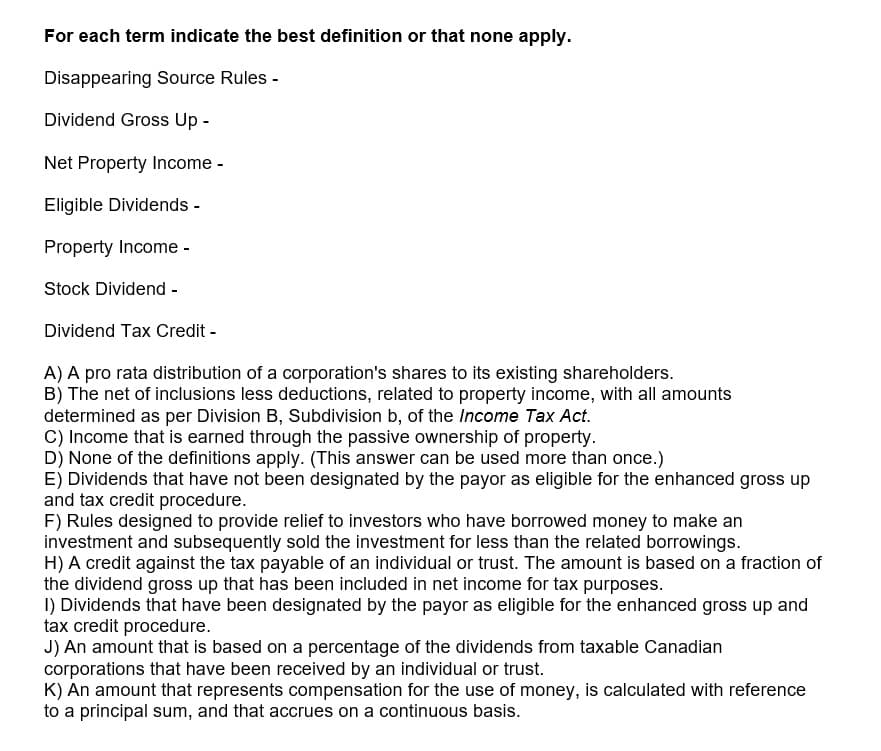

For each term indicate the best definition or that none apply. Disappearing Source Rules - Dividend Gross Up - Net Property Income - Eligible Dividends - Property Income - Stock Dividend - Dividend Tax Credit - A) A pro rata distribution of a corporation's shares to its existing shareholders. B) The net of inclusions less deductions, related to property income, with all amounts determined as per Division B, Subdivision b, of the Income Tax Act. C) Income that is earned through the passive ownership of property. D) None of the definitions apply. (This answer can be used more than once.) E) Dividends that have not been designated by the payor as eligible for the enhanced gross up and tax credit procedure. F) Rules designed to provide relief to investors who have borrowed money to make an investment and subsequently sold the investment for less than the related borrowings. H) A credit against the tax payable of an individual or trust. The amount is based on a fraction of the dividend gross up that has been included in net income for tax purposes. I) Dividends that have been designated by the payor as eligible for the enhanced gross up and tax credit procedure. J) An amount that is based on a percentage of the dividends from taxable Canadian corporations that have been received by an individual or trust. K) An amount that represents compensation for the use of money, is calculated with reference to a principal sum, and that accrues on a continuous basis.

For each term indicate the best definition or that none apply. Disappearing Source Rules - Dividend Gross Up - Net Property Income - Eligible Dividends - Property Income - Stock Dividend - Dividend Tax Credit - A) A pro rata distribution of a corporation's shares to its existing shareholders. B) The net of inclusions less deductions, related to property income, with all amounts determined as per Division B, Subdivision b, of the Income Tax Act. C) Income that is earned through the passive ownership of property. D) None of the definitions apply. (This answer can be used more than once.) E) Dividends that have not been designated by the payor as eligible for the enhanced gross up and tax credit procedure. F) Rules designed to provide relief to investors who have borrowed money to make an investment and subsequently sold the investment for less than the related borrowings. H) A credit against the tax payable of an individual or trust. The amount is based on a fraction of the dividend gross up that has been included in net income for tax purposes. I) Dividends that have been designated by the payor as eligible for the enhanced gross up and tax credit procedure. J) An amount that is based on a percentage of the dividends from taxable Canadian corporations that have been received by an individual or trust. K) An amount that represents compensation for the use of money, is calculated with reference to a principal sum, and that accrues on a continuous basis.

SWFT Essntl Tax Individ/Bus Entities 2020

23rd Edition

ISBN:9780357391266

Author:Nellen

Publisher:Nellen

Chapter15: S Corporations

Section: Chapter Questions

Problem 11P

Related questions

Question

100%

Transcribed Image Text:For each term indicate the best definition or that none apply.

Disappearing Source Rules -

Dividend Gross Up -

Net Property Income -

Eligible Dividends -

Property Income -

Stock Dividend -

Dividend Tax Credit -

A) A pro rata distribution of a corporation's shares to its existing shareholders.

B) The net of inclusions less deductions, related to property income, with all amounts

determined as per Division B, Subdivision b, of the Income Tax Act.

C) Income that is earned through the passive ownership of property.

D) None of the definitions apply. (This answer can be used more than once.)

E) Dividends that have not been designated by the payor as eligible for the enhanced gross up

and tax credit procedure.

F) Rules designed to provide relief to investors who have borrowed money to make an

investment and subsequently sold the investment for less than the related borrowings.

H) A credit against the tax payable of an individual or trust. The amount is based on a fraction of

the dividend gross up that has been included in net income for tax purposes.

I) Dividends that have been designated by the payor as eligible for the enhanced gross up and

tax credit procedure.

J) An amount that is based on a percentage of the dividends from taxable Canadian

corporations that have been received by an individual or trust.

K) An amount that represents compensation for the use of money, is calculated with reference

to a principal sum, and that accrues on a continuous basis.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning