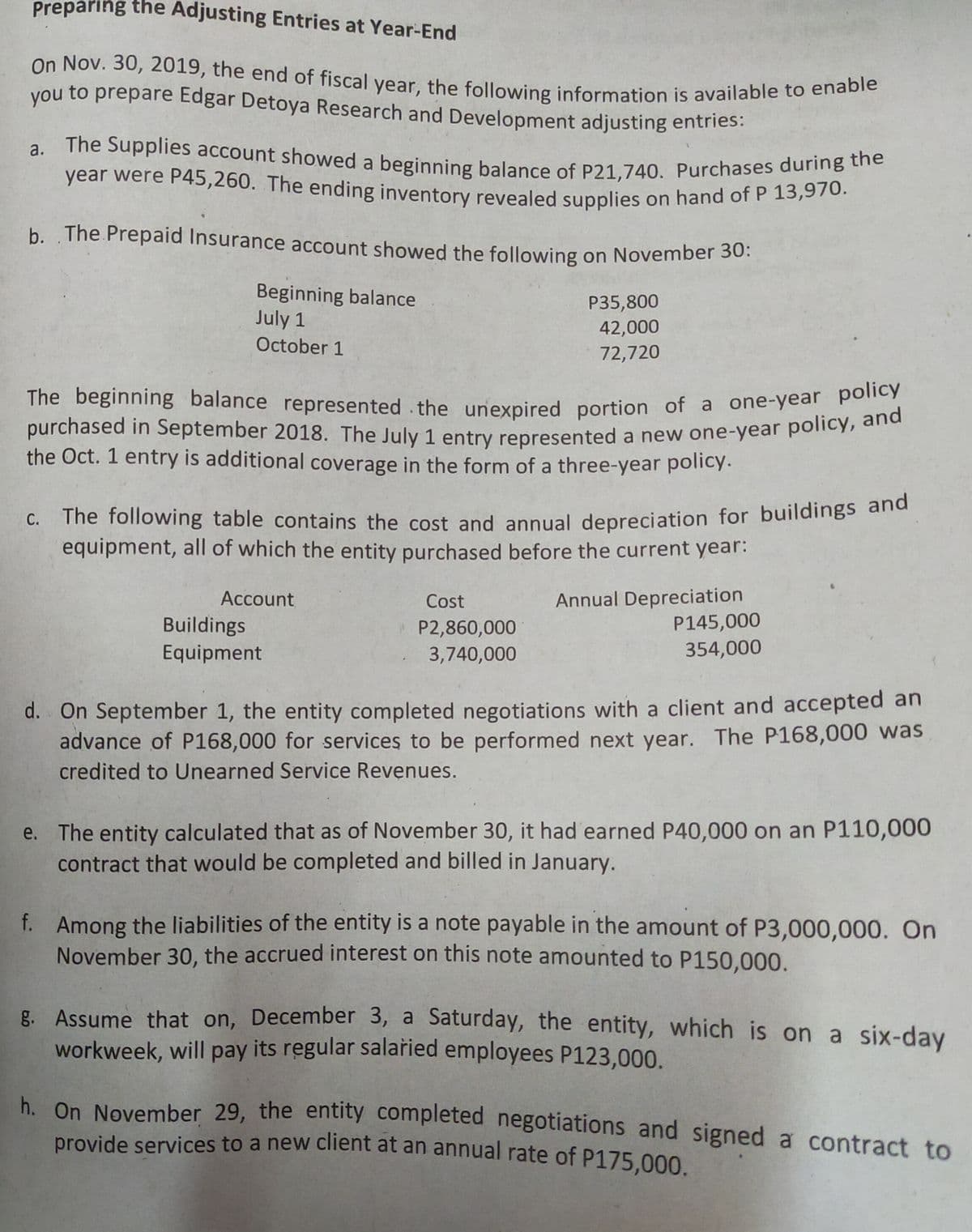

Preparing the Adjusting Entries at Year-End

a. The Supplies account showed a beginning balance of P21,740. Purchases during the

you

you to prepare Edgar Detoya Research and Development adjusting entries:

b. The Prepaid Insurance account showed the following on November 30.

Beginning balance

July 1

P35,800

42,000

October 1

72,720

The beginning balance represented the unexpired portion of a one-yeal pand

purchased in September 2018. The July 1 entry represented a new one-year policy, eme

the Oct. 1 entry is additional coverage in the form of a three-year policy.

c. The following table contains the cost and annual depreciation for buildings ana

equipment, all of which the entity purchased before the current year:

Annual Depreciation

P145,000

354,000

Account

Cost

Buildings

Equipment

P2,860,000

3,740,000

d. On September 1, the entity completed negotiations with a client and accepted an

advance of P168,000 for services to be performed next year. The P168,000 was

credited to Unearned Service Revenues.

e. The entity calculated that as of November 30, it had earned P40,000 on an P110,000

contract that would be completed and billed in January.

f. Among the liabilities of the entity is a note payable in the amount of P3,000,000. On

November 30, the accrued interest on this note amounted to P150,000.

g. Assume that on, December 3, a Saturday, the entity, which is on a six-day

workweek, will pay its regular salařied employees P123,000.

h. On November 29, the entity completed negotiations and signed a contract to

provide services to a new client at an annual rate of P175.000.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning