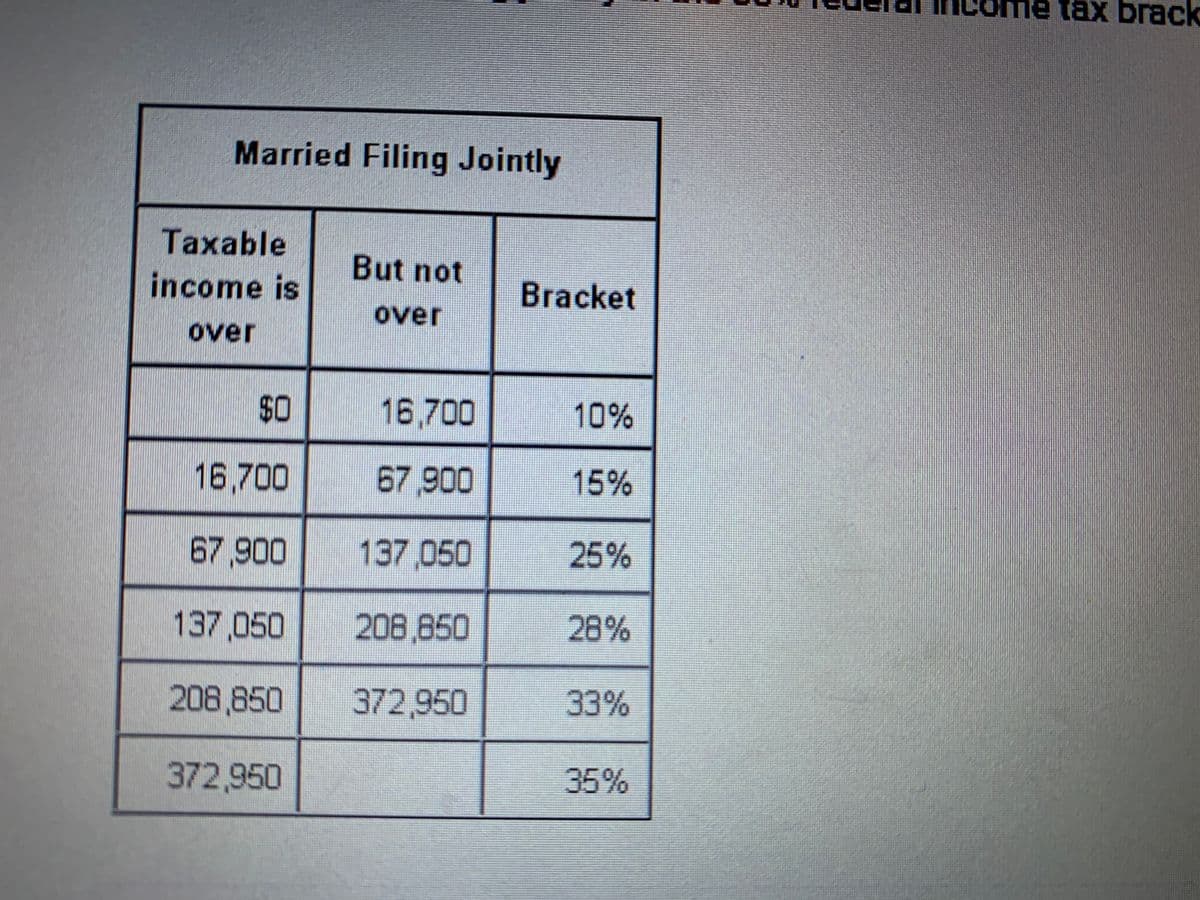

Married Filing Jointly Тахable But not income is Bracket over over $0 16,700 10% 16,700 67 900 15% 67,900 137,050 25% 137,050 208,850 28% 208,850 372,950 33% 372,950 35%

Married Filing Jointly Тахable But not income is Bracket over over $0 16,700 10% 16,700 67 900 15% 67,900 137,050 25% 137,050 208,850 28% 208,850 372,950 33% 372,950 35%

Functions and Change: A Modeling Approach to College Algebra (MindTap Course List)

6th Edition

ISBN:9781337111348

Author:Bruce Crauder, Benny Evans, Alan Noell

Publisher:Bruce Crauder, Benny Evans, Alan Noell

Chapter3: Straight Lines And Linear Functions

Section3.3: Modeling Data With Linear Functions

Problem 18E: Tax Table Here are selected entries from the 2014 tax table that show the federal income tax owed by...

Related questions

Question

According to the table below, which of these is a possible taxable income for a married couple filing jointly in the 33% federal income tax bracket?

Transcribed Image Text:tax brack

Married Filing Jointly

Taxable

But not

income is

Bracket

over

over

$0

16,700

10%

16,700

67,900

15%

67,900

137,050

25%

137,050

208,850

28%

208,850

372,950

33%

372,950

35%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, algebra and related others by exploring similar questions and additional content below.Recommended textbooks for you

Functions and Change: A Modeling Approach to Coll…

Algebra

ISBN:

9781337111348

Author:

Bruce Crauder, Benny Evans, Alan Noell

Publisher:

Cengage Learning

Functions and Change: A Modeling Approach to Coll…

Algebra

ISBN:

9781337111348

Author:

Bruce Crauder, Benny Evans, Alan Noell

Publisher:

Cengage Learning