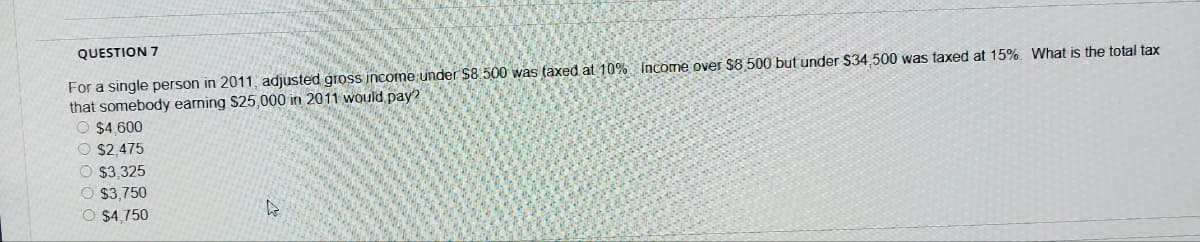

For a single person in 2011, adjusted gross income under $8.500 was taxed at 10% Income over $8.500 but under S34,500 was taxed at 15%. What is the total tax that somebody earning S25,000 in 2011 would pay? O $4,600 O $2,475 O $3,325 O $3,750 O $4,750 QUESTION 7

For a single person in 2011, adjusted gross income under $8.500 was taxed at 10% Income over $8.500 but under S34,500 was taxed at 15%. What is the total tax that somebody earning S25,000 in 2011 would pay? O $4,600 O $2,475 O $3,325 O $3,750 O $4,750 QUESTION 7

Algebra & Trigonometry with Analytic Geometry

13th Edition

ISBN:9781133382119

Author:Swokowski

Publisher:Swokowski

Chapter5: Inverse, Exponential, And Logarithmic Functions

Section5.3: The Natural Exponential Function

Problem 8E

Related questions

Question

Transcribed Image Text:QUESTION 7

For a single person in 2011, adjusted gross income under $8.500 was (axed at 10% Income over $8.500 but under S34,500 was taxed at 15%. What is the total tax

that somebody earning $25,000 in 2011 would pay?

O $4.600

O $2,475

O $3,325

O $3,750

O $4,750

Expert Solution

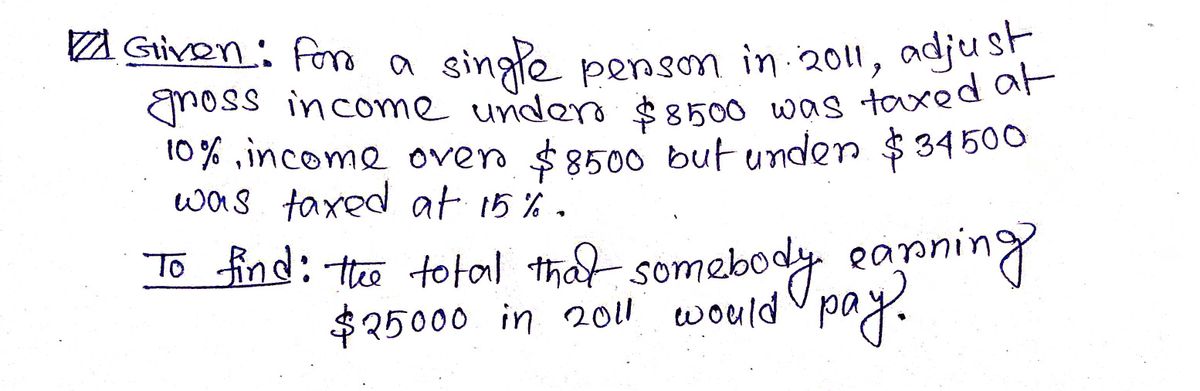

Step 1

Step by step

Solved in 2 steps with 2 images

Recommended textbooks for you

Algebra & Trigonometry with Analytic Geometry

Algebra

ISBN:

9781133382119

Author:

Swokowski

Publisher:

Cengage

Algebra & Trigonometry with Analytic Geometry

Algebra

ISBN:

9781133382119

Author:

Swokowski

Publisher:

Cengage