following transactions for Product B during the fiscal year ended on December 31, 2020. Date Transactions Units Unit Cost Sale Price March 5 Purchase 19,000 $ 9 June 15 Sale 10,000 $27 September 19 November 20 Purchase Sale 8,000 16,000 11 30 Additional information: • The beginning inventory consisted of 7,000 units at a total cost of $56,000. • All sales are made on account with credit terms, 2/10, n/30. • Customers who purchased 10,000 units on November 20 paid the amount due within the discount period. All other customers paid their accounts receivable after the discount period. At the start of each question below, we indicate whether the First-in, First-out (FIFO) method or the Weighted Average Cost

following transactions for Product B during the fiscal year ended on December 31, 2020. Date Transactions Units Unit Cost Sale Price March 5 Purchase 19,000 $ 9 June 15 Sale 10,000 $27 September 19 November 20 Purchase Sale 8,000 16,000 11 30 Additional information: • The beginning inventory consisted of 7,000 units at a total cost of $56,000. • All sales are made on account with credit terms, 2/10, n/30. • Customers who purchased 10,000 units on November 20 paid the amount due within the discount period. All other customers paid their accounts receivable after the discount period. At the start of each question below, we indicate whether the First-in, First-out (FIFO) method or the Weighted Average Cost

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter7: Inventories: Cost Measurement And Flow Assumptions

Section: Chapter Questions

Problem 9RE: RE7-8 Johnson Company uses a perpetual inventory system. On October 23, Johnson purchased 100,000 of...

Related questions

Topic Video

Question

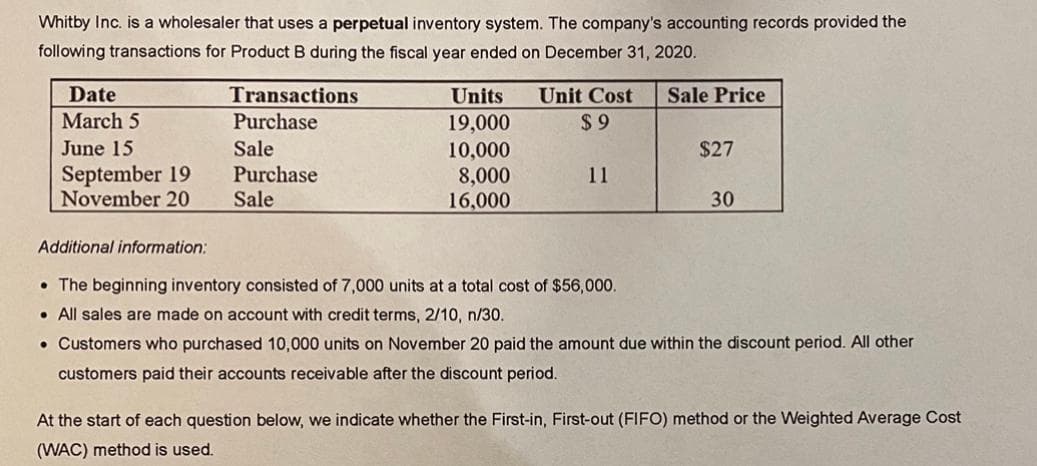

Transcribed Image Text:Whitby Inc. is a wholesaler that uses a perpetual inventory system. The company's accounting records provided the

following transactions for Product B during the fiscal year ended on December 31, 2020.

Date

Transactions

Units

Unit Cost

Sale Price

March 5

Purchase

$ 9

19,000

10,000

8,000

16,000

June 15

Sale

$27

September 19

November 20

Purchase

Sale

11

30

Additional information:

• The beginning inventory consisted of 7,000 units at a total cost of $56,000.

• All sales are made on account with credit terms, 2/10, n/30.

• Customers who purchased 10,000 units on November 20 paid the amount due within the discount period. All other

customers paid their accounts receivable after the discount period.

At the start of each question below, we indicate whether the First-in, First-out (FIFO) method or the Weighted Average Cost

(WAC) method is used.

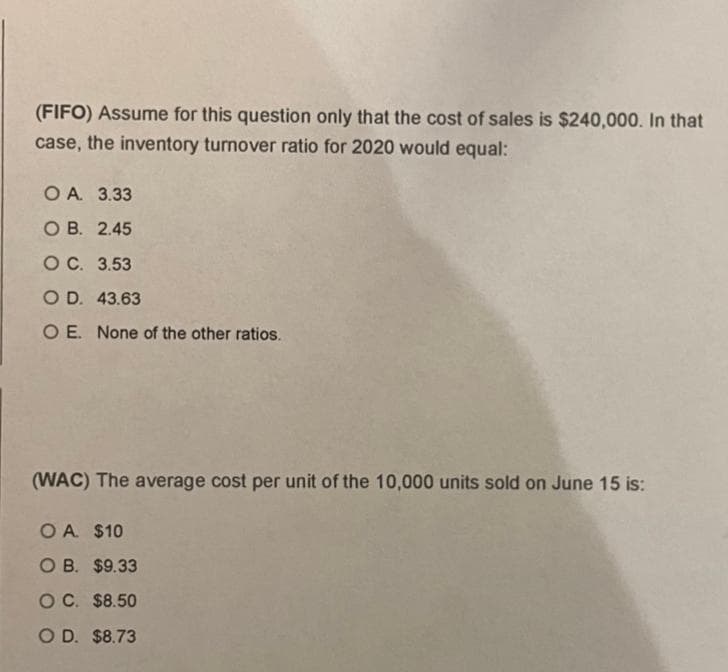

Transcribed Image Text:(FIFO) Assume for this question only that the cost of sales is $240,000. In that

case, the inventory turnover ratio for 2020 would equal:

O A 3.33

ОВ. 2.45

OC. 3.53

O D. 43.63

O E. None of the other ratios.

(WAC) The average cost per unit of the 10,000 units sold on June 15 is:

O A $10

оВ. $9.33

OC. $8.50

O D. $8.73

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,