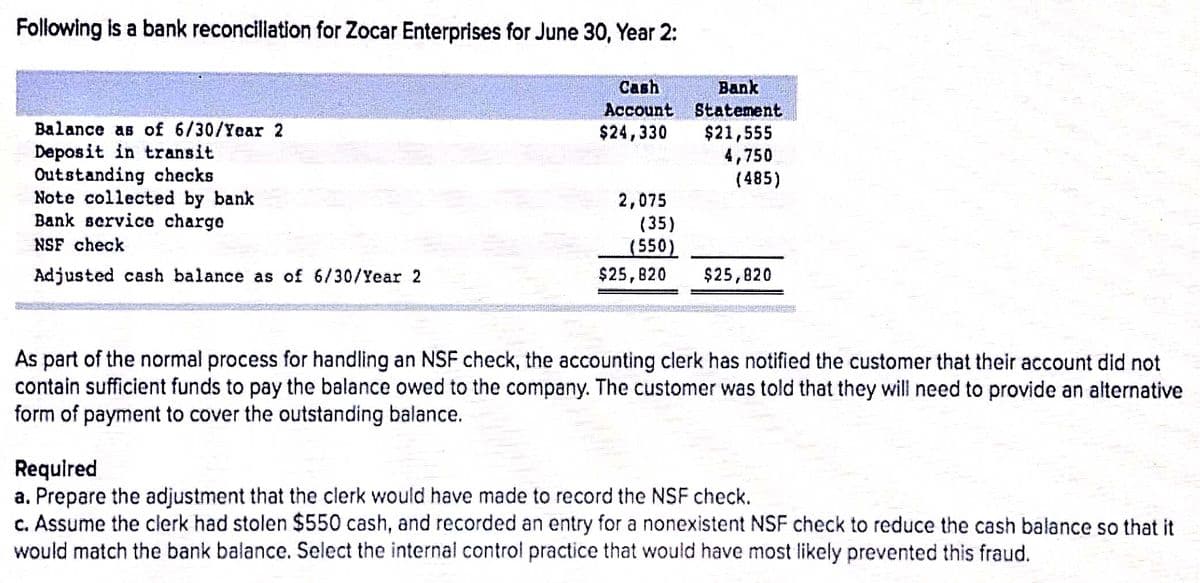

Following is a bank reconciliation for Zocar Enterprises for June 30, Year 2: Cash Bank Account Statement Balance as of 6/30/Year 2 Deposit in transit Outstanding checks Note collected by bank Bank service charge $24,330 $21,555 4,750 (485) 2,075 (35) (550) NSF check Adjusted cash balance as of 6/30/Year 2 $25,820 $25,820 As part of the normal process for handling an NSF check, the accounting clerk has notified the customer that their account did not contain sufficient funds to pay the balance owed to the company. The customer was told that they will need to provide an alternativ form of payment to cover the outstanding balance. Required a. Prepare the adjustment that the clerk would have made to record the NSF check. c. Assume the clerk had stolen $550 cash, and recorded an entry for a nonexistent NSF check to reduce the cash balance so that it would match the bank balance. Select the internal control practice that would have most likely prevented this fraud.

Following is a bank reconciliation for Zocar Enterprises for June 30, Year 2: Cash Bank Account Statement Balance as of 6/30/Year 2 Deposit in transit Outstanding checks Note collected by bank Bank service charge $24,330 $21,555 4,750 (485) 2,075 (35) (550) NSF check Adjusted cash balance as of 6/30/Year 2 $25,820 $25,820 As part of the normal process for handling an NSF check, the accounting clerk has notified the customer that their account did not contain sufficient funds to pay the balance owed to the company. The customer was told that they will need to provide an alternativ form of payment to cover the outstanding balance. Required a. Prepare the adjustment that the clerk would have made to record the NSF check. c. Assume the clerk had stolen $550 cash, and recorded an entry for a nonexistent NSF check to reduce the cash balance so that it would match the bank balance. Select the internal control practice that would have most likely prevented this fraud.

Survey of Accounting (Accounting I)

8th Edition

ISBN:9781305961883

Author:Carl Warren

Publisher:Carl Warren

Chapter5: Internal Control And Cash

Section: Chapter Questions

Problem 2SEQ

Related questions

Question

kindly help me related to accounting question

Transcribed Image Text:Following is a bank reconcillation for Zocar Enterprises for June 30, Year 2:

Cash

Bank

Account Statement

Balance as of 6/30/Year 2

Deposit in transit

Outstanding checks

Note collected by bank

Bank service charge

$24,330

$21,555

4,750

(485)

2,075

(35)

(550)

NSF check

Adjusted cash balance as of 6/30/Year 2

$25,820

$25,820

As part of the normal process for handling an NSF check, the accounting clerk has notified the customer that their account did not

contain sufficient funds to pay the balance owed to the company. The customer was told that they will need to provide an alternative

form of payment to cover the outstanding balance.

Required

a. Prepare the adjustment that the clerk would have made to record the NSF check.

c. Assume the clerk had stolen $550 cash, and recorded an entry for a nonexistent NSF check to reduce the cash balance so that it

would match the bank balance. Select the internal control practice that would have most likely prevented this fraud.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning