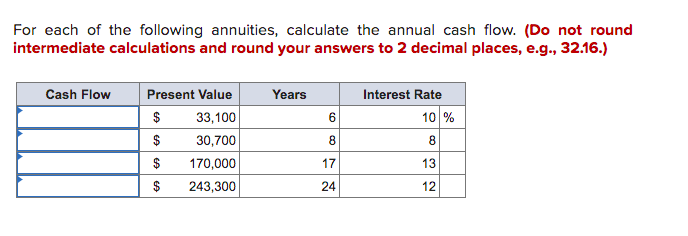

For each of the following annuities, calculate the annual cash flow. intermediate calculations and round your answers to 2 decimal places Cash Flow Present Value Years Interest Rate $ 33,100 6 10 % 30,700 8 8 $ 170,000 17 13 $ 243,300 24 12

For each of the following annuities, calculate the annual cash flow. intermediate calculations and round your answers to 2 decimal places Cash Flow Present Value Years Interest Rate $ 33,100 6 10 % 30,700 8 8 $ 170,000 17 13 $ 243,300 24 12

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter11: The Statement Of Cash Flows

Section: Chapter Questions

Problem 13MCQ

Related questions

Question

Transcribed Image Text:For each of the following annuities, calculate the annual cash flow. (Do not round

intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.)

Cash Flow

Present Value

Years

Interest Rate

$

33,100

6

10 %

30,700

8

8

$

170,000

17

13

$

243,300

24

12

%24

Expert Solution

Step 1

The time value of money is the idea that the value of money received today will be more worthy than the value of money received in the future. The time value of money becomes an important factor for capital budgeting decisions. Money has a time value because of the reinvestment opportunities, risk, and uncertainty involved in each penny.

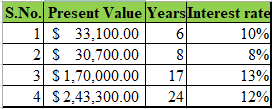

Given:

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning