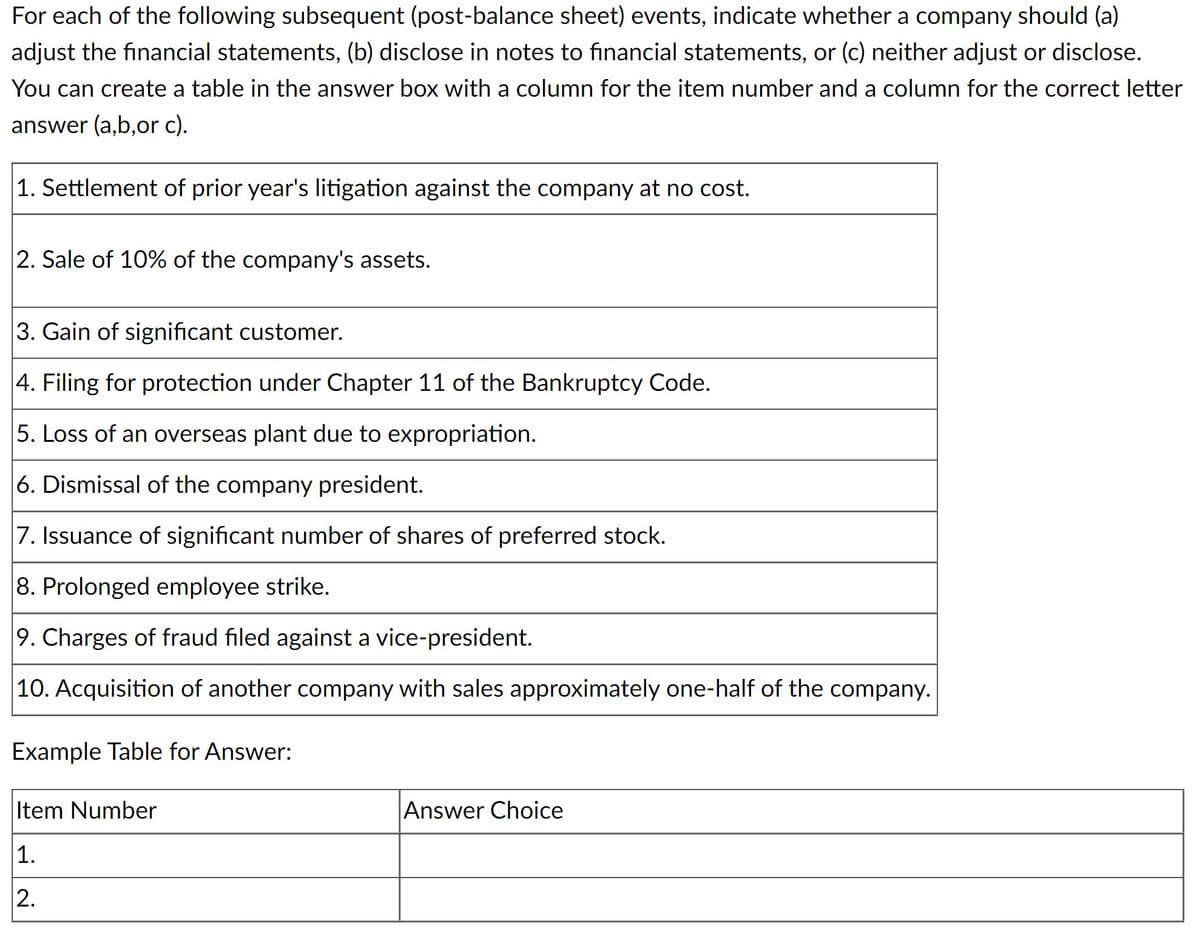

For each of the following subsequent (post-balance sheet) events, indicate whether a company should (a) adjust the financial statements, (b) disclose in notes to financial statements, or (c) neither adjust or disclose. You can create a table in the answer box with a column for the item number and a column for the correct letter answer (a,b,or c).

For each of the following subsequent (post-balance sheet) events, indicate whether a company should (a) adjust the financial statements, (b) disclose in notes to financial statements, or (c) neither adjust or disclose. You can create a table in the answer box with a column for the item number and a column for the correct letter answer (a,b,or c).

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter22: Accounting For Changes And Errors.

Section: Chapter Questions

Problem 11P: A review of Anderson Corporations books indicates that the errors and omissions pertaining to the...

Related questions

Question

Transcribed Image Text:For each of the following subsequent (post-balance sheet) events, indicate whether a company should (a)

adjust the financial statements, (b) disclose in notes to financial statements, or (c) neither adjust or disclose.

You can create a table in the answer box with a column for the item number and a column for the correct letter

answer (a,b,or c).

1. Settlement of prior year's litigation against the company at no cost.

2. Sale of 10% of the company's assets.

3. Gain of significant customer.

4. Filing for protection under Chapter 11 of the Bankruptcy Code.

5. Loss of an overseas plant due to expropriation.

6. Dismissal of the company president.

7. Issuance of significant number of shares of preferred stock.

8. Prolonged employee strike.

9. Charges of fraud filed against a vice-president.

10. Acquisition of another company with sales approximately one-half of the company.

Example Table for Answer:

Item Number

Answer Choice

1.

2.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College