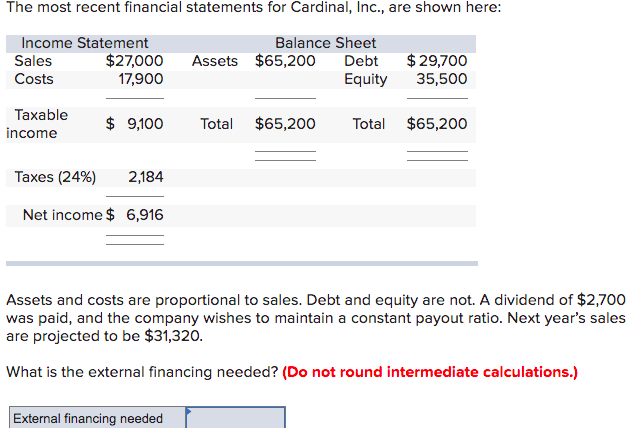

The most recent financial statements for Cardinal, Inc., are shown here: Income Statement Sales Costs $27,000 17,900 Balance Sheet Debt $ 29,700 35,500 Assets $65,200 Equity Тахable $ 9,100 Total $65,200 Total $65,200 income Taxes (24%) 2,184 Net income $ 6,916 Assets and costs are proportional to sales. Debt and equity are not. A dividend of $2.700

The most recent financial statements for Cardinal, Inc., are shown here: Income Statement Sales Costs $27,000 17,900 Balance Sheet Debt $ 29,700 35,500 Assets $65,200 Equity Тахable $ 9,100 Total $65,200 Total $65,200 income Taxes (24%) 2,184 Net income $ 6,916 Assets and costs are proportional to sales. Debt and equity are not. A dividend of $2.700

College Accounting, Chapters 1-27 (New in Accounting from Heintz and Parry)

22nd Edition

ISBN:9781305666160

Author:James A. Heintz, Robert W. Parry

Publisher:James A. Heintz, Robert W. Parry

Chapter15: Financial Statements And Year-end Accounting For A Merchandising Business

Section: Chapter Questions

Problem 4CE

Related questions

Question

Transcribed Image Text:The most recent financial statements for Cardinal, Inc., are shown here:

Income Statement

Balance Sheet

$27,000

17,900

$29,700

35,500

Sales

Assets $65,200

Debt

Costs

Equity

Тахable

$ 9,100

Total

$65,200

Total

$65,200

income

Taxes (24%)

2,184

Net income $ 6,916

Assets and costs are proportional to sales. Debt and equity are not. A dividend of $2,700

was paid, and the company wishes to maintain a constant payout ratio. Next year's sales

are projected to be $31,320.

What is the external financing needed? (Do not round intermediate calculations.)

External financing needed

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Recommended textbooks for you

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT