Following are the balance sheets of Power Boogie Musical Corporation and Shoot-Toot Tuba Company as of December 31, 20X5. POWER BOOGIE MUSICAL CORPORATION Balance Sheet December 31, 20X5 Assets Cash Accounts Receivable Allowance for Uncollectible Accounts Inventory Plant and Equipment Accumulated Depreciation Other Assets Total Assets Assets Cash Accounts Receivable Allowance for Uncollectible Accounts Inventory Plant and Equipment Accumulated Depreciation Other Assets Total Assets Liabilities and Equities $ 23,000 Accounts Payable 85,000 Notes Payable (1,200) Mortgage Payable 192,000 Bonds Payable 980,000 Capital Stock ($10 par) (160,000) Additional paid-in capital 14,000 Retained Earnings $ 1,132,800 Total Liabilities and Equities SHOOT-TOOT TUBA COMPANY Balance Sheet December 31, 20x5 Liabilities and Equities $ 300 Accounts Payable 17,000 Notes Payable (600) Mortgage Payable 78,500 Bonds Payable 451,000 Capital Stock ($50 par) (225,000) Additional paid-in capital 25,800 Retained Earnings $347,000 Total Liabilities and Equities $ 48,000 65,000 200,000 200,000 500,000 1,000 118,800 $1,132,800 $ 8,200 10,000 50,000 100,000 100,000 150,000 (71,200) $ 347,000 In preparation for a possible business combination, a team of experts from Power Boogie Musical made a thorough examination and audit of Shoot-Toot Tuba. They found that Shoot-Toot's assets and liabilities were correctly stated except that they estimated uncollectible accounts at $1,400. The experts also estimated the market value of the inventory at $35,000 and the market value of th plant and equipment at $500,000. The business combination took place on January 1, 20X6, and on that date Power Boogie Musical acquired all the assets and liabilities of Shoot-Toot Tuba. On that date, Power Boogie's common stock was selling for $55 per share. Required: Record the combination on Power Boogie's books assuming that Power Boogie issued 9,000 of its $10 par common shares in exchange for Shoot-Toot's assets and liabilities. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field.

Following are the balance sheets of Power Boogie Musical Corporation and Shoot-Toot Tuba Company as of December 31, 20X5. POWER BOOGIE MUSICAL CORPORATION Balance Sheet December 31, 20X5 Assets Cash Accounts Receivable Allowance for Uncollectible Accounts Inventory Plant and Equipment Accumulated Depreciation Other Assets Total Assets Assets Cash Accounts Receivable Allowance for Uncollectible Accounts Inventory Plant and Equipment Accumulated Depreciation Other Assets Total Assets Liabilities and Equities $ 23,000 Accounts Payable 85,000 Notes Payable (1,200) Mortgage Payable 192,000 Bonds Payable 980,000 Capital Stock ($10 par) (160,000) Additional paid-in capital 14,000 Retained Earnings $ 1,132,800 Total Liabilities and Equities SHOOT-TOOT TUBA COMPANY Balance Sheet December 31, 20x5 Liabilities and Equities $ 300 Accounts Payable 17,000 Notes Payable (600) Mortgage Payable 78,500 Bonds Payable 451,000 Capital Stock ($50 par) (225,000) Additional paid-in capital 25,800 Retained Earnings $347,000 Total Liabilities and Equities $ 48,000 65,000 200,000 200,000 500,000 1,000 118,800 $1,132,800 $ 8,200 10,000 50,000 100,000 100,000 150,000 (71,200) $ 347,000 In preparation for a possible business combination, a team of experts from Power Boogie Musical made a thorough examination and audit of Shoot-Toot Tuba. They found that Shoot-Toot's assets and liabilities were correctly stated except that they estimated uncollectible accounts at $1,400. The experts also estimated the market value of the inventory at $35,000 and the market value of th plant and equipment at $500,000. The business combination took place on January 1, 20X6, and on that date Power Boogie Musical acquired all the assets and liabilities of Shoot-Toot Tuba. On that date, Power Boogie's common stock was selling for $55 per share. Required: Record the combination on Power Boogie's books assuming that Power Boogie issued 9,000 of its $10 par common shares in exchange for Shoot-Toot's assets and liabilities. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field.

Chapter1: Financial Statements And Business Decisions

Section: Chapter Questions

Problem 1Q

Related questions

Question

Help please with this question

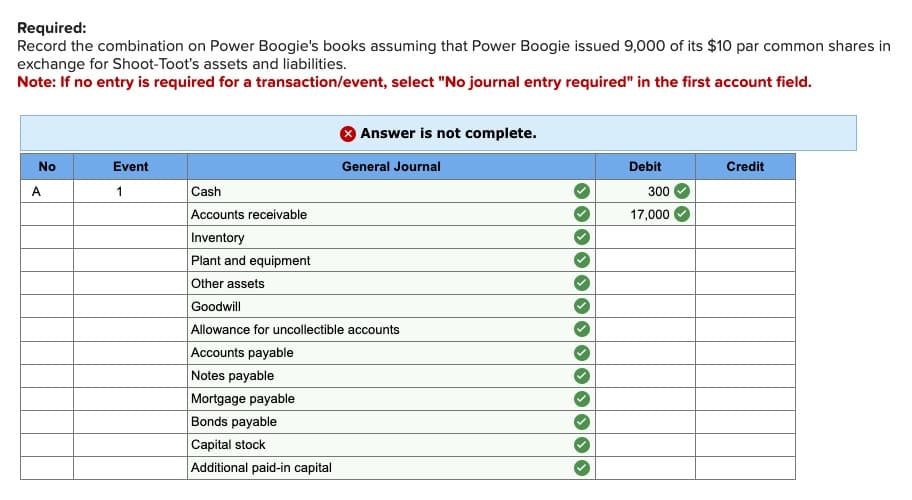

Transcribed Image Text:Required:

Record the combination on Power Boogie's books assuming that Power Boogie issued 9,000 of its $10 par common shares in

exchange for Shoot-Toot's assets and liabilities.

Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field.

No

A

Event

1

Answer is not complete.

General Journal

Cash

Accounts receivable

Inventory

Plant and equipment

Other assets

Goodwill

Allowance for uncollectible accounts

Accounts payable

Notes payable

Mortgage payable

Bonds payable

Capital stock

Additional paid-in capital

Debit

300

17,000

Credit

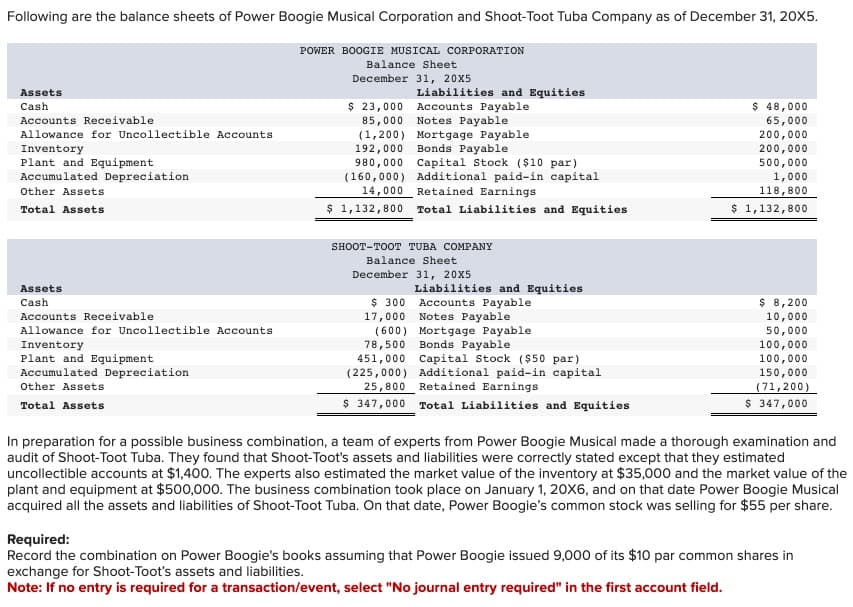

Transcribed Image Text:Following are the balance sheets of Power Boogie Musical Corporation and Shoot-Toot Tuba Company as of December 31, 20X5.

Assets

Cash

Accounts Receivable

Allowance for Uncollectible Accounts

Inventory

Plant and Equipment

Accumulated Depreciation

Other Assets

Total Assets

Assets

Cash

Accounts Receivable

Allowance for Uncollectible Accounts.

Inventory

Plant and Equipment

Accumulated Depreciation

Other Assets

Total Assets

POWER BOOGIE MUSICAL CORPORATION

Balance Sheet

December 31, 20X5

$ 23,000

85,000

Liabilities and Equities

Accounts Payable

Notes Payable

(1,200) Mortgage Payable

192,000 Bonds Payable

980,000 Capital Stock ($10 par)

(160,000) Additional paid-in capital

Retained Earnings

14,000

$ 1,132,800 Total Liabilities and Equities

SHOOT-TOOT TUBA COMPANY

Balance Sheet

December 31, 20X5

Liabilities and Equities

Accounts Payable

$ 300

17,000

Notes Payable

(600) Mortgage Payable

78,500 Bonds Payable

451,000 Capital Stock ($50 par)

(225,000) Additional paid-in capital

Retained Earnings

25,800

$ 347,000

Total Liabilities and Equities

$ 48,000

65,000

200,000

200,000

500,000

1,000

118,800

$ 1,132,800

$ 8,200

10,000

50,000

100,000

100,000

150,000

(71,200)

$ 347,000

In preparation for a possible business combination, a team of experts from Power Boogie Musical made a thorough examination and

audit of Shoot-Toot Tuba. They found that Shoot-Toot's assets and liabilities were correctly stated except that they estimated

uncollectible accounts at $1,400. The experts also estimated the market value of the inventory at $35,000 and the market value of the

plant and equipment at $500,000. The business combination took place on January 1, 20X6, and on that date Power Boogie Musical

acquired all the assets and liabilities of Shoot-Toot Tuba. On that date, Power Boogie's common stock was selling for $55 per share.

Required:

Record the combination on Power Boogie's books assuming that Power Boogie issued 9,000 of its $10 par common shares in

exchange for Shoot-Toot's assets and liabilities.

Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis…

Accounting

ISBN:

9780134475585

Author:

Srikant M. Datar, Madhav V. Rajan

Publisher:

PEARSON

Intermediate Accounting

Accounting

ISBN:

9781259722660

Author:

J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:

McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:

9781259726705

Author:

John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:

McGraw-Hill Education