Following are the transactions for Valdez Services. The company paid $500 cash for payment on a 3-month-old account payable for office supplies. The company paid $2,200 cash for the just-completed two-week salary of the receptionist. The company paid $42,000 cash for equipment purchased. The company paid $200 cash for this month’s utilities. The company paid a $10,500 cash dividend to the owner (sole shareholder). 1. Prepare general journal entries for the above transactions of Valdez Services. 2. Listed below are three reasons why a transaction would not result in an expense. Match each of the reasons to the transaction it properly describes.

Following are the transactions for Valdez Services. The company paid $500 cash for payment on a 3-month-old account payable for office supplies. The company paid $2,200 cash for the just-completed two-week salary of the receptionist. The company paid $42,000 cash for equipment purchased. The company paid $200 cash for this month’s utilities. The company paid a $10,500 cash dividend to the owner (sole shareholder). 1. Prepare general journal entries for the above transactions of Valdez Services. 2. Listed below are three reasons why a transaction would not result in an expense. Match each of the reasons to the transaction it properly describes.

Chapter4: The Adjustment Process

Section: Chapter Questions

Problem 1EA: Identify whether each of the following transactions, which are related to revenue recognition, are...

Related questions

Topic Video

Question

Following are the transactions for Valdez Services.

- The company paid $500 cash for payment on a 3-month-old account payable for office supplies.

- The company paid $2,200 cash for the just-completed two-week salary of the receptionist.

- The company paid $42,000 cash for equipment purchased.

- The company paid $200 cash for this month’s utilities.

- The company paid a $10,500 cash dividend to the owner (sole shareholder).

1. Prepare general

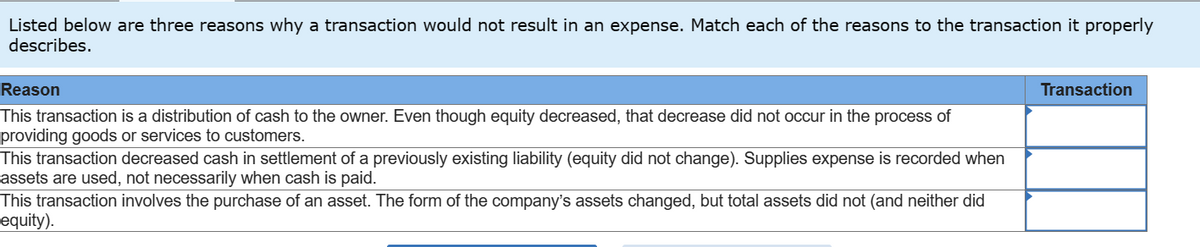

2. Listed below are three reasons why a transaction would not result in an expense. Match each of the reasons to the transaction it properly describes.

Transcribed Image Text:Listed below are three reasons why a transaction would not result in an expense. Match each of the reasons to the transaction it properly

describes.

Reason

This transaction is a distribution of cash to the owner. Even though equity decreased, that decrease did not occur in the process of

providing goods or services to customers.

This transaction decreased cash in settlement of a previously existing liability (equity did not change). Supplies expense is recorded when

assets are used, not necessarily when cash is paid.

This transaction involves the purchase of an asset. The form of the company's assets changed, but total assets did not (and neither did

equity).

Transaction

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub