Profits or losses are recorded in a share capital account. O TRUE O FALSE The main differences between profit reported by a proprietorship and a corporation are income tax expense and salaries paid to owners. O TRUE O FALSE

Q: These are cumulative profits which are retained in the business and not yet distributed to the…

A: We prepare the following financial statements - Income statement Balance sheet Cash flows statement…

Q: How is the investor’s share of gross profit on intra-entity sales calculated? Under the equity…

A: The share of investor is calculated in the following manner in an intra-entity sale: Investor's…

Q: Appropriation of retained earnings is necessary when the corporation reacquires its own share…

A: Acquisition of own share capital means purchase of corporate's own shares from the investors either…

Q: Which one of the following would appear on IBM’s statement of financial position

A: In accounting statement of financial position is also known as balance sheet. In a statement of…

Q: In an S Corporation are the unit holders liable for busin

A: Yes, they are liable for business losses too if they fulfill these requirements.

Q: For purposes of the qualified business income (QBI) deduction, qualified business income does not…

A: Qualified Business Income deduction refers to that income that is related to trade and business. In…

Q: All of the following terms can be used for a corporation to describe the difference between assets…

A: The balance sheet represents the financial position of the business with assets, liabilities and…

Q: For each term indicate the best definition or that none apply. Disappearing Source Rules - Dividend…

A: Companies pay divided out of profit earned in the accounting year.

Q: Noncontrolling interest reported on the balance sheet represents the amount of the net assets of a…

A: Balance sheet: This financial statement reports a company’s resources (assets) and claims of…

Q: xplain the difference between a Shar

A: Efforts of various people in order to run a successful business and many people associated with the…

Q: The account Retained Earnings is: the amount paid as dividend. a subdivision of paid-in capital. net…

A: Hi student Since there are multiple questions, we will answer only first question. If you want…

Q: Pass through. If the corporation is structured as an S corporation, profits and losses are…

A: Meaning of "Passed Through" Status : It is a concept in which the income or loss of an entity is…

Q: Interest paid on preferred stock is deductible from gross income of the paying corporation

A: Disclaimer: "Since you have asked multiple questions in a single question so we solve the first…

Q: Profits that have been subjected to IAET will be liable to dividend tax when they are eventually…

A: Tax is the charge which is charged on the taxable income earned by the corporation or business…

Q: Please concisely explain how the excess investment cost over book value is allocated. When is the…

A: 1. The excess cost of investment over book value can be allocated through the process of…

Q: Dividends are recognized in profit or loss only when: Group of answer choices A. The amount of the…

A: Dividends are recognized in profit by the company received it when the dividends are received.

Q: The shareholders of the company gets share in the profit. This distribution of profit is called as O…

A: The distribution of the profits by the company to the shareholders is called the Dividend... Option…

Q: Comparing dividends per share to earnings per share indicates the extent to which the corporation is…

A: Dividend is the amount distributed to the shareholders out of excess profits.

Q: When do the corporations also report their retained earnings?

A: When do the corporations also report their retained earnings?

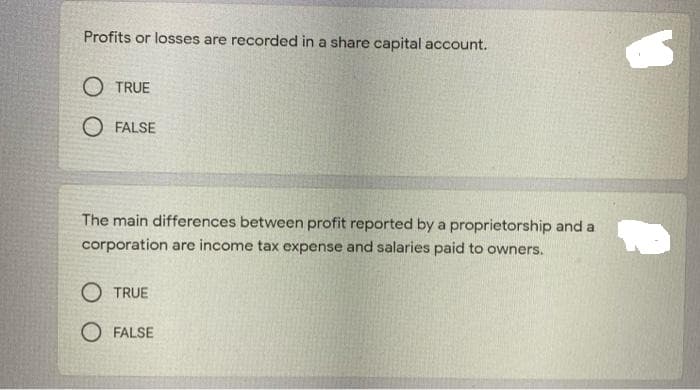

Q: Profits or losses are recorded in a share capital account. O TRUE O FALSE The main differences…

A: Pay as you earn system or tax deduction at source in some countries are the advance tax payment…

Q: True (t) or False (f) _____ Bond interest paid by a corporation is an expense, whereas dividends…

A: Bonds are the certificates of loan taken by a corporation. It is typically secured in nature. The…

Q: The following independent statements may be true or false. Discuss the circumstances whereby the…

A: Consolidated Profit After Tax means the Borrowers' current consolidated earnings (excluding…

Q: Dividends are recognized in profit or loss only when a. the entity's right to receive payment of…

A: Solution: Dividends are recognized in profit or loss only when a. the entity's right to receive…

Q: perating income. Long-term capital gain. Cost of goods sold.

A: The shareholder begins with their commencing capital contribution to the S corporation or the…

Q: 1) Real assets of a corporation are claims on their financial assets. TRUE/FALSE 2) Managers,…

A: A corporation is a separate entity, and has a limited liability

Q: Which of the following is incorrect regarding for-profit corporations? Multiple Choice Most business…

A: Corporations are the entity created by laws. Corporation can be two types, one is formed for profit…

Q: ich of the following statements best describes the purpose of the dividend refund? A) The…

A: Step 1 Tax revenue earned by an organization can be processed or used in a variety of ways, although…

Q: Which characteristic of a corporation limits a stockholder's loss to the amount of his or her…

A: One of the type of legal structure of business operation that declares the business as a separate,…

Q: Which of the following is not something that corporations can do with their profits? a. Pay…

A: Corporations are large company or group of companies.

Q: explain the difference between the net income and net income available for common shareholders.

A: Introduction:- i)Net income means as follows under:- Net income means deduction of all expenses…

Q: accounting treatment for a corporate organization cost

A: Corporate organization cost is the cost incurred in forming the corporation.

Q: Dividends are recognized in profit or loss

A: First option is correct because an income is recognized only when it can be measured reliably. Third…

Q: Shareholders' equity is the corporate accounting element when we subtracted corporate assets from…

A: Total Assets = Total Liabilities + Shareholders' equity Shareholders' equity = Total Assets - Total…

Q: The cost of equity is the rate associated with what the shareholders expect the corporation to earn…

A: Equity refers to the amount contributed by the owners of a entity i.e. shareholders of a entity.

Q: A shareholder in a company:

A: Shareholders A person or entity who holds the shares or stocks of a company is known as shareholders…

Q: If common stockholders are the owners of the company, why do they have the last claim on assets and…

A: common shareholders are the owners of the company because they are the actual owners, shareholder…

Q: 1. Which of the following does not affect retained earnings? Choices; Actual payment/distribution…

A: Disclaimer: “Since you have asked multiple questions, we will solve the first question for you. If…

Q: Which activities changes equity but does not affect a corporation's assets and liabilities?

A: Changes in equity: The amount of equity changes due to increase or decrease in the business…

Q: Taxes affect many financial decisions. Explain how (a)interest and dividend payments are treated for…

A: a. From the company’s perspective, Interest and dividend payment reduce the tax liability of the…

Q: In corporations the stockholders are equally liable for the debts of the firm. a. True b. False

A: As the corporation is a separate entity, it is liable for the its debt, shareholders are not…

Q: Indicate whether the following statements are true or false. If the statementis false, explain…

A: The Tax Code offers the investors the benefit of tax deductibility on interest that is paid on debt.…

Q: Which of the following is a characteristic of a corporation?a. No income taxb. Limited liability of…

A: Corporation: It can be defined as a legal organization or an entity that is completely different…

Q: Dividends are recognized in profit or loss only when: a. It is probable that the economic benefits…

A: As per IFRS 9 dividend needs to recognize in profit and loss account when, Entity's right to…

Q: Business income allocations from an S corporation to its shareholders are self- employment income to…

A: The S-corporation is a special type of corporation in which all the income, gains, and losses of the…

Q: A retained earnings statement shows the same information as a corporation income statement Select…

A: The financial statements of a company include the income statement, the balance sheet, the cash flow…

Step by step

Solved in 3 steps

- Retained earnings refer to the portion of a corporation's profits that are paid out to shareholders. a. True b. FalseTRUE OR FALSE The change in Gross Income will have the same changes to Taxable Net Income because of their direct relationship. Cost of Equity by way of paying dividends, which is deductible from gross income. Interest paid in advance for the amount borrowed by the business has no tax benefit.Which of the following regarding retained earnings is false?a. Retained earnings is increased by net income.b. Retained earnings is a component of stockholders’equity on the balance sheet.c. Retained earnings is an asset on the balance sheet.d. Retained earnings represents earnings not distributed tostockholders in the form of dividends

- If a company uses the equity method to account for an investment in another company, which of the following is true? Income is combined proportionate to ownership. Income to the investing company consists of actual dividends, interest, or capital gains. All of the investee’s income is included in the investor’s income except for income relating to intra-entity transactions. Income of the investee is included in the investor’s income but reduced by any dividends paid to the investor.Which of the following statements is incorrect? Earnings and profits are conceptually similar to retained earnings. A distribution from earnings and profits in excess of stockholder basis is a nontaxable return of capital. A distribution of appreciated property creates a gain to the corporation. Distributions paid in excess of earnings and profits are nontaxable to the extent of stockholder basis.For purposes of the qualified business income (QBI) deduction, qualified business income does not include certain types of investment income [e.g., capital gains or capital losses, dividends, and interest income (unless properly allocable to a trade or business, such as lending]. True False

- When an investor uses the cost method to account for investments in subsidiary, cash dividends received by the investor from the investee should normally be recorded as: A. Ignored. B. Dividend income. C. An addition to the investor’s share of the investee’s profit. D. A deduction from the investment account E. A deduction from the investor’s share of the investee’s profit.The statement of shareholders' equity reports the effects from the recognition or valuation of certain asset or liability transactions that change Accumulated Other Comprehensive Income. True FalseProfits that have been subjected to IAET will be liable to dividend tax when they are eventually declared as dividends. True and false statements.

- Corporate taxable income is based on an income statement that is similar to income statements prepared for financial reporting. It has Revenues less expenses equals income. How is the computation for personal taxable income different from this income statement concept? Why do you think these differences exist?Which of the following statements concerning retained earnings is true?a. Retained earnings is the difference between revenues and expenses.b. Retained earnings is increased by dividends and decreased by net income.c. Retained earnings represents accumulation of the income that has not been distributed as dividends.d. Retained earnings is reported as a liability on the balance sheet.Which of the following statements is TRUE regarding the equity method? A. The equity method is used for reporting gains or losses for non-strategic investments. B. The investor's share of the associate's dividends declared is reported as revenue. C. The investor's investment in the associate changes in direct relation to the changes taking place in the associate's equity accounts. D. The equity method reports unrealized gains and losses on revaluations to fair value in net income.