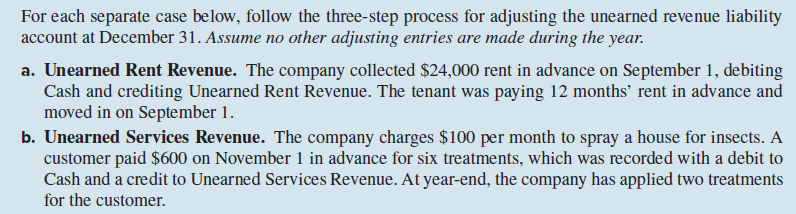

For each separate case below, follow the three-step process for adjusting the unearned revenue liability account at December 31. Assume no other adjusting entries are made during the year. a. Unearned Rent Revenue. The company collected $24,000 rent in advance on September 1, debiting Cash and crediting Unearned Rent Revenue. The tenant was paying 12 months' rent in advance and moved in on September 1. b. Unearned Services Revenue. The company charges $100 per month to spray a house for insects. A customer paid $600 on November 1 in advance for six treatments, which was recorded with a debit to Cash and a credit to Unearned Services Revenue. At year-end, the company has applied two treatments for the customer.

For each separate case below, follow the three-step process for adjusting the unearned revenue liability account at December 31. Assume no other adjusting entries are made during the year. a. Unearned Rent Revenue. The company collected $24,000 rent in advance on September 1, debiting Cash and crediting Unearned Rent Revenue. The tenant was paying 12 months' rent in advance and moved in on September 1. b. Unearned Services Revenue. The company charges $100 per month to spray a house for insects. A customer paid $600 on November 1 in advance for six treatments, which was recorded with a debit to Cash and a credit to Unearned Services Revenue. At year-end, the company has applied two treatments for the customer.

Chapter4: The Adjustment Process

Section: Chapter Questions

Problem 8EB: On July 1, a client paid an advance payment (retainer) of $10,000, to cover future legal services....

Related questions

Question

Transcribed Image Text:For each separate case below, follow the three-step process for adjusting the unearned revenue liability

account at December 31. Assume no other adjusting entries are made during the year.

a. Unearned Rent Revenue. The company collected $24,000 rent in advance on September 1, debiting

Cash and crediting Unearned Rent Revenue. The tenant was paying 12 months' rent in advance and

moved in on September 1.

b. Unearned Services Revenue. The company charges $100 per month to spray a house for insects. A

customer paid $600 on November 1 in advance for six treatments, which was recorded with a debit to

Cash and a credit to Unearned Services Revenue. At year-end, the company has applied two treatments

for the customer.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 4 images

Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning