Footfall Manufacturing Ltd. reports the following financial information at the end of the current year: Net Sales Debtor's turnover ratio (based on net sales) 2 Inventory turnover ratio Fixed assets turnover ratio Debt to assets ratio $100,000 1.25 0.8 0.6 Net profit margin Gross profit margin Return on investment 5% 25% 2% Use the given information to fill out the templates for income statement and balance sheet given below: Income Statement of Footfall Manufacturinf Ltd. for the year ending December 31, 20XX (in S) Sales Cost of goods sold |Gross profit Other expenses Earnings before tax Таx (@ 50% Earnings after tax 100,000 Balance Sheet of Footfall Manufacturing Ltd. as at December 31, 20XX (in S) Liabilities Equity Long term debt Amount Assets Net fixed assets Amount 50,000 Inventory Short term debt Debtors Cash ТОTAL ТОTAL

Footfall Manufacturing Ltd. reports the following financial information at the end of the current year: Net Sales Debtor's turnover ratio (based on net sales) 2 Inventory turnover ratio Fixed assets turnover ratio Debt to assets ratio $100,000 1.25 0.8 0.6 Net profit margin Gross profit margin Return on investment 5% 25% 2% Use the given information to fill out the templates for income statement and balance sheet given below: Income Statement of Footfall Manufacturinf Ltd. for the year ending December 31, 20XX (in S) Sales Cost of goods sold |Gross profit Other expenses Earnings before tax Таx (@ 50% Earnings after tax 100,000 Balance Sheet of Footfall Manufacturing Ltd. as at December 31, 20XX (in S) Liabilities Equity Long term debt Amount Assets Net fixed assets Amount 50,000 Inventory Short term debt Debtors Cash ТОTAL ТОTAL

Corporate Financial Accounting

14th Edition

ISBN:9781305653535

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter14: Financial Statement Analysis

Section: Chapter Questions

Problem 14.1EX: Vertical analysis of income statement Revenue and expense data for Innovation Quarter Inc. for two...

Related questions

Question

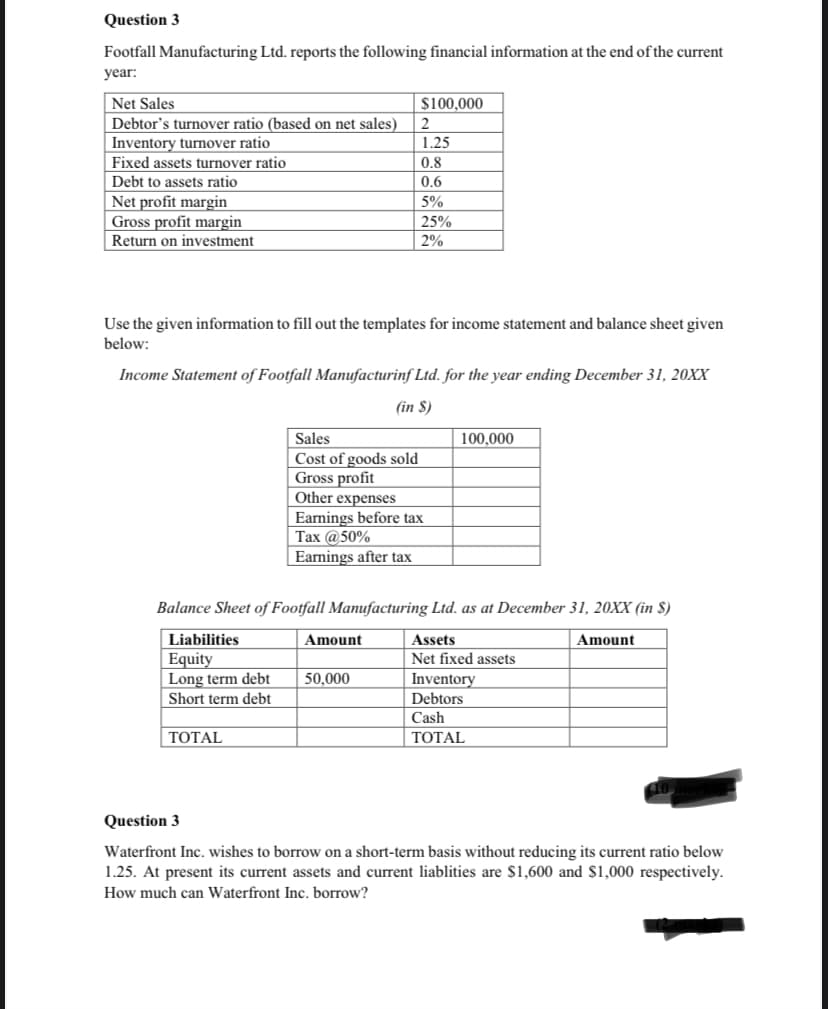

Transcribed Image Text:Question 3

Footfall Manufacturing Ltd. reports the following financial information at the end of the current

year:

Net Sales

$100,000

Debtor's turnover ratio (based on net sales)

Inventory turnover ratio

1.25

Fixed assets turnover ratio

0.8

Debt to assets ratio

|Net profit margin

Gross profit margin

Return on investment

0.6

5%

25%

2%

Use the given information to fill out the templates for income statement and balance sheet given

below:

Income Statement of Footfall Manufacturinf Ltd. for the year ending December 31, 20XX

(in $)

Sales

100,000

Cost of goods sold

Gross profit

Other expenses

Earnings before tax

Тах @ 50%

Earnings after tax

Balance Sheet of Footfall Manufacturing Ltd. as at December 31, 20XX (in $)

Liabilities

Equity

Long term debt

Amount

Assets

Amount

Net fixed assets

50,000

Inventory

Debtors

Cash

Short term debt

ТОTAL

ТОTAL

Question 3

Waterfront Inc. wishes to borrow on a short-term basis without reducing its current ratio below

1.25. At present its current assets and current liablities are $1,600 and $1,000 respectively.

How much can Waterfront Inc. borrow?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 4 images

Recommended textbooks for you

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Financial & Managerial Accounting

Accounting

ISBN:

9781337119207

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning