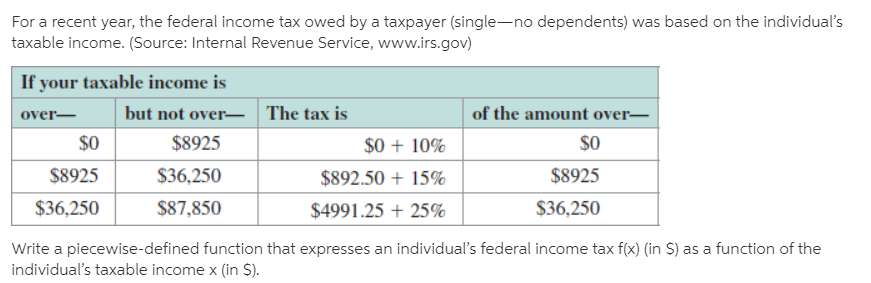

For a recent year, the federal income tax owed by a taxpayer (single-no dependents) was based on the individual's taxable income. (Source: Internal Revenue Service, www.irs.gov) If your taxable income is but not over– The tax is of the amount over- over– $0 $8925 $0 + 10% $O $8925 $36,250 $892.50 + 15% $8925 $36,250 $87,850 $4991.25 + 25% $36,250 Write a piecewise-defined function that expresses an individual's federal income tax f(x) (in S) as a function of the individual's taxable income x (in S).

For a recent year, the federal income tax owed by a taxpayer (single-no dependents) was based on the individual's taxable income. (Source: Internal Revenue Service, www.irs.gov) If your taxable income is but not over– The tax is of the amount over- over– $0 $8925 $0 + 10% $O $8925 $36,250 $892.50 + 15% $8925 $36,250 $87,850 $4991.25 + 25% $36,250 Write a piecewise-defined function that expresses an individual's federal income tax f(x) (in S) as a function of the individual's taxable income x (in S).

Functions and Change: A Modeling Approach to College Algebra (MindTap Course List)

6th Edition

ISBN:9781337111348

Author:Bruce Crauder, Benny Evans, Alan Noell

Publisher:Bruce Crauder, Benny Evans, Alan Noell

Chapter3: Straight Lines And Linear Functions

Section3.3: Modeling Data With Linear Functions

Problem 18E: Tax Table Here are selected entries from the 2014 tax table that show the federal income tax owed by...

Related questions

Question

Transcribed Image Text:For a recent year, the federal income tax owed by a taxpayer (single-no dependents) was based on the individual's

taxable income. (Source: Internal Revenue Service, www.irs.gov)

If your taxable income is

but not over– The tax is

of the amount over-

over–

$0

$8925

$0 + 10%

$O

$8925

$36,250

$892.50 + 15%

$8925

$36,250

$87,850

$4991.25 + 25%

$36,250

Write a piecewise-defined function that expresses an individual's federal income tax f(x) (in S) as a function of the

individual's taxable income x (in S).

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Recommended textbooks for you

Functions and Change: A Modeling Approach to Coll…

Algebra

ISBN:

9781337111348

Author:

Bruce Crauder, Benny Evans, Alan Noell

Publisher:

Cengage Learning

Functions and Change: A Modeling Approach to Coll…

Algebra

ISBN:

9781337111348

Author:

Bruce Crauder, Benny Evans, Alan Noell

Publisher:

Cengage Learning