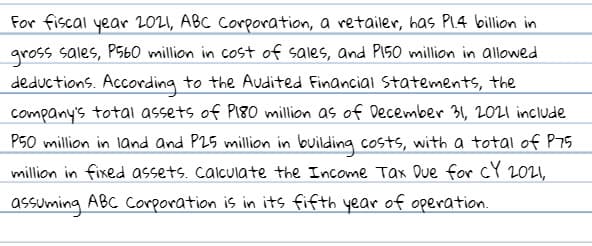

For fiscal year 2021, ABC Corporation, a retailer, has Pl.4 billion in gross sales, P560 million in cost of sales, and PI50 million in allowed deductions. According to the Audited Financial Statements, the company's total assets of PI80 million as of December 31, 2021 include P50 million in land and P25 million in building costs, with a total of P75 million in fixed assets. calculate the Income Tax Due for CY 2021, assuming ABC Corporation is in its fifth year of operation.

For fiscal year 2021, ABC Corporation, a retailer, has Pl.4 billion in gross sales, P560 million in cost of sales, and PI50 million in allowed deductions. According to the Audited Financial Statements, the company's total assets of PI80 million as of December 31, 2021 include P50 million in land and P25 million in building costs, with a total of P75 million in fixed assets. calculate the Income Tax Due for CY 2021, assuming ABC Corporation is in its fifth year of operation.

Chapter11: The Corporate Income Tax

Section: Chapter Questions

Problem 14P: Grevilla Corporation is a manufacturing company. The corporation has accumulated earnings of...

Related questions

Question

10

Transcribed Image Text:For fiscal year 2021, ABC Corporation, a retailer, has Pl.4 billion in

gross sales, P560 million in cost of sales, and PI50 million in allowed

deductions. According to the Audited Financial Statements, the

company's total assets of Pi80 million as of December 31, 202I include

P50 million in land and P25 million in building costs, with a total of P75

million in fixed assets. calculate the Income Tax Due for cY 2021,

assuming ABC Corporation is in its fifth year of operation.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning